Restoring the Lost Republic (6 PART SERIES): Part 3 – Department of the Treasury & The Federal Reserve (The Fed)

Restoring the Lost Republic (6 PART SERIES)

1 - Money, Currency, Debt, & Credit Backgrounder

2 - The Legitimacy of the Federal Government in Washington D.C.

3 - Department of the Treasury & The Federal Reserve (The Fed)

4 - The 16th Amendment and the IRS (Internal Revenue Service)

5 - 3-POINT ACTION PLAN

6 - Conclusion & Quotes from U.S. Presidents

In Part 1 – Money, Currency, Debt, & Credit Backgrounder of this 6-part series, we explored the difference between money, currency, debt, and credit.

In Part 2 – The Legitimacy of the Federal Government in Washington D.C. we looked at some historical facts regarding the federal government and learned more about the nation's capital - Washington D.C. We also posed many questions including whether Washington D.C. and the United States itself are corporations.

In Part 3 – Department of the Treasury & The Federal Reserve (The Fed) we will examine who has the legal authority to issue money in the United States focusing on the US Department of Treasury and the US Federal Reserve.

Part 3 – Department of the Treasury & The Federal Reserve (The Fed)

Let’s begin with a simple question: who has the legal authority to issue and regulate the money supply in the United States?

To answer this critical question we must first refer back to the Constitution (of 1787). Article 1 – Section 8 – clause 5 of the Constitution states:

[The Congress shall have Power] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

As per the Constitution only Congress has the power to create the money supply, nobody else does.

On September 2, 1789, Congress passed An Act to establish the Treasury Department (16) to facilitate the management of money resources in the United States.

According to Wikipedia (17):

The Treasury prints and mints all paper currency and coins in circulation through the Bureau of Engraving and Printing and the United States Mint. The Department also collects all federal taxes through the Internal Revenue Service, and manages U.S. government debt instruments.

On the Treasury’s own website (18) (‘Organization and Functions’ section) is it also indicated that they are responsible for the “production of coin and currency”.

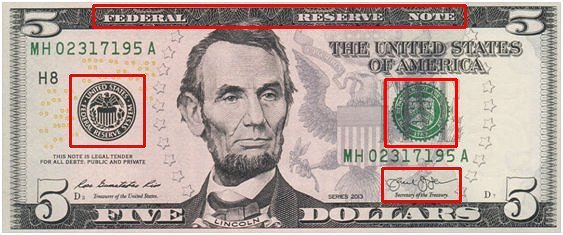

So, we can confirm that they do indeed “produce” or “print” the currency, as can be noticed from the official green colored seal of Treasury (visible on the right hand side of notes) along with the signature of the Secretary of the Treasury (currently Mr. Jacob Lew) on paper notes. By looking at paper notes (see Figure 3 below) you will also notice the seal of the Federal Reserve System (on the left hand side).

Figure 3 – A $5 Federal Reserve Note from 2013 (19)

But who actually “issues” the currency? What really I mean by this is who “creates” this currency? Notice I use the word “currency” because these notes are NOT money – they are debt instruments.

So, if the Treasury Department is not the entity who is creating the money supply, then what exactly are they responsible for?

If you look at the Mission (20) of the U.S. Department of the Treasury it reads as follows:

Maintain a strong economy and create economic and job opportunities by promoting the conditions that enable economic growth and stability at home and abroad, strengthen national security by combating threats and protecting the integrity of the financial system, and manage the U.S. Government’s finances and resources effectively.

Part of the Treasury’s mission states: “strengthen national security by combating threats and protecting the integrity of the financial system, and manage the U.S. Government’s finances and resources effectively.” With over $20 trillion in national debt (21) (an enormous threat in itself) and a central bank (The Federal Reserve) engaged in reckless debasement (“money printing”) of the nation’s currency, one could easily argue that they are in fact mismanaging the nation’s finances, not using their resources effectively, and are thus failing miserably at this part of their mission.

The Federal Reserve (The Fed)

The Federal Reserve acts as the Central Bank of the United States and is currently the sole entity that has the control over the nation’s money supply. It was created in 1913 through the Federal Reserve Act (22,23,24). The Fed is organized as a “System” (The Federal Reserve System) which simply means that it is composed of 12 reserve banks (districts) (25) located across the nation along with a Board of Governors (26) located in Washington D.C.

