Canada Just Took the FIRST STEP to CRASH Real Estate! Here’s Why.

Canadian real estate is impervious to crashes it has been said. There can be no way prices ever come down. This is of course all according the mainstream financial media and those who have everything riding on the fact that real estate rill continue to rocket upward. There’s just one issue however...

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

STEEMIT: https://steemit.com/@themoneygps

T-SHIRTS: http://themoneygps.com/store

MY FREE eCOURSE - Financial Education Taught in Simple Illustrative Videos:

http://themoneygps.com/freeecourse

Sources:

https://goo.gl/UpprQe

In This Episode:

Canadian real estate is impervious to crashes it has been said. There can be no way prices ever come down. This is of course all according the mainstream financial media and those who have everything riding on the fact that real estate rill continue to rocket upward. There’s just one issue however...

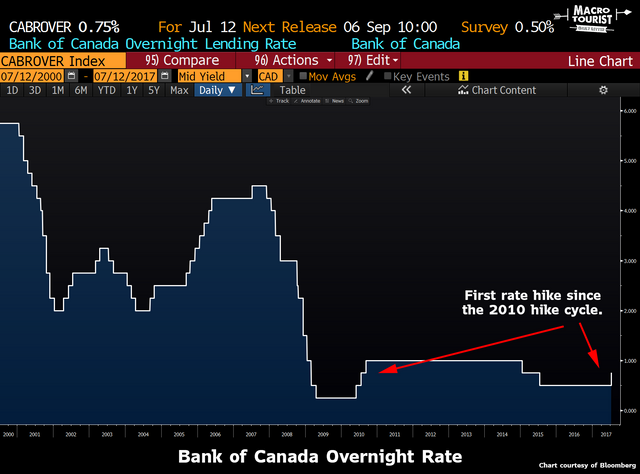

canada central bank interest rates home housing

Bank of Canada raises interest rate for 1st time in 7 years to 0.75% - Business - CBC News

http://www.cbc.ca/news/business/bank-canada-interest-rate-monetary-policy-1.4200814

Big 5 banks increase prime rates after Bank of Canada's interest rate hike - Business - CBC News

http://www.cbc.ca/news/business/prime-interest-rate-increases-1.4201403

HikeJul1217.png (1680×1244)

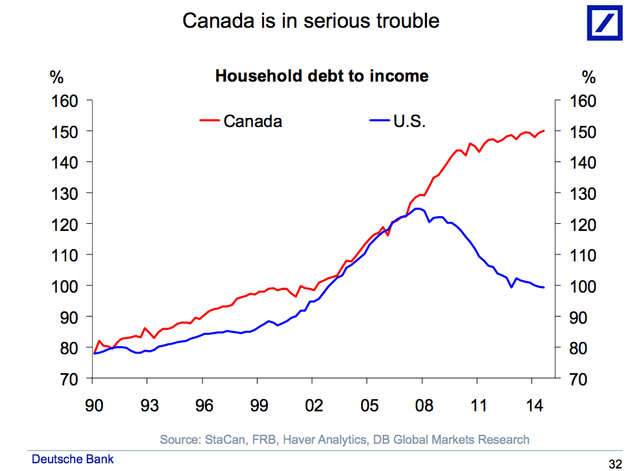

canada-vs-us-debt-to-income.png (986×726)

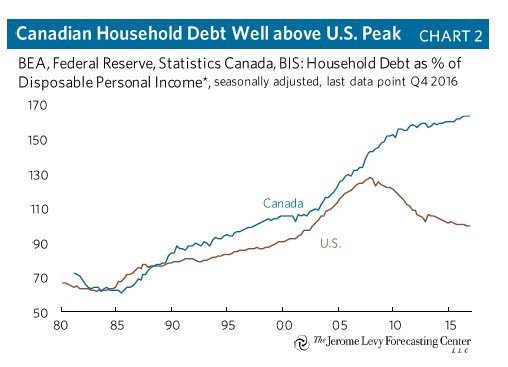

canada household debt.jpg (508×367)

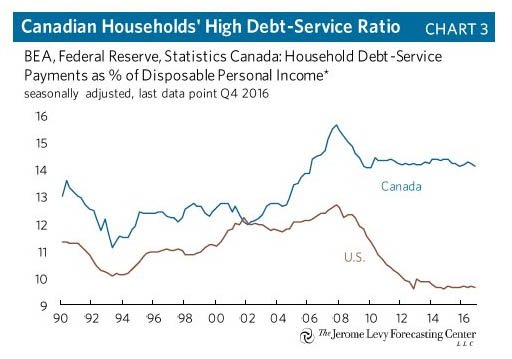

canada household debt service.jpg (512×359)

Toronto’s real estate market could keep cooling off thanks to interest rate hike: economist - National | Globalnews.ca

http://globalnews.ca/news/3594672/toronto-real-estate-market-interest-rate/

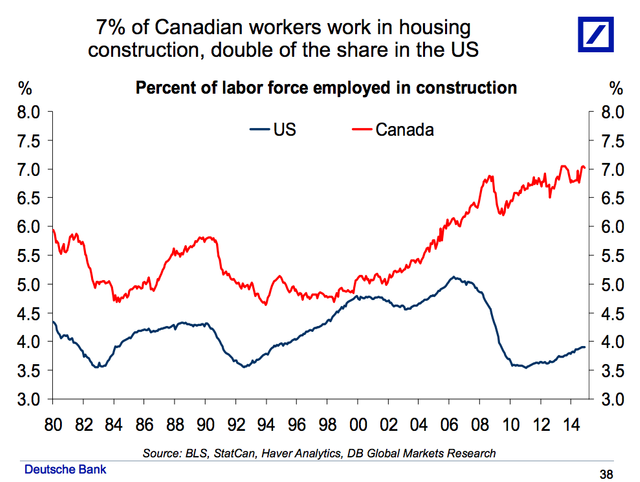

construction.png (989×745)

inflation,stocks,stock market,US,U.S. Dollar,financial,stock chart,currency,cash,gold,federal reserve,interest rates,deflation,money,dollar,s&p 500,dow jones,trump,central bank,bank,donald trump,millennials,canada,house,housing,bank of canada,real estate

Is there any chance that Canadian real estate can withstand higher interest rates?

great work as usual. Where I live your vids always pop up at around 12 am so I listen before bed. haha.

That's when I post! Research all evening then post before bed. Thank you for watching!

It's not looking well for Canadians. Also, this going to hurt other countries too?

Clearly Canada is needing this bubble in real estate but the economy actually isn't doing well.

Same situation elsewhere. Increase interest rates and the real problems will arise.

Great post! Indeed its not looking to good for Canada. Debt ratios are skyrocketing, but still most are blissfully unaware that the fecal matter may soon hit the spinney thingy.

Definitely! But most people would disagree with you and I

an increase in the interest rate will definitely affect mortgage payers.

I'm thinking we would see a huge widespread issue is mortgage rates hit around 4-5%

You guys are funny! This is a move to make the bubble grow even more.

Higher interests rates will put some new buyers on the housing market because they will fear to pay more for a house

Everybody with a variable interest rate on a open loan and who as some money aside will rush to the bank to make some anticipated payments, which will inject some liquidity in the banking system.

Some people will even get a loan for a car or for personal expenses that will stir up business while the rates are still low.

This bubble as 2 more years before it bursts.