The Everything Bubble is about to burst

Economic bubbles... We all remember the American housing bubble that triggered the credit crisis in the USA in 2007. Seven years earlier, investors lost a lot of money when the Dot-com bubble burst. Investors never seem to learn from previous bubbles, because spotting a bubble is not always easy. Of course it's easy afterwards, but even while a market is in a bubble it can always go higher. Even much higher!

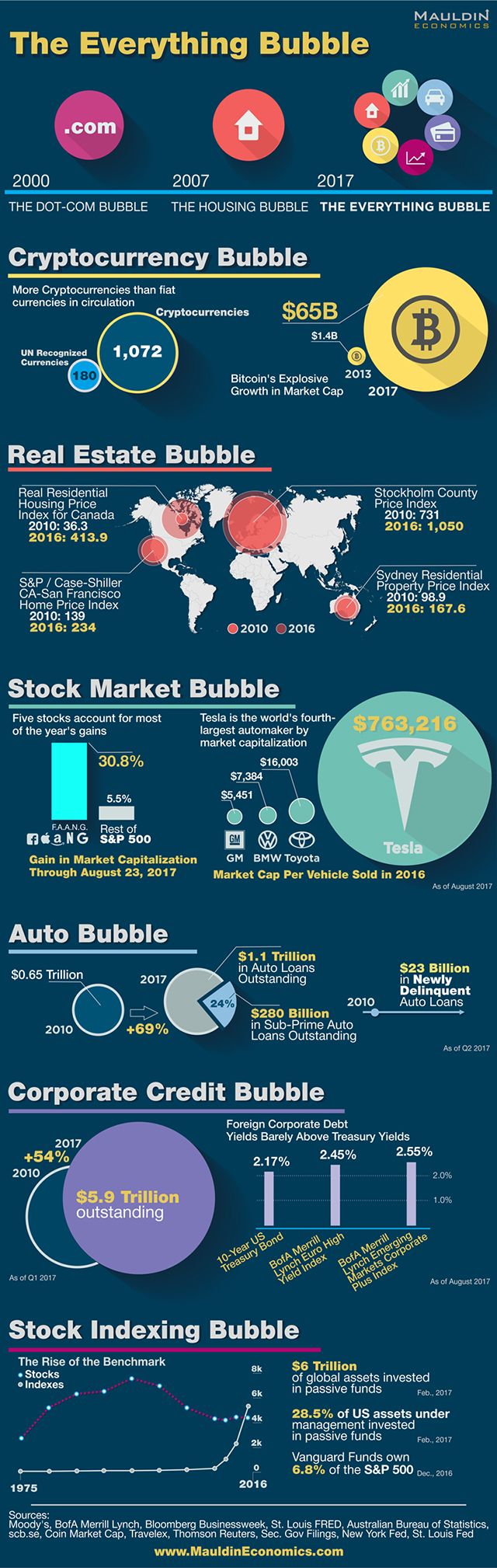

The Everything Bubble

According to Jared Dillian, economist at Mauldin Economics, everything is a bubble at the moment. Together with his colleagues at Mauldin Economics he created the infographic below to show us all the bubbles he believes we are currently dealing with.

In 2000, we had the dot-com bubble.

In 2007, we had the housing bubble.

In 2017, we have the everything bubble.

S&P 500 Stock Index

Is the stock market in a bubble right now? Below is a chart of the S&P 500 Stock Index. How can one argue this is not a huge bubble? Can the index go higher? Sure, but corrections and crashes will always come one day. No asset goes straight to the top without corrections and crashes. The last correction was in January 2016 and the last stock market crash was during the crisis of 2008. We haven't seen a correction in almost 2 years. This is not normal! Look how overbought this market is on the RSI indicator in the chart below. A correction will surely come, you just don't know exactly when.

Cryptocurrencies

Do you remember when the Bitcoin bubble burst when Bitcoin Exchange Mt. Gox collapsed in 2013? Below is a chart of the total market capitalization of all cryptocurrencies. As you can see the bubble of 2013 was nothing compared to today's prices. The question remains if cryptocurrencies are in a bubble right now? Only the future knows.

To put things in perspective...

| Asset | Value |

|---|---|

| Value of all gold in the world | $7,823 billion |

| Value of all companies on the NASDAQ in March 2000 | $6,710 billion |

| Value of all Apple stocks | $805 billion |

| Value of all Google stocks | $679 billion |

| Value of all Facebook stocks | $498 billion |

| Value of all cryptocurrencies combined | $154 billion |

| Value of all Bitcoins | $80 billion |

| Value of all STEEM | $243 million |

As you see... If the cryptocurrency market is currently a bubble then it is a relative small one.

Which bubble do you think is going to burst first?

What was the source of your numbers above, especially for gold? It would be interesting to look at today’s stock market cap. I would also add the bond market which more obviously in bubble territory

Here is the source for the value of all gold: http://onlygold.com/Info/All-The-Gold-In-The-World.asp

For the market capitalization of a company you can just google 'stock company name'. Stock Apple for example.

The biggest one is the debt bubble. Treasuries and Co.

This is a very old topic, I agree with you, if there is bubble in things like bitcoin, the bubble is too small to burst so far.

Thanks for sharing

Upvoted for great content

Regarding Bitcoin :

If bubble is defined quantitatively as an exponential increase in price over a short period of time.

Than yes, it is a bubble.

From a qualitative perspective I do not think it is though.

I fucking love this article, and that infographic is pure gold!

It's like a multibubbleverse

Regarding the infographic: comparing the number of cryptocurrencies to the number of UN recognized Fiat currencies doesn't give it much credibility. There are no UN recognized cryptocurrencies, they're not really comparable entities anyway.

Great post! I always have a hard time explaining to people that the crypto bubble is still relatively small.

Still think we're barely even reached bubble stage, if this was the dot-com bubble, we'd be in 1996/1997 (as an analyst predicted recently), so I think it'll be a few years before it pops. There's still the need for some real institutional/hedge investment to pump up the prices from Goldman Sachs & co, more widespread adoption of crypto. Only when we delude ourselves into thinking we don't need fiat, because 5-20% of the population use crypto, when the price of Bitcoin is 50,000/100,000+, then it'll be a the bubble will pop.

The situation we're in now is beyond insanity. A correction is much needed across the board. It would be very painful, but is much needed. The runaway money printing by central bankers has created an environment of utter chaos. How long can it go on? Who knows. When you can simply print your way out of every problem it could last for some time. I wonder if we'll see helicopter money in it's true form, ala a living wage to keep the wheel turning.

Nice man, I have been reading Mauldin's letters for years. Met him in person way back in 2002. Jared's stuff is good as its short and to the point.