37 trillion bubble

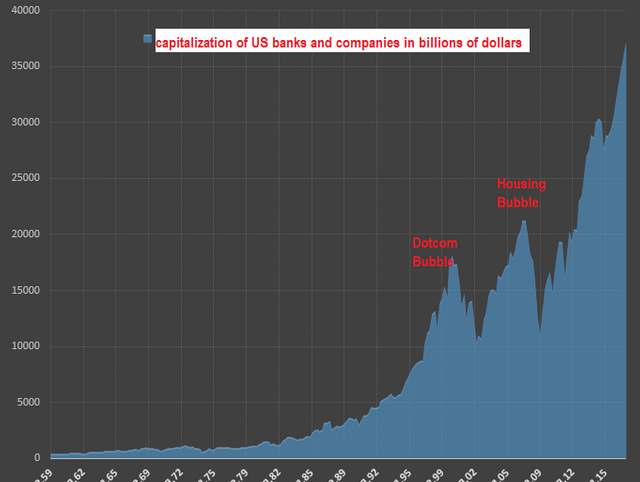

The capitalization of all companies (banks and non-financial businesses) circulating on all exchanges in the United States on Friday (2017/10/27) exceeded $ 45.5 trillion, of which $ 37 trillion are directly owned by US joint stock companies (of which $ 31 trillion are public ones).

For 5 years +17 trillion dollars or almost twice!

How pathetic and insignificant is the dotcom bubble on the chart in comparison with what we see now?

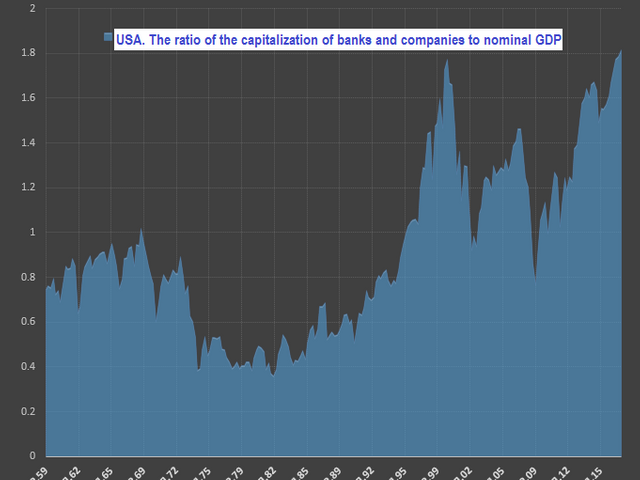

As of October 30, 2017, the ratio of capitalization of American banks and companies to nominal GDP was 1.82, which is an absolute historical maximum. During the period of the dot-com bubble this coefficient was 1.77. Now even higher than at the time of the greatest bubble of the 30s.

Although there are no detailed series of that period, but according to estimates at the time of the collapse of the 1930s, there were 1.65. But it is worth noting that the degree of concentration of business at public auction at that time was significantly less than now. However, in any case, current events are not ordinary and we are present at the grand bubble of the century.

For any basic financial ratios (P/E, P/S, EV/EBITDA, P/BV), the deviation of the current market capitalization, on average, by 35% exceeds historical averages over the past 30 years. It's just incredible! On Friday (2017/10/27), more than 90% of the estimated financial ratios exceeded historical highs! So expensive there was never at all - and this is taking into account the buyback of shares!

Also on Friday, the record was updated for the lowest volatility of trades on average over the last 20 trading days for the entire period of electronic trading since the late 80's

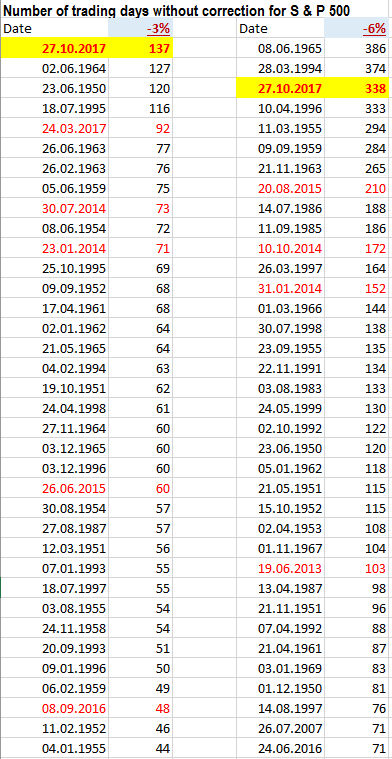

Another absolute record was set, but not from the 80's, but in the whole history.

137 trading days without a 3% correction.

The last time was like this in 1964 and 1950 ...

Ahead truly disastrous events await us. And not only in the US, but everywhere. Remember these unique moments, we are present at historical processes.

What do you think will happen with bitcoin, when the bubble begins to burst? Write in the comments.