The Federal Reserve is still on the way to raising interest rates, but there are "little followers" who can't hold back the suspension of interest rate hikes

Since 2022, the Federal Reserve has launched the latest round of the interest rate hike cycle. Central banks in Europe and the United States have followed the pace of the Federal Reserve to continuously raise interest rates to curb inflation and cool down the economy. A year has passed, and the Fed is still on the way to raising interest rates, but its followers have become incompetent and unable to continue raising interest rates.

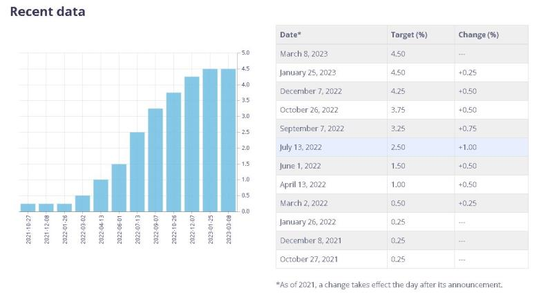

This week, Federal Reserve Chairman Powell hinted that there will be larger and possibly faster interest rate hikes in the future, but the Bank of Canada has made it clear that it will pause interest rate hikes. On Wednesday local time, the Bank of Canada's interest rate decision statement stated that it will maintain the benchmark interest rate unchanged at 4.50%. In the previous year, Canada raised interest rates eight times, in line with the actions of the Federal Reserve.

The Bank of Canada said in a statement that Canada's economic growth in the fourth quarter of 2022 was flat, below the bank's forecast. The weaker-than-expected GDP was largely due to a sharp slowdown in inventory investment as consumption, government spending, and net exports picked up. Restrictive monetary policy continues to weigh on household spending, with business investment weakening as domestic and foreign demand slows.

The Bank of Canada said the country's inflation rate fell to 5.9 percent in January, reflecting lower price increases for energy, durable goods, and some services. Price increases for food and shelter remain high, causing continued hardship for Canadians. Pressure on product and labor markets is expected to ease as economic growth softens in the coming quarters. That would slow wage growth and increase competitive pressure, making it harder for businesses to pass on higher costs to consumers.

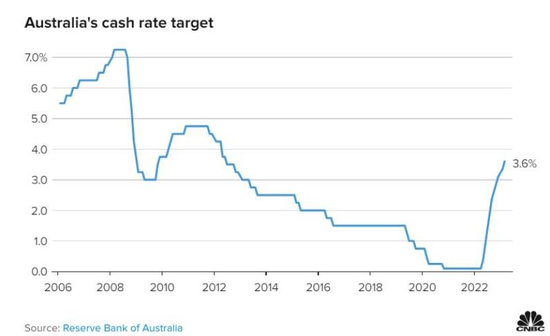

In addition to Canada's clear announcement of the suspension of interest rate hikes, the Australian central bank is also briefing on the suspension of interest rate hikes. RBA Chairman Philip Lowe said in a speech on Wednesday that the RBA is close to being ready to hit the brakes on rate hikes.

"With monetary policy currently in the restrictive territory, we are close to an opportune time to pause rate hikes to allow more time to assess the state of the economy," said Philip Lowe.

In emphasizing the central bank's goal of reducing the cost of living, Philip Lowe said that the RBA has to deal with two risks when making monetary policy decisions: "One is the risk of not doing enough, which will lead to high inflation continuing, which will lead to the eventual Lowering inflation is costly. Another risk is that we move too fast, go too far, and slow the economy far more than needed to lower inflation.”

Philip Lowe's comments came after the Reserve Bank of Australia raised its benchmark overnight cash rate by another 25 basis points to 3.6%, the highest level since June 2012. On Tuesday, Australia's S&P 200 rose on the back of a small rate hike by the RBA and Philip Lowe's non-hawkish speech.

Gareth Aird, an economist at the Commonwealth Bank of Australia, said the RBA could suspend as early as April, when comparing language from the central bank's last meeting.

A sentence in the February statement of the Reserve Bank of Australia stated: The interest rate decision committee expects that further increases in interest rates (further increases in interest rates) will be needed to ensure that the current high inflation is only temporary. The Reserve Bank of Australia stated in a statement in March that the interest rate decision-making committee expects that further tightening of monetary policy will be required to ensure that the inflation rate returns to the target and that the period of high inflation is only temporary.

Gareth Aird writes that removing the aforementioned plural expression of raising interest rates (which is expressed in the plural in English many times, as in further increases above), "means that the RBA rate-setting committee does not believe that it needs to raise interest rates many times from now on." Cash rate. Markets should treat April’s RBA rate decision meeting as ‘live’ and the RBA may pause rate hikes then.”

Since the Reserve Bank of Australia followed the Federal Reserve to raise interest rates, the Australian S&P 200 index has fallen sharply twice in 2022. Now, Australia's S&P 200 index has returned to the level at the beginning of the 2022 rate hike. This is in stark contrast to the Australian dollar (0.6589, 0.0000, 0.00%), which is hovering at levels not seen since December 2022 following a dovish speech from RBA Governor Philip Lowe.

RBA economists wrote: “Divergent comments from the Fed and RBA chairs imply sharply higher USD/AUD.”

IG's market analyst Yeap Jun Rong wrote that the Aussie "is experiencing the double whammy of a 'dovish rate hike' from the RBA and a more hawkish Fed," with the RBA's latest statement "leading to speculation that the next two meetings are about to be suspended. There are psychological expectations for interest rate hikes.”