Why Savers Are Losers - This Information Will Help Protect Your Retirement

Hello Guys and Gals... Here Again.... Back with a Money topic.

I wrote the book 'Savers are Losers' in Mar 2016 after close 200 hours of studying Currency and Money from many sources.

It is a condensed form of what I understood from the hours and hours of study going back to ancient times, today and what to expect in the future.

Here is a gist of it. Please read the book, it is written in a very different way, taking some example all the way back to cave-man time.

The link to the book is http://www.lulu.com/shop/srikrishna-krishnarao-srinivasan/savers-are-losers/ebook/product-22596859.html

So, Saving is a good discipline right? What is wrong with it? Saving is indeed a good discipline. We all save for the rainy day.

1). History Repeats:

However, since ancient times, currencies have risen and fallen. This is something very hard for people to accept. The usual argument is, it won't happen to our currency. However, history says otherwise. Don't take my word, do some research on it.

- Roman empire

- Weimar Germany

- Brazil

- Mexico

To name a few. You most likely might have heard about recent Venezuela, previously Argentina and notorious Zimbabwe. I wanted to leave them out in highlighting list, just to show you two things. This phenomenon has been happening from the past. This happens in what we consider as very stable countries.

2). What really happens if a currency faces a crisis?

Let us assume a farmer saved 100 bags of grain and 500 units of his/her country's currency. Lets also assume 1 bag = 5 currency units and 1 chicken costs 5 currency units. When things are good, he could have given a bag of grain and got 5 currency units and he could have given the 5 currency units and got a chicken. In total he could have got 500 chicken for 100 bags of grain and 100 chicken for 500 units of currency, in total 100+100 = 200 chicken.

When a government faces a financial challenge, they respond in many different ways. For example, in the case of Roman empire, they needed more money to fund the soldiers fighting the war. They reduced the quality of the gold and silver coins and circulated among the higher quality gold and silver coins and minted more of them. When more coins came into circulation, the day to day items started costing more. This is nothing new. If one person had a cow and 10 people had bundles of currencies, each of them will offer more bundles for the same cow.

In the case of the farmer's country, lets assume same thing happened. More currency units printed and circulated. Now the equation changed. He had 100 bags of grain, 500 units of currency. Now 1 bag = 10 currency units and 1 chicken costs 10 currency units. With this new equation, he could not get 100 chicken from 100 bags of grain and 50 chicken from 500 units of currency, in total 100+50 = only 150 chicken for the same number of grain bags and same value of saved currency.

What really happened here? The value of currency saved is the same. But, the 'store of value' in the currency diminished. We generally call it 'inflation' and move along. But, it is actually a losing power of saved money, not to take it lightly and move along. If you notice, the store of value in the bag of grains remained the same in the example, as it does in real life, most food items are always in demand, hence their 'store of value' is maintained.

3). How this affects your retirement?

If you saved from 25 yrs to 55 yrs, each year, the 'store of value' in the money saved keeps changing, reducing, every year. If you had the ability to get all of them in physical cash and not as some numbers in a bank account, and if you colored the bank notes each year with a rainbow color, and if you framed the item that the bank note could buy each year, you would notice that violet bank note could buy more of the same item than red bank note by the 7th year. Imagine this. You have the same amount of bank notes, but, it is buying less and less each year. This happens in an economy which does not have crisis breaking at the seams.

4). Full blown crisis

In some countries, the creation of money went too far, breaking at the seams, causing a full blown crisis. The currency itself had to be discontinued and new currency had to be adopted by governments. This is an extreme case, which we cannot say as rare. There are a number of countries where this happened. Venezuela is the one facing devaluation of currency every hour. A loaf of bread costed $1 an hour ago, but now it is $2, by end of the day it would cost $10. What would people do? Hoard the items when they are cheap (meaning, bread is more valuable than currency, if you are able to see otherway around). People would be greeted with empty shelves in super markets when the mistrust in currency grows and people give it away to hoard other forms of value (bags of grain as in the above example).

In such a situation, there is more money, more millionaires, billionaires and trillionaires, but they could afford only daily needs.

Conclusion:

Now tell me. Are the Savers not Losing?

Again I'm reminding you to study the book, it will give you great insights which will help you a lot. Please spread the good word to others, your friends, your colleagues who may be investing in savings and bonds without anticipating what could happen to their currency value, which has potential to cause pain and dissatisfaction in their retirement. Please help them to avoid.

The link to the book is http://www.lulu.com/shop/srikrishna-krishnarao-srinivasan/savers-are-losers/ebook/product-22596859.html

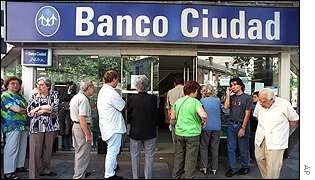

Some pictures from hyper inflation countries, due credit to original publishers, these are images from the internet:

Mark notes are weighed by a woman in Germany 1923

Argentina seizes pension funds - bbc

Also read http://www.businessinsider.com/us-government-7-trillion-pension-shortfall-2016-4

Cyprus

Greece

Venezuela

Hi @geo-krishna, I saw your answer to a question about Steemit on Quora and found your post. Great to see different people now jumping onto the platform and I hope you keep writing because the content is quite good :)