Financial conditions will start to bite

Financial conditions in World's financial markets are starting to tighten, is it the beginning of something more severe?

In this article we will firstly try to explain what are financial conditions and secondly we will measure the current situation and try to evaluate the risks we may be about to face.

A situation of tight financial conditions is one in which it is relatively difficult to receive credit / loans for a house or business.

A more restrictive financial environment is therefore likely going to make people less comfortable about their financial security, which, as a consequence, are going to reduce spending hence slow down economic growth. It is natural.

Are financial conditions really starting to tighten?

