Dick’s Sporting Goods, Another Retailer That Going To Bit The Dust

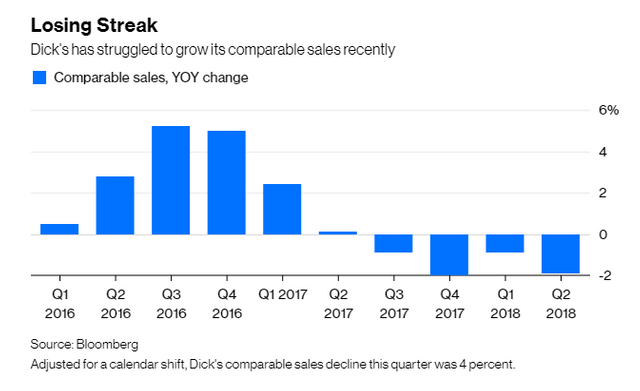

Dick’s Sporting Goods reported second-quarter earnings on Wednesday and lets just say, they had triple bogey on a par 4 hole. Dick's second quarter same-store sales fell again and the company revised down their same-store sales guidance for the year.

"We delivered double digit growth in eCommerce, private brands, and athletic apparel excluding Under Armour, however, as expected, sales were impacted by the strategic decisions we made regarding the slow growth, low margin hunt and electronics businesses, which accounted for nearly half of our comp decline. In addition, we experienced continued significant declines in Under Armour sales as a result of their decision to expand distribution. We are very confident our sales trajectory will improve next year as these headwinds are expected to subside."

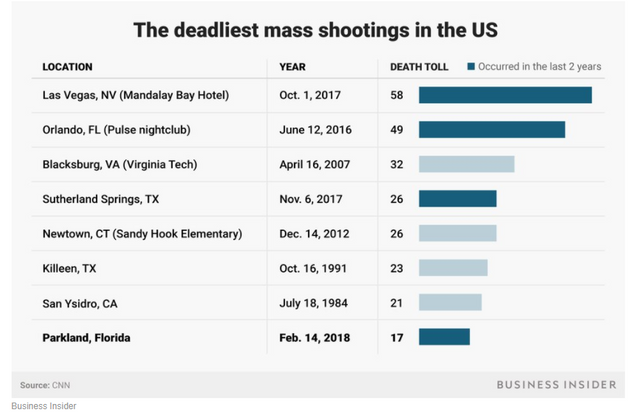

I commend them for their decision to stop selling assault-style rifles because things in America continue to get crazier and crazier.

The CEO, Stack went on to say during the conference call that the challenges with Under Armour should subside in 2019, as Dick's finds new inventory — including fresh items from Under Armour — to fill its shelves. Stack said he's excited about Under Armour displaying more "premium" merchandise at Dick's stores, like the HOVR sneaker, and sneakers and clothing from Under Armour's new line with Dwayne Johnson.

Trading is easy, we just make it hard. Sometimes trading is just a matter of connecting the dots.

I think Dick’s future doesn’t look great. Stack is talking about filling their shelves with fresh items. Maybe I should show Stack the picture below and introduce Stack to Amazon because store/mall traffic is declining, Retail Apocalypse is real and only those brick and mortar stores that have a serious online presence have a chance at survival.

Stack is also looking forward to Under Armour’s premium wear. So Dick’s is relying on wear from a desperate company in Under Armour. They are desperat because what was once a must own brand, is ubiquitous now.

Kohl’s Corp. began selling Under Armour wear in 2017 and is found in hundreds of stores and online. Kohl's also had a conference call last week. During their conference call they said Under Armour was a hot seller. The CEO later when on to say Under Armour delivered very strong growth and said the label’s comparable sales growth is actually accelerating.

So what makes you think at some point, Under Armour won’t sell their premium wear at Kohl’s too. Because to be frank, Under Armour isn’t doing well either. In addition, with their nine categories: team sports, men's training, women's training & studio, outdoor, golf, run, basketball, global football and athleisure and getting into the athleisure later, Under Armour can’t focus and totally missed the boat on the athleisure tectonic trend.

With all that said, I think Dick’s is a long term short. Lets go to the monthly charts to see how low Dick’s can go over time.

Price is approaching the monthly supply at $40. If price returns to the monthly supply, the chart suggest price can go down at least to $27. However, with the pending Market crash coming, my final target is $12.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

Continued great posts. Some background/context and then boom, let's go to the charts. Good stuff.

Thanks @morseke1 The next 12-18 months are going to get really interesting.

I couldn't agree more:

-Cryptos should boom

-Gold and the resource stocks are the most hated in years and COT just show smart money only has 2000 net short contracts. There is usually 100K-150K net short contracts. Sentiment is terrible with massive gold ETF withdrawals since June. Last time COT was at this level was December 2015, just before gold went on a 30% run over the 6 months. One of the largest Precious metals funds just killed the fund a couple of weeks ago due to extended poor performance. The last time they did this was in 2001 and gold went on a 600% run.

-Will emerging markets cause a global crash. Turkey, Venezuela, Argentina... Will Italy and Europe's banking system crash?

-Will a trade war lead to global economic slowdown, which leads to a recession?

-Will we get a yield curve inversion and mark the warning shot for the requisite US recession within 6-9 months?

-Will the stock market boom as it has in the last 12 months of the previous bull markets?

You hit on all the themes to pay attention to in the next 12-18 months, nice summary.