Stash Invest: My Portfolio Weekly Recap (2017-06-10)

Hello and welcome to my weekly Stash Invest recap where I will go over how my portfolio has been affected through the market week. If you are unfamiliar with Stash Invest, it is an app that allows you to invest with as little as $5 using fractional shares so even someone who doesn't have much money, like me, can get started. I plan to make a lot more posts about Stash - which I think is an excellent beginner's tool to help get into investing - so follow me to learn a lot more about it.

This week saw a hault to the upward movement of the last two week’s upward trend.

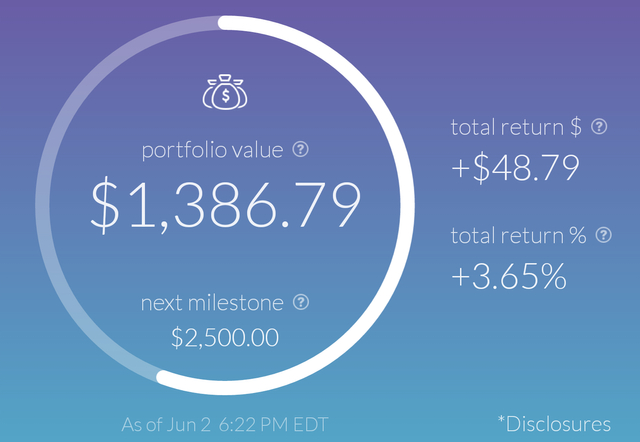

Week Open

Last week we reached historic highs and I have been back to putting my small investments ($20) in the lesser performing funds like Clean & Green (ICLN) that have high dividend yields.

Day One

Monday fell a few dollars and I was wondering if this would be the start of a slide or just something passing. After the last two weeks, you couldn’t help but feel the money, but if you know me, I am always looking to buy when it’s cheap. To go in with higher volume (which for me is over 100-300 USD) I’m going to want those prices much lower than historic highs.

