Will Banksters Ruin Indian Economy?

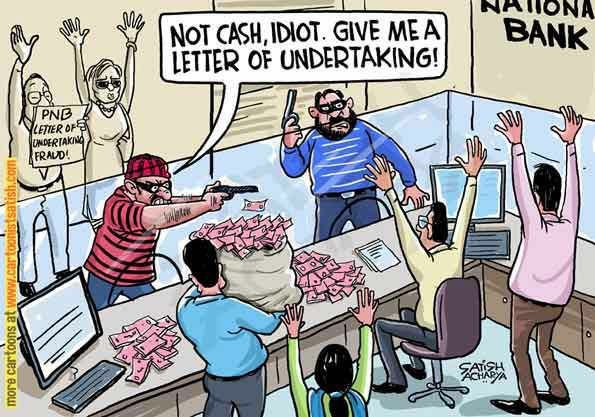

In recent times, Indian banking sector is hit by a number of frauds. Two employees of Punjab National Bank colluded with a top diamond merchant and made away with $1.77 billion dollar or about INR 11,300 crores worth of money. It is now expected that the bank is likely to make good on these losses but where will this fresh money come in from?

RBI-the central bank of India on the other hand is choking the country on its high interest rates. The total sum of bad loans in the country are over $140 billion. It doesn’t seem to be affecting anyone but what if this causes another major market collapse. Are you not reminded of the 2008 crash yet?

India is on an economic slow down and all these numbers from the government remain are just a load of crap.

Maybe we’ll see a movie on this scam as the fraudsters sip on their margaritas in the bahamas perhaps. More the reason for the bank sector to power their systems on a blockchain and instead of having strict policies such as know-your-clients (KYC) they need to have KYE (know-your-employees) in place.

Income Tax Department infact has warned in a note seen by Reuters that Indian banks face a risk exposure of $3 billion from bad loans from guarantees given to Nirav Modi and his uncle-top diamond retailers in India. Nirav Modi and his family is untraceable and have run away with this huge sum.

People like Vijay Mallya are scot free even after years of scamming. India has failed to deport him back to face judicial enquiry from UK. He’s literally given the finger to his country of birth as he scammed away from here and continues to live a lavish lifestyle.

Failing Trust in Banks.

News like this has taken away my trust in our favored custodians of our money. If we don’t keep money in the bank, where else do we store our savings carefully? For more people banks are the default place to head to for saving their income.

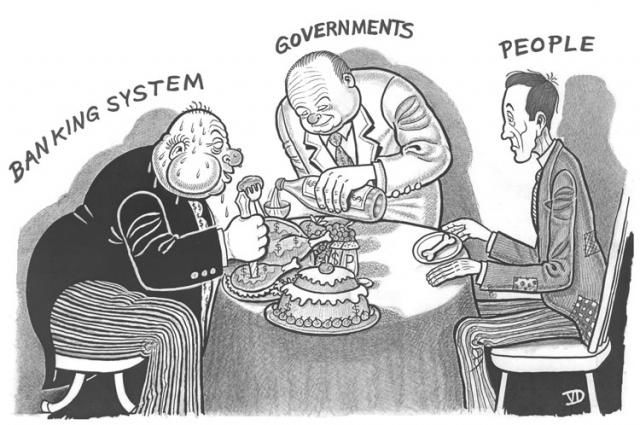

The same banks however, prevent us to transact our money and invest in areas such as cryptocurrencies. They tend to force our hand into doing things as they want to. This world needs a revolution in terms of banking. These banking fraudsters have made away with billions of dollars of income earned by the poor across the world with no repercussions.

Even today, common people in far flung areas have no access to banking or credit but these businessmen in India run away with billions of dollars worth of Rupees. I’m no good at predictions but looking at the current situation the day isn’t far when we see another collapse in banking and stock markets come crashing down like it happened 10 years ago.

It’s a shame that the so called government refuses to acknowledge revolutionary changes in monetary systems propelled by cryptocurrencies and blockchain and continues to lead us into the abyss with their haphazard policies and arrogance.

You can read here about the biggest scam in Indian banking history. So much for Aadhar, KYC and a whole lot of other bullshit that we have to undergo to access basic banking needs while corporates continue taking us for a ride!

Perfect ad by Nirav Modi. 😂🤣 #PNBScam pic.twitter.com/SeB2Q4syYJ

Akshay Jain (@AkshayKatariyaa) February 15, 2018

Keep money in the bank - Nirav Modi will take it.

Put money in cricket - Lalit Modi will take it.

Keep money at home Narendra Modi will take it.

What to do?

What do you feel about the latest scam? Is something similar happening in your country dear readers?

If you like my work kindly resteem it to your friends. You may also continue reading my recent posts which might interest you:

- Let's Watch This Fun Video From India Steem Meetup #1—Jaipur Edition!

- Let's Watch This Fun Video From India Steem Meetup #2—Bangalore Edition!

- India Steem Meetup #4—An AWESOME Meetup In New Delhi—India's Capital and 40+ Attended!

These kind of frauds happen everywhere.

Sometimes it is done by the employes of the bank and sometimes banks do that intentially to file the bankcrupcy or anything like that.

But the more we become digital and adopt technology, I am sure these kind of incidents will decrease.

Just add another name to this meme,it's Vikram Kothari (Rotomac company owner)😉😂

Paper money is the biggest fraud in human history...You just had to fundamentally trust the institution printing the paper money that it could somehow back up the value...Now RBI have 2 options, either issue the order to print more money on cost of inflation or run another demonetization campaign again to bring the poor man's money into the banking system.

hate banks

totally !!

Ah the death throws of paper money. As an aside to India, Africa has one of the highest use cases of internet over phones (laptops being too expensive).

Any crypto that's stable enough to be paid in and has a good android wallet is going to see mass adoption. Most local guys I worked with on mine sites have big issues with theft after pay days.

Or pay premiums to have someone drive it into town for them. Most of them get robbed that way to when the courier never comes back to the village.

People say crypto will change banking forever. They have no idea when it comes to places like Africa. Its going to be huge.

America is not far behind with this tax cut from Trump.

People are unable to procure one meal a day and whats happening with the money is really shameful.

No wonder most people these days prefer to keep their money themselves especially when. The money is much. We have seem people over here stack money in their houses and cars just in a bid to avoid the bank. The bank can't be trusted any more with our money......Who do we run to for help?

I hate putting my money in the bank! They charge ridiculous fees. Cant wait till crypto takes over and we wont neex them anymore!

Banksters are fraudsters.

what are the interest rates in India?