Starting to Have Doubts About Bitdice's Investment Opportunity

As I wrote before, I put roughly 0.1 BTC into BitDice's investment a couple of days ago. So far my investment has lost 0.65%, which is totally reasonable given that I'm invested in a casino that can get taken for large losses in the short term, but should regress to the mean over the long haul.

However, I've taken a close look at their documentation and statistics, where I spotted a disturbing trend.

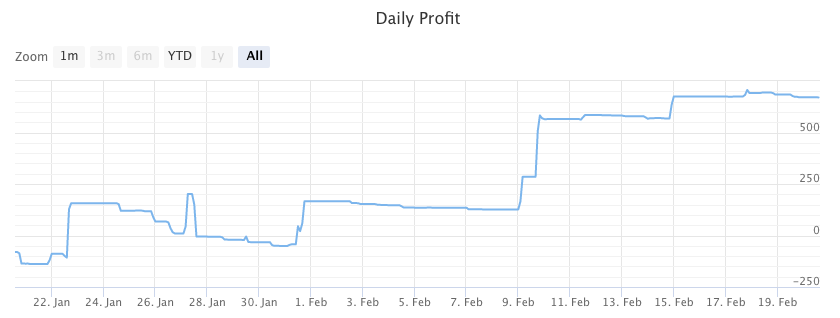

You will notice that there are basically no periods of steady upward profit. Instead, the low volatility periods trend slowly downward and then there are significant spikes up. I suspect the reason for this is that the casino take a 30% cut of the house edge. The edge is 1% on standard rolls, which means that the house takes 0.3% of every roll, win or lose.

The upward spikes are due to gamblers using the Martingale method of gambling. They double their bet every time they lose, so that when they eventually win they will get their entire loss covered, unless they catch a string of bad rolls, in which they bankrupt themselves and blow the whole bankroll. When they fly too close to the sun, that's where we see the big spikes happening.

I chose bitdice because it seemed to be stable in terms of popularity and had a design that suggested they weren't just trying to make a run for it with the investment. However, after a couple of days its pretty clear that their fee is too big, and seriously cuts into its investors' earnings. I'm probably going to move on to my next venture very soon.