SUPERIOR GOLD INC. SGI

Sabatooths Fundamentals Series: SUPERIOR GOLD INC.

Exhchange: TSX Venture

Ticker: SGI

Company Description:

Superior Gold Inc is a gold producer. It is engaged in the acquisition, exploration, development and operation of gold resource properties. Its principal asset is the Plutonic Gold Operations, located in Australia.

Summary:

-Clean Balance sheet No debt

-Hermes Mine site to come online in 2018 Pushing production past 100k ounces a year.

-SGI needs to prove mine life at the Plutonic Gold Operation.

-Undervalued compared to it's peer

SGI is a name that I recently discovered and really like for their clean balance sheet, potential reserves and cost structure. All data used is based on 2017 Q3 filings.

SGI produced 80,000 ounces of gold in 2017 from it's Plutonic Gold Operations and is expected to boost past 100,000 ouces in 2018 as its Hermes Gold Operations comes online.

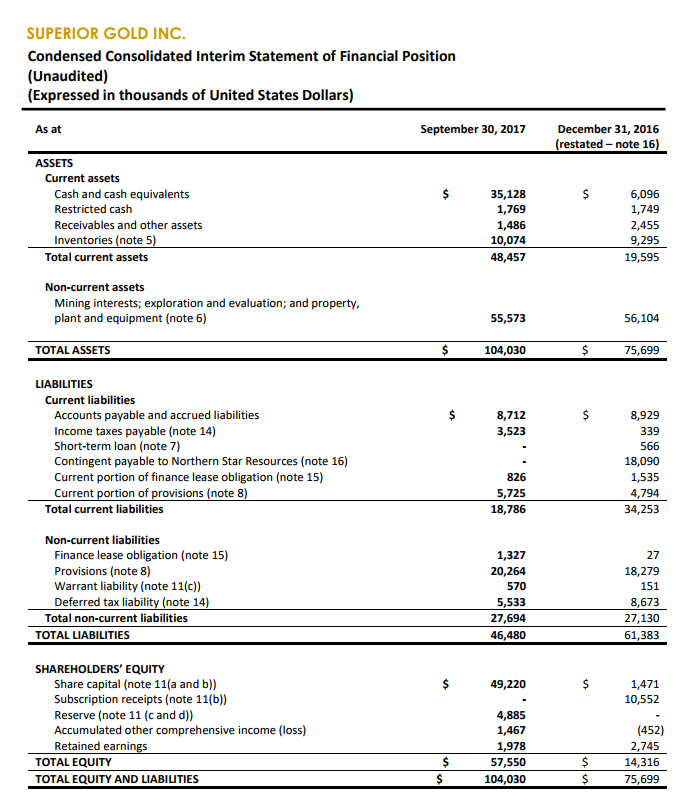

Balance Sheet View:

With no debt and 36million in cash, SGI's position in comparison to it's peers(gold producers with a market cap under 150million) is excellent.

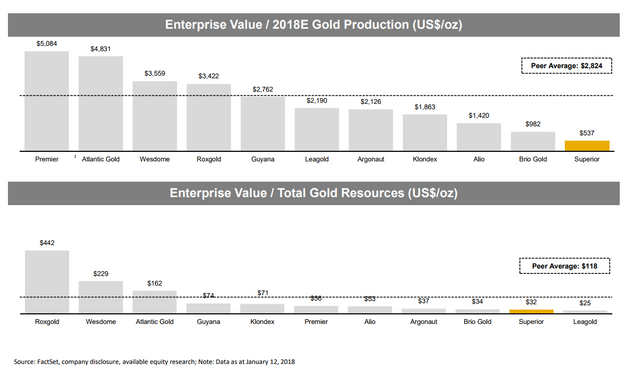

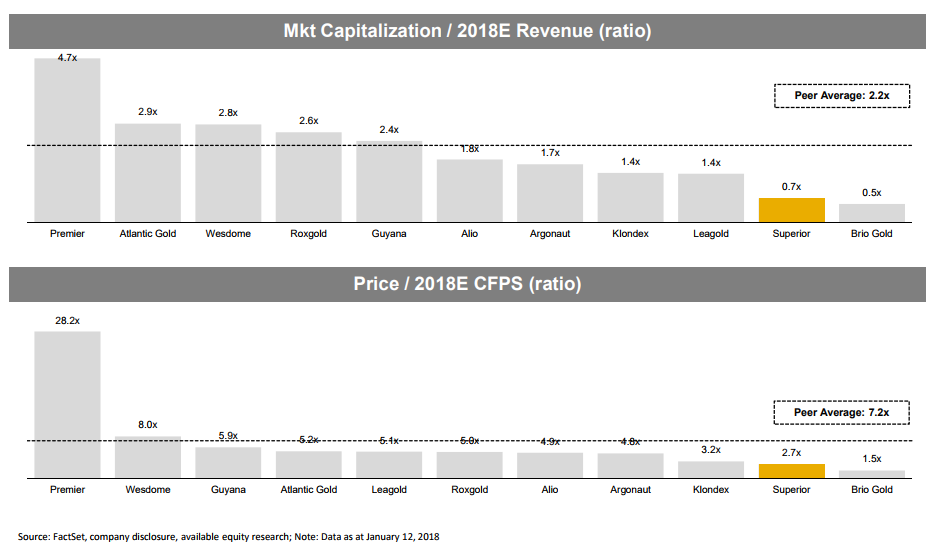

Now lets get into the juicy part. SGI's is currently is trading at a lower multiple to it's peers as seen below charts. This is likely due to reserve and all in sustaining costs risks.

As far as reserves go SGI is commited to increasing reserves and resources by increasing drill activity in 2018. The latest NR indicated some great results!

"KEY FINDINGS

236 intersections encountered more than 5g Au/t

114 intersections encountered more than 10g Au/t

44 intersections encountered more than 20g Au/t

10 intersections encountered more than 50g Au/t

The intersection of 4480.00g Au/t over 0.30 metres is the highest grade intersections encountered since the Company acquired the Plutonic Gold Mine in October 2016" Jan 17 NR.

This certainly does not suffice a SP jump in the short term but it does make it interesting on a watch list until proven reserves can be established. Which I believe will be based on historical finds at the Plutonic Gold Mine.

Another risk is the high All in sustaining costs currently sitting around 969ish CAD. Certinly some of SGI's peers are sitting much higher then the 969, however with the volatility in gold markets cheaper producers receive the greater multipliers. With gold hovering at 1300 usd/ouce. SGI is revenue generating positive and as such believe as long as prices stay above $1300, reserves are proven at Plutonic Gold Mine and 2018 ounces are in excess of 100k, SGI is name worth holding long term.

*Disclaimer: All statments in this post are mine and I have no affiliation with the companies mentioned other than possibly holding a position. I currently hold a position in SGI with no intent to sell in the next 2 weeks. I hold no position in any other gold producer and do not intend on taking one in the next few days.