A few years before its creation, what was to become The Federal Reserve was conceived by a small cast of politicians and big bankers at a highly secretive meeting held on a private resort on Jeckyll island (27) (in the state of Georgia). The following two books describe the meeting in great detail:

• The Creature from Jeckyll Island, by G. Edward Griffin (28,29); and

• The Secrets of the Federal Reserve (30), by Eustace Mullins (30)

Among the attendees were United States Senator Nelson Aldrich (31), A. Piatt Andrew (Assistant Secretary of the Treasury), Frank Vanderlip (32) (president of the National City Bank of New York, now called Citibank), Henry P. Davison and Benjamin Strong (representing J.P. Morgan & Company, now simply called JP Morgan Chase – currently the biggest bank in the U.S.), Charles D. Norton (president of the Morgan-dominated First National Bank of New York), as well as Paul Warburg (33) (a German-born American banker representing the interests of the Warburg family, a Jewish banking dynasty).

Benjamin Strong later served as Governor of the Federal Reserve Bank of New York for 14 years (34).

The name they came up with for the Central Bank was “The Federal Reserve”. But, its name is both misleading and deceptive. There is nothing “Federal” about The Federal Reserve; it’s a private corporation that has the power to act on its own and is not accountable to the federal government. On its own website (35) it states:

…It is considered an independent central bank because its monetary policy decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government,…

In other words, neither the President nor Congress has control over the actions that the Federal Reserve takes. Therefore, it is indeed an independent entity from the Federal Government.

Although Congress does have some “oversight” on the Fed – mostly by holding congressional hearings (whereby they question members of the Fed, such as the Fed Governor) – they are virtually powerless over the actions of Fed policies and, most of all, of their ensuing disastrous consequences. You can find many examples of this throughout the last century. But perhaps one of the most ridiculous examples occurred after the Financial crisis of 2007–08 (36) when U.S. Representative Alan Grayson questioned Elizabeth Coleman (the Inspector General of the Federal Reserve System) about where $9 trillion dollars in credit went missing from the Fed’s books (37); she either didn’t have a clue about where the funds went or she was not willing to share that information in the hearing. A video of this hearing can be viewed on YouTube (see the footnote above for the link); it’s definitely worth the watch!

Knowing very well that such hearings were, in essence, pointless, the former U.S. Representative Ron Paul nevertheless took the opportunity to express his views (back in 2011) to the then Chairman of The Fed – Mr. Ben Bernanke – about the unconstitutionality and the failure of the Federal Reserve (38).

Who owns the Fed?

Let’s first have a look at what the Federal Reserve has to say regarding this very question; if you look at its website regarding this question (39) you will see:

The 12 regional Federal Reserve Banks, which were established by the Congress as the operating arms of the nation's central banking system, are organized similarly to private corporations--possibly leading to some confusion about "ownership." For example, the Reserve Banks issue shares of stock to member banks. However, owning Reserve Bank stock is quite different from owning stock in a private company. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. The stock may not be sold, traded, or pledged as security for a loan; dividends are, by law, 6 percent per year.

This web page is not really helpful in answering the question; in fact, it avoids giving a clear answer regarding this very important matter. All it says is that the 12 regional banks of the Fed are organized “similarly” to “private corporations” and their stock (shares) cannot be sold. Usually, with private corporations, shares of stock can be sold. But with the Fed, the member banks are never allowed to sell their shares. In other words, nobody else will ever be able to buy shares and gain ownership of the Federal Reserve. Only the member banks who own these shares are entitled to these 6 percent dividends per year; that means that profits made by the Fed (through interest income derived through its lending activities) are distributed back to the member banks, none of this money ever goes to the Federal Government. Accordingly, when they state “Reserve Banks are not operated for profit”, they are indeed not being truthful.

Now, wouldn’t it be nice to see who exactly the member banks are? Because here, we are not only talking about 12 banks. Rather, we are talking about a much larger number. Unfortunately, the Federal Reserve doesn’t mention on its website (nor will it reveal it by other means) who exactly the private member banks are. As with most “private corporations” they are not required by law to reveal its shareholders (owners).

Thus, the only way we can answer the question is by looking at two things in particular: first, by examining the actions the Fed has taken in the past; and secondly, through the fruits of painstaking research conducted by different people and organizations over the years.

