Ancient Financial Plan Written On Clay Tablets Still Works For Creating Wealth Today

You know that feeling. You work your ass off every day to just pay the bills and it never seems like you'll ever get ahead. No matter how hard you try to get out of the hole you dug for yourself you just end up feeling like a rat on a wheel.

How will you ever get out of this rat race?

In high school, I felt something was missing in my education. My passion for learning is strong, but honestly, I felt more could be learned faster from reading books on subjects that interested me and applying lessons learned in the real world. It wasn't until after graduation that it dawned on me that my educational curriculum lacked was anything to do with understanding how money works.

Money would seem an important enough subject, right up there with health, to be taught in schools, but curiously both are absent from most classrooms.

I graduated high school with a sense of being indoctrinated to be a worker bee and the rest of the hive were oblivious, happy to buzz along in search of pollen (money) to make money.

How could subjects of such importance to a thriving, sovereign individual, to say nothing of a functioning society, be glossed over or omitted entirely?

Money is such an old subject there must be some books written about it by now that would tutor one to the intelligent managing of it. There are. They just are not taught in public schools.

Schools, it would seem, do not prepare their students for anything other than being a good worker. Just smart enough to do the task assigned to them but not smart enough to get out of the rat race entirely.

To do that one needs to continue their financial education on their own. One book fell in my lap and profoundly jump started my understanding about money titled, The Richest Man In Babylon by George S. Clason.

Here's a free copy of The Richest Man In Babylon by George S. Calson

This book is an easy read with only 50 or so pages. One could easily read it in a couple hours, but applying the lessons in this book to your daily life will have life-changing benefits to your financial well being.

Anyone who does what this book teaches will grow their investments while eliminating their debts at the same time all from the same paycheck they are earning now.

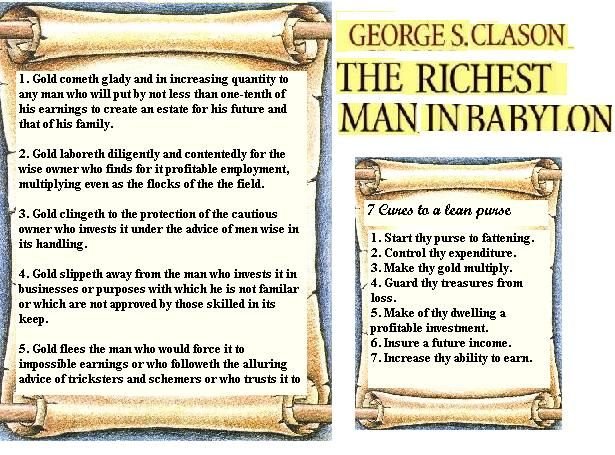

The Richest Man in Babylon is a book by George Samuel Clason that dispenses financial advice through a collection of parables set in ancient Babylon. Through their experiences in business and managing household finance, the characters in the parables learn simple lessons in financial wisdom. Originally a series of separate informational pamphlets distributed by banks and insurance companies, the pamphlets were bound together and published in book form in 1926. Wikipedia

This book was first published in 1926 but was originally translated from ancient hieroglyphics found in Babylon, making this knowledge much older than that. This suggests that the fundamental principles taught in the book are universal and transcend time. What worked in Babylonian times still work today.

The basic rules of the book in plain English are as follows:

Pay Ourselves First (Start thy purse to fattening)

Live below our means (Control thy expenditures)

Make our money work for us (Make thy gold multiply)

Insurance protects our wealth (Guard they treasures from loss)

Our home is our biggest expense (Make of they dwelling a profitable investment)

Have a retirement plan (Insure a future income)

Invest in ourselves (Increase thy ability to earn)

Track Our Wealth (Know where you are and where you are going)

Pay Ourselves First (Start thy purse to fattening)

In my view, this in the most important lesson in the book. Often people pay all their bills and debts first leaving nothing left from their paycheck for the future.

Take 10% of every check and setting it aside without spending it is a rewarding habit to get into. Learning to live on 90% of your income is not as hard as it seems and before long you will have some money to invest.

Why are you working so hard to begin with? Is it just to pay bills or are you striving for a better future? Unless you pay yourself first, setting 10% or more aside for the future, you will not have a future different that what you are doing now.

Your employer and government pay themselves first and so should you. By taking 10 cents from every dollar you earn and paying it to yourself you will be able to take advantage of opportunities to increase your wealth in the future.

Even the taxman pays himself first by taking it out of your check before you even see it. If it makes it any easier, consider the 10% you set aside as a Me Tax for your prosperous future.

Live below our means (Control thy expenditures)

Many of the things we spend money on are foolish and completely unnecessary and the things we own often end up owning us just as much as we own them.

Reduce your spending on frivolous expenditures and redirect those earnings towards reducing debt and increasing your savings. Budget your expenses so that you may have money to pay for your necessities, to pay for your enjoyments and to gratify your worthwhile desires without spending more than nine-tenths of your earnings.

This habit will create a surplus that can be invested or saved each month and increased your ability to create wealth.

Make our money work for us (Make thy gold multiply)

I recommend not investing until you have enough money saved to cover a year of expenses. Following rule 1 and 2 consistently will put you in a position to cover your expenses faster than you think.

