What to expect with the Dollar

This is huge news!

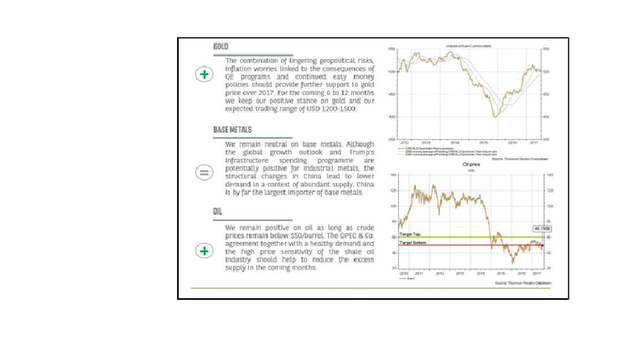

Basically in the info graphic below is what the Spanish banks believe will happen over the next year. While it is very simple it contains a lot of vital information to the economies.

As everyone knows, the global economies are not doing as well as mainstream medias are saying we are. Once you look at the actual data that is coming out with job claims, or with trade surplus, and even 1st time business applications, and especially consumer spending. Everything is not doing as well as it was a year ago. This is important paired with what major investors, banks, and my own analysis conclude. There will be a big weakening of the dollar. The best way to describe it is after an earthquake there are always the aftershocks. The same thing goes with economies.

We are more than due for our aftershock and at the intense momentum in the strength in the market only proves that. Similar to what was seen with the pound in Brexit, to the real estate markets in 2007, the roaring 20's then the crash of '29. While i do not believe this is the end of the world or anything else doomsday people believe, i do believe that a correction in the market is long overdue and even needed for us to continue forward.

With Gold prices expected to go up over the year, means that the dollar should be decreasing. Dollar is a safe-haven currency however; when that under preforms investors tend to revert back to gold. The same is true with investors in the DOW and NASDAQ when they under preform or the consensus is bearish, investors tend to look for other investments to have a greater return.

it will be an interesting year for both the dollar & gold. Maybe time to stock up on gold :-)

i keep on reading about how other filthy rich, or investors are stocking up on Gold since last year. Makes sense, then we see a huge run in the markets. Not to mention the info-graphic that the C.B. of Spain released in one of their documents. Pretty interesting to say the least.

yes, and to the ordinary person who cannot afford gold, invest in silver, I think that would be the next best thing to physical gold.