We needn’t look too far back to see who has benefited from the rich coffers of the Fed. In the aftermath of the Financial crisis of 2007–08, the Federal Government passed the TARP (Troubled Asset Relief Program) (40,41) program which, in itself, secured over $700 billion in taxpayer funds to bail-out troubled banks. Although initiated by Congress and the U.S. Treasury, the Fed was ultimately in charge (under which authority I am not sure) of disbursing these funds and did so in a very secretive manner. So secretive in fact, that when Bloomberg News was investigating the matter with the Fed in order to find out who the recipients of the TARP program were, they were denied access to that information. Bloomberg thus had to initiate a legal battle and use the U.S. Freedom of Information Act in order to get the Fed to disclose the recipients of TARP funds. (42,43)

Apart from TARP, the Fed also provided nearly $13 trillion of dollars in aid through at least 11 other programs to help troubled banks. (44,45) Not only did the Fed provide funds to American banks and companies, but is also provided hundreds of billions of dollars to European banks (46,47).

Another report from Bloomberg showed that 407 banks and companies had tapped Federal Reserve emergency programs during the 2007 to 2009 financial crisis. (48,49) From these reports, we can safely assume that there may very well be at least a few hundred banks that are integrated (most likely through share ownership) within the Federal Reserve System and that possibly even more companies are (most likely in an indirect fashion). Among these are the nation’s major banks such as JP Morgan Chase, Citigroup, Bank of America, Wells Fargo, Goldman Sachs, and Morgan Stanley. Each of these major banks are shareholders of many other banks and businesses.

A research report entitled Federal Reserve Directors: A Study of Corporate and Banking Influence published in 1976 (50) indicates that several European and American banking families including the likes of the Rothschilds, J. Henry Schroder, the Rockefellers, Alan Pifer (President of Carnegie Corporation of New York), and Maurice F. Granville (Chairman of The Board of Texaco Incorporated) were the principle shareholders of the Federal Reserve (in 1976); in addition, the charts from this research report reveals a complex web of hundreds more powerful banks, families, and corporations that are included in the mix.

A more recent (2011) research endeavor entitled The Federal Reserve Cartel (a 5 Part Series) by Dean Henderson (51,52,53,54,55,56) also digs into the matter revealing the same usual suspects.

I think if one were inclined to investigate the precise ownership structure of the Federal Reserve today, it would probably take years of investigative hard work to compile. In my opinion, there wouldn’t really be a point in investigating the precise ownership of the Fed. What really matters is that everyone knows that these rich bankers, families, and corporations are the owners and beneficiaries of the Federal Reserve System.

How does the Fed create money?

Firstly, I want to emphasize that the Fed creates currency, not money. I say this because what distinguishes money from currency is that money has a store of value over a long period of time. Since Federal Reserve currency notes are not backed by anything at all, nor can they be redeemed for anything but other currency notes, they are indeed not a store of value over the long term.

So how does the Fed create currency? In brief, it creates currency out of thin air as debt with the simple action of creating a book entry.

Specifically, here are the steps of currency creation:

- When the U.S. government needs money to pay its bills it asks the Treasury Department to create bonds to be sold on the market. (These bonds increase the national debt);

- The Treasury then sells these bonds to the big banks;

- These big banks then sell these same bonds to the Fed (which they actually own) at a profit;

- The Fed buys those bonds with checks it writes (even though the account from which the checks were written has a $0 balance);

- The Fed gives those checks to the banks thus creating currency in the system;

- Then, those banks use those funds to lend and create more currency into the banking system;

- The process repeats.

This process may seem confusing to many. But as shown in steps 4 and 5 above, the Fed literally creates currency out of thin air by making a book entry on a computer. By doing so, they are actually committing fraud, as they are writing checks from an account that has no funds. If you or I were to do that, we would be convicted of fraud. But the Fed has been permitted to operate like this for a very long time. They even admit this as per the following quote (57):

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.” – Federal Reserve Bank of Boston, Putting It Simply (1984)

The important thing to note here is that each and every dollar of currency that is created is created as debt.

Consequently, interest must eventually be paid on each and every one of those dollars.