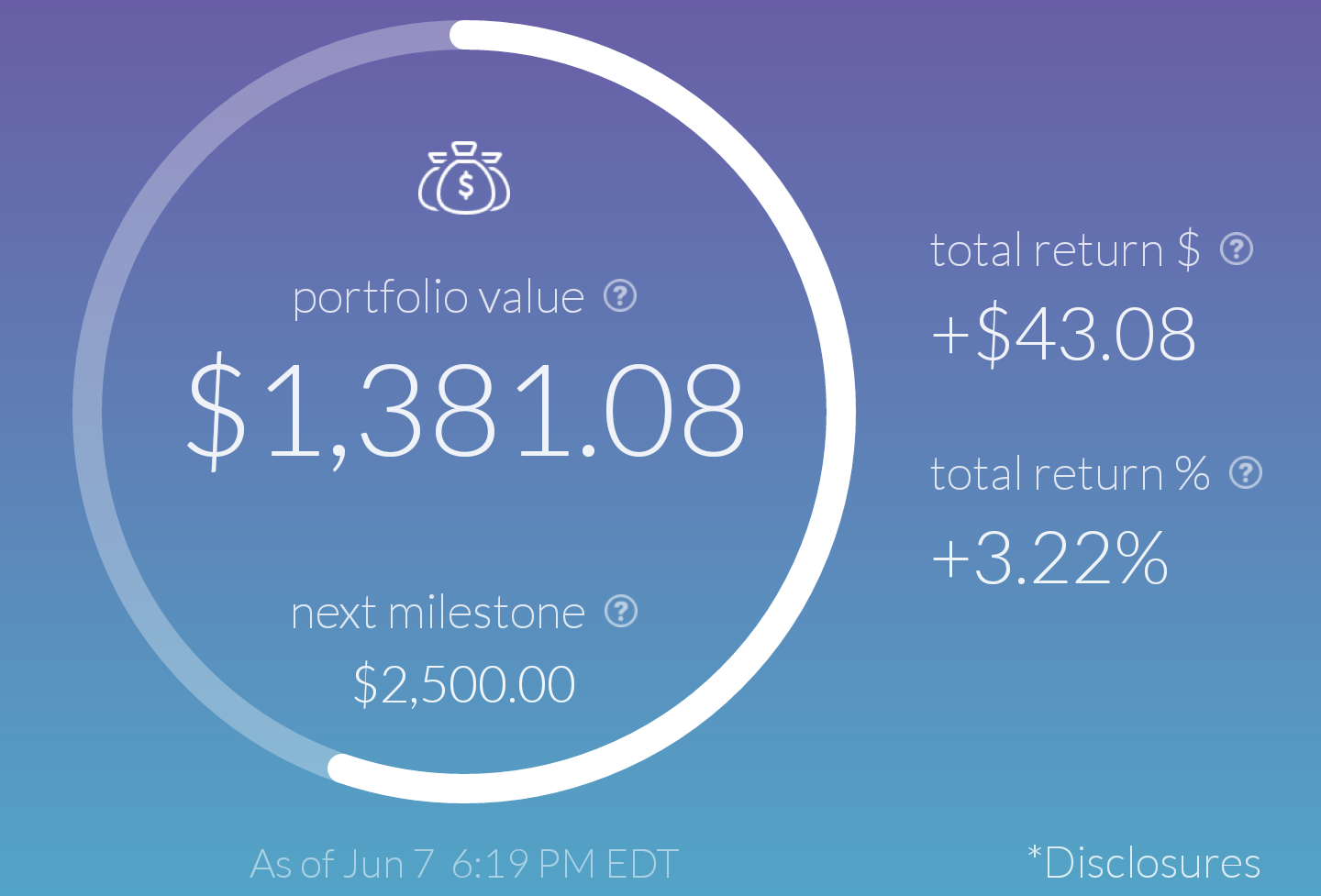

Day Two

Tuesday was a slight decrease in the portfolio. Just a waiting game to see where things are going to go at this point.

Day Three

This is now a third day in a row with small losses. They are starting to compile and I’m wondering if it will drop harder soon or rebound. I hold off on buying more, curious to see what will happen.

Day Four

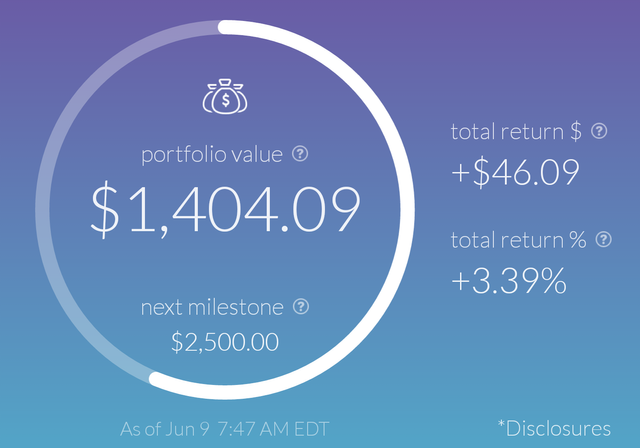

Thursday morning, the trend continued as the market slowly dropped. I ended up dropping another $20 in (ICLN) Clean & Green shares but by the time the day closed, it had recovered most of the losses from the previous two days.

Day Five

Friday, the markets slowly crept up through the day with little overall change until the very end of the day it took a big hit! I went down nearly $9, a sizable chunk of my return, in the last couple hours of trading. Now is looking like a good time to buy, and as luck would have it, my top performing fund, American Innovators (VGT), took a hit.

I have $100 going into that fund and another $40 destined for a cyber security fund. I’ll be paying attention, in so much that I’ll have time for on what is going to be a long Monday of work, for more buying opportunities.

This screener shows percentage returns over time and the funds Rsf, or Relative Strength Factor, of the funds in this portfolio . I will delve into this more in a future article, but the idea behind this metric is to compare one fund with all other funds. It is scored on a scale from 0 to 100, 100 being the best. This, of course, is only comparing current performance, not overall and obviously isn’t the only factor to measure when considering an investment.

The funds with the hardest hit 1-day return are the ones I have investments pending for.

Fund Overview

I’m probably not going to overview any of the funds in my portfolio this week or next, as I’ve been working 7 days a week, tied up on some projects. I’ll get back to profiling them when I get time off.

Looking Forward

I will continue to post overviews of the funds I am currently invested in, probably one every week or two. I’m also going to get into some investing jargon to explain a variety of terms. Dividends are coming later this month. Might I make a whole $10 this quarter? Small goals…

If you want to learn more about Stash Investing, check out this old article. I plan to redo it and continue the series soon.

That's pretty smart going in with just small amounts. I like the idea of that app and the looks.

I follow the same strategy and do the same with a $10 a day investment in cryptos.