Don't invest more than you can afford to lose and never invest in something you don't completely understand. The more knowledge you have about what you're investing in the better chance of succeeding in that investment.

If you are young time is your best friend and safe investments with low returns over a long time will ensure success. Compounding interest works like magic but takes time, often your entire working life, to show results.

I started investing later in life and am willing to take more risks. With more risk comes better returns but also more, well, the risk of losing it all. The riskier the investment the more knowledge needed about what you're investing in.

Insurance protects our wealth (Guard they treasures from loss)

We never know what is going to happen in life. You could get injured in a car accident or suffer some health issue and the cost could wipe out your saving or put you in debt.

Having insurance, be it renters, homeowners, or life insurance, protects you financially from the consequences of unexpected events. it's better to be safe than sorry.

Our home is our biggest expense (Make of they dwelling a profitable investment)

Many of us do not own a home and instead rent one. There is absolutely nothing wrong with that but I believe the lesson we can learn here is that we should manage our biggest expense smartly.

Many people think their home is their biggest asset but in realit,y it is their biggest expense. To me, an asset is anything that puts money in your pocket whether you work or not. Unless you own a property that you can rent for more than the mortgage, it will be an expense, now an asset.

While you must live somewhere it is important to not live beyond our means and that is the biggest mistake people make when purchasing a home. They buy a large home because they can afford it at the moment without considering their financial situation could most likely change over the course of their 30-year mortgage.

It's better to have a smaller home and a surplus of income at the end of each month than a large home you can barely keep up the payments on.

Have a retirement plan (Insure a future income)

There's a wealth of information on creating a retirement plan available and I'll just add here that to get a result that you want you'll need to have a plan.

Any plan is better than no plan. No plan is no plan at all.

Invest in ourselves (Increase thy ability to earn)

The best investment one can make is investing in yourself. Getting in the habit of increasing your knowledge with the aim of increasing your earning ability pays huge dividends.

Robert Kiyosaki once told me to never take a job for the money alone, take it for the skills it will teach you. I've had many jobs in my lifetime and each one taught me skills that acted as a catalyst propelling me to earn more.

Ironically, some of my biggest failures in life taught me the lessons needed to earn me more money in the future. The important takeaway is whether you fail or succeed, the learning experience stays with you and can be the driving force behind your next success.

Reading books that continue growing your knowledge is an invaluable investment in yourself. Learning doesn't stop after high school or college, in fact, it is just the beginning.

Any investment in yourself is always a good investment.

Track Our Wealth (Know where you are and where you are going)

To get from point A to point B you need to know where you are and where you want to go. Sounds simple enough, right?

Tracking your earnings, investments, and expenditures is the only way to know where your money is coming from and where it is going each month.

In order for us to fully develop a plan to be wealthy, we need to learn how to track our wealth so that we may know where we want to go and create a plan to get there.

Tracking your progress will show you where you are and what you need to do to get to where you want to go. You'll have a sense of controlling your destiny and a visual representation of your progress as you move towards your goal.

I hope these points help you on your journey. You owe it to yourself to read the book and take control of your finances so you can have a better future.

I love that this is originally translated from ancient hieroglyphics, and gives information about understanding money and finance in general, instead of how it works in America or how it works in present day. Until the day money is obsolete, these concepts outlined here will continue to be important for everyone to understand. I will personally be reading this book, thank you for the link. Blessings.

I was astounded with the title a very fantastic, but after I read it, I get a lot of science on.

#great grandfather

Wow! What an amazing post! You really have outlined a very fundamental principle to wealth building in a simple and easy format to follow. Thank you for the link to the book, well worth the time to read! I hope this post reaches a very large audience and that they actually take the time to read, understand, and apply it to their lives. This simple formula could be life-altering to many.

Good contribution

It seems in this case that a picture DOES tell a thousand words. Thanks for your words and the ancient hieroglyphics.

Very interesting! And, thanks for your support.

Excellent post!

I wish I read that when I was younger.

I was bred to be a worker bee and when they removed the beehive I was left in the abyss.

Thanks for the PDF too, my life is fucked but there might be hope for my kids if they can learn the basics from the PDF.

Upvoted & resteemed

Knowledge obtained is never a bad thing. Perhaps had you found this when you were younger it may have had a bigger impact, or perhaps at your young immature age it would have gone over your head and you wouldn't have bothered to listen to it.

But what you can do is learn it now, and also try to teach others sharing our knowledge is the only way humanity improves over time.

This works no matter what age you are.

Good post @luzcypher..

Si pudiera llevar a cabo la mitad de las premisas sería Gardel caminando por Corrientes .Creo que partimos de la misma necesidad de buscar algo mas que la escuela y por suerte nos refugiamos en los libros y no en la calle que no es mucho lo que enseña y aveces enseña mal. El asunto es que me fui para otro lado y no le di importancia a la administración menetaria. Hoy se que ya es tarde porque ya me acostumbré a meter la energía en otro lado pero ..... pero las indicaciones me parecen correctas y me sirven para corregir cosas que se pero que me hago el pendejo y olvido. Gracias me gustó un abrazo

No se porqué escribo una cosa y sale escrito cualquiera .Difícil comunicarse porque parece que uno manda un abrazo y sale una cachetada. soy nuevo y no me se manejar muy bien,