Thus, it is mathematically impossible to ever repay all this debt and interest without increasing additional debt (dollars) in the system (in order to pay merely the interest on the previous dollars issued). It’s a perpetual cycle that was viciously designed this way by the creators of the Federal Reserve System in order to ensure a steady flow of income to its shareholders – the big banks.

Since the Fed purchases the bonds from the Treasury, they are entitled to interest payments on those bonds. In other words, the federal government needs not only to pay back those bonds, but also the cost of borrowing (interest) to the Fed.

It is plain and simple for anyone with half a brain to see, the Federal Reserve System is nothing more than a looting mechanism for the big banks.

The BIG QUESTION

If Congress, through its authority over the Treasury Department, has the authority to mint and coin money then why is letting the Federal Reserve do it?

Think about it for a minute. They have the power to issue currency at zero cost but instead are still letting the Fed do it and must pay them enormous amounts of interest. Why the hell would they do that? The simple answer is that in the last hundred years the powerful banking interests in this country have undoubtedly been in control of both Congress and, many would also argue, of the presidency itself. I’ve provided many quotes from past presidents regarding this very issue at the bottom of this article.

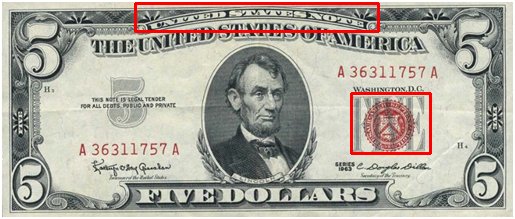

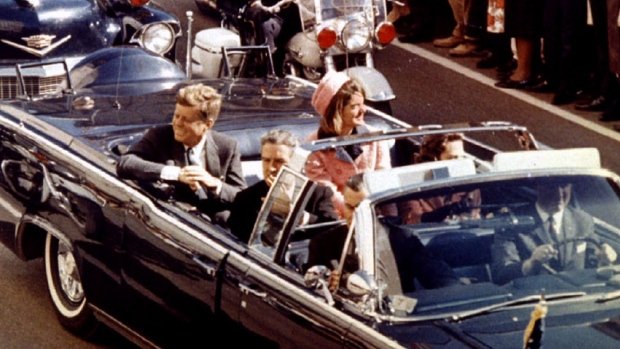

John F. Kennedy was perhaps the only president who had the courage to take on these banksters when in 1963 he enacted Executive Order 11110 (58,59) which gave back power to the U.S. Government to issue currency without going through the Federal Reserve. These were known as United States Notes and were, most importantly and significantly, interest free. As can be seen in the following figure, these currency notes were easily distinguishable from Federal Reserve Notes in that they used a red seal (as opposed to the green seal seen on Federal Reserve Notes) and were titled ‘United States Note’ rather than ‘Federal Reserve Note’.

Figure 4 – A $5 United States Note from 1963 (60)

These 1963 United States Notes (available in $2 and $5 denominations) were actually silver certificates and thus were backed by silver held by the Treasury as stated in the Executive Order:

“to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denominations of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption,”

After President Kennedy’s assassination in November of 1963, these United States Notes were immediately taken out of circulation. This is an absolute tragedy. At the end of 1963 the National Debt was about $306 billion (61); it has since ballooned to over $20 trillion today, or roughly $63,000 per American citizen (62). Who will end up paying this debt? Of course it is the current citizenry and future generations of Americans.

The good news, however, is that Executive Order 11110 seems to have never been repealed by any U.S. President (63,64,65). In other words, it is still in effect; yet no president has used it since the death of President Kennedy. Regardless, the U.S. Government still has the power under the Constitution to issue debt-free and interest-free currency. Why it chooses not to remains a mystery, not to mention a tragedy.

[END OF PART 3]

For further exploration into the Fed, I would highly recommend one of the best documentary films ever made about the subject entitled Century of Enslavement: The History of The Federal Reserve that was produced by James Corbett of the famous Corbett Report.

Also, I recommend you have a look at the very informative infographic The Buying Power of the U.S. Dollar Over the Last Century to see what $1 could by over the century and how the US Money Supply went from $13 billion in the 1910s to a colossal $13+ Trillion by 2010 (note that this figure is verifiable on the Fed's own website!)

Stay tuned for Part 4 - The 16th Amendment and the IRS (Internal Revenue Service) where we will discover that the IRS is merely a collection agency of the Fed and is, in fact, an illegal organization.

Notes:

(16) An Act to establish the Treasury Department, http://www.treasury.gov/about/history/Pages/act-congress.aspx

(17) United States Department of the Treasury (Wikipedia), http://en.wikipedia.org/wiki/United_States_Department_of_the_Treasury

(18) U.S. Department of the Treasury (About – Organization and Functions),

http://www.treasury.gov/about/history/Pages/organization_and_functions.aspx

(19) Figure 3 – 2013 $5 Federal Reserve Note, St. Louis, Rios – Jacob Lew, http://www.panix.com/~clay/currency/new-prefix.html

(20) Mission of the U.S. Department of the Treasury, http://www.treasury.gov/about/role-of-treasury/Pages/default.aspx

(21) US Debt Clock, http://usdebtclock.org/

(22) Federal Reserve Act – Original Document (in PDF format), 1913, http://www.federalreservehistory.org/Media/Material/Event/10-58

(23) Federal Reserve Act – Original Document (in PDF format), 1913,

https://fraser.stlouisfed.org/scribd/?title_id=966&filepath=/docs/historical/fr_act/nara-dc_rg011_e005b_pl63-43.pdf#scribd-open

(24) Federal Reserve Act – Index and Sections, http://www.federalreserve.gov/aboutthefed/fract.htm

(25) The 12 Federal Reserve Districts, https://www.federalreserveeducation.org/about-the-fed/structure-and-functions/districts/

(26) Board of Governors of the Federal Reserve System, http://www.federalreserve.gov/aboutthefed/default.htm

(27) Jekyll Island Club (Wikipedia), http://en.wikipedia.org/wiki/Jekyll_Island_Club#Role_in_the_history_of_the_Federal_Reserve

(28) A Lecture on the Federal Reserve (The Creature from Jekyll Island), by G. Edward Griffin,

http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed15.htm

(29) G. Edward Griffin, author of the book The Creature from Jekyll Island (Wikipedia), http://en.wikipedia.org/wiki/G._Edward_Griffin

(30) Book: The Secrets of the Federal Reserve, by Eustace Mullins, http://www.barefootsworld.net/fedsecrets_00.html and

http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed06.htm

(31) United States Senator Nelson W. Aldrich (Wikipedia), http://en.wikipedia.org/wiki/Nelson_W._Aldrich

(32) Frank A. Vanderlip (Wikipedia), http://en.wikipedia.org/wiki/Frank_A._Vanderlip

(33) Paul Warburg (Wikipedia), http://en.wikipedia.org/wiki/Paul_Warburg

(34) Benjamin Strong (Wikipedia), http://en.wikipedia.org/wiki/Benjamin_Strong,_Jr.

(35) The Federal Reserve FAQ, http://www.federalreserve.gov/faqs/about_14986.htm

(36) Financial crisis of 2007–08 (Wikipedia) http://en.wikipedia.org/wiki/Financial_crisis_of_2007%E2%80%9308

(37) Video: U.S. Rep. Alan Grayson questioning the Inspector General of The Fed about the missing $9 trillion,

(38) Video: U.S. Rep. Ron Paul talking to the Chairman of The Fed Ben Bernanke,

(39) Federal Reserve - Who owns the Federal Reserve? http://www.federalreserve.gov/faqs/about_14986.htm

(40) Troubled Asset Relief Program (TARP) via Wikipedia, http://en.wikipedia.org/wiki/Troubled_Asset_Relief_Program

(41) U.S. Dept. of the Treasury –TARP Programs, http://www.treasury.gov/initiatives/financial-stability/TARP-Programs/Pages/default.aspx

(42) Bloomberg – Fed Refuses to Disclose Recipients of $2 Trillion (Correct), http://www.bloomberg.com/apps/news?sid=apx7XNLnZZlc&pid=newsarchive

(43) Bloomberg – U.S. Taxpayers Risk $9.7 Trillion on Bailout Programs (Update1), https://www.bloomberg.com/apps/news?pid=washingtonstory&sid=aGq2B3XeGKok

(44) Bloomberg – Fed Refuses to Release Bank Data, Insists on Secrecy (Correct), http://www.bloomberg.com/apps/news?pid=newsarchive&sid=axd4zwYGfdv0

(45) Fed Shrouding $2 Trillion in Bank Loans in ‘Secrecy,’ Suit Says, http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aS89AaGjOplw

(46) Bloomberg – Foreign Banks Used Fed Secret Lifeline Most at Crisis Peak, http://www.bloomberg.com/news/articles/2011-04-01/foreign-banks-tapped-fed-s-lifeline-most-as-bernanke-kept-borrowers-secret

(47) Bloomberg – Wall Street Aristocracy Got $1.2 Trillion in Secret Loans, http://www.bloomberg.com/news/articles/2011-08-21/wall-street-aristocracy-got-1-2-trillion-in-fed-s-secret-loans

(48) Bloomberg – Secret Fed Loans Gave Banks $13 Billion Undisclosed to Congress, http://www.bloomberg.com/news/articles/2011-11-28/secret-fed-loans-undisclosed-to-congress-gave-banks-13-billion-in-income

(49) Bloomberg – Fed’s Once-Secret Data Compiled by Bloomberg Released to Public, http://www.bloomberg.com/news/articles/2011-12-23/fed-s-once-secret-data-compiled-by-bloomberg-released-to-public

(50) Federal Reserve Directors: A Study of Corporate and Banking Influence published in 1976, http://www.save-a-patriot.org/files/view/whofed.html, http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed01.htm, http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed07.htm, http://oneradionetwork.com/the-economy-articles/who-owns-the-federal-reserve-banks-2/

(51) The Federal Reserve Cartel (a 5 Part Series) by Dean Henderson, http://www.bibliotecapleyades.net/sociopolitica/esp_sociopol_fed30.htm

(52) The Federal Reserve Cartel: Part I – The Eight Families ,by Dean Henderson, http://www.globalresearch.ca/the-federal-reserve-cartel-the-eight-families/25080

(53) The Federal Reserve Cartel: Part II – Freemasons and The House of Rothschild, http://www.globalresearch.ca/the-federal-reserve-cartel-freemasons-and-the-house-of-rothschild/25179

(54) The Federal Reserve Cartel: Part III – The Roundtable & The Illuminati, http://www.silverbearcafe.com/private/12.11/cartel3.html

(55) The Federal Reserve Cartel: Part IV – A Financial Parasite, http://www.shoah.org.uk/2013/12/26/the-federal-reserve-cartel-part-iv-a-financial-parasite/

(56) The Federal Reserve Cartel: Part V – A Solution, http://netteandme.blogspot.com/2014/06/the-federal-reserve-cartel-part-5-of-5.html

(57) Federal Reserve System – Quotes via Wikipedia, http://en.wikiquote.org/wiki/Federal_Reserve_System#Quotes

(58) Executive Order 11110 via Wikipedia, http://en.wikipedia.org/wiki/Executive_Order_11110

(59) The American Presidency Project – Executive Order 11110, http://www.presidency.ucsb.edu/ws/index.php?pid=59049&st=&st1=

(60) Figure 4 – 1963 $5 United States Note, http://www.banknoteden.com/USA.html

(61) TreasuryDirect – Historical Debt Outstanding - Annual 1950 – 1999,

https://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo4.htm

(62) usgovernmentspending.com – Debt Clock and Federal Debt per person, http://www.usgovernmentspending.com/federal_debt_chart.html

(63) John F. Kennedy vs The Federal Reserve, http://www.silverbearcafe.com/private/JFK.html

(64) End the Illusion, https://endtheillusion.wordpress.com/tag/debt/

(65) The Economic Collapse – Debt-Free United States Notes Were Once Issued Under JFK And The U.S. Government Still Has The Power To Issue Debt-Free Money, http://theeconomiccollapseblog.com/archives/debt-free-united-states-notes-were-once-issued-under-jfk-and-the-u-s-government-still-has-the-power-to-issue-debt-free-money

Amazing post as always Dan. Upvoting and Resteeming. I've been on vacation this past week and trying to keep up with the school shooting and controversy related to such surrounding my posts, so been very busy. But checking out your great well researched material here now. Big thanks.

Thank you!

good information I think I watched some videos on this by a good author, about the whole system, time for people to open their eyes for sure

This is some great content. I can actually use this to teach people about the Fed. Since people have the attention span of a goldfish, articles like these are easier to digest than whole books. I'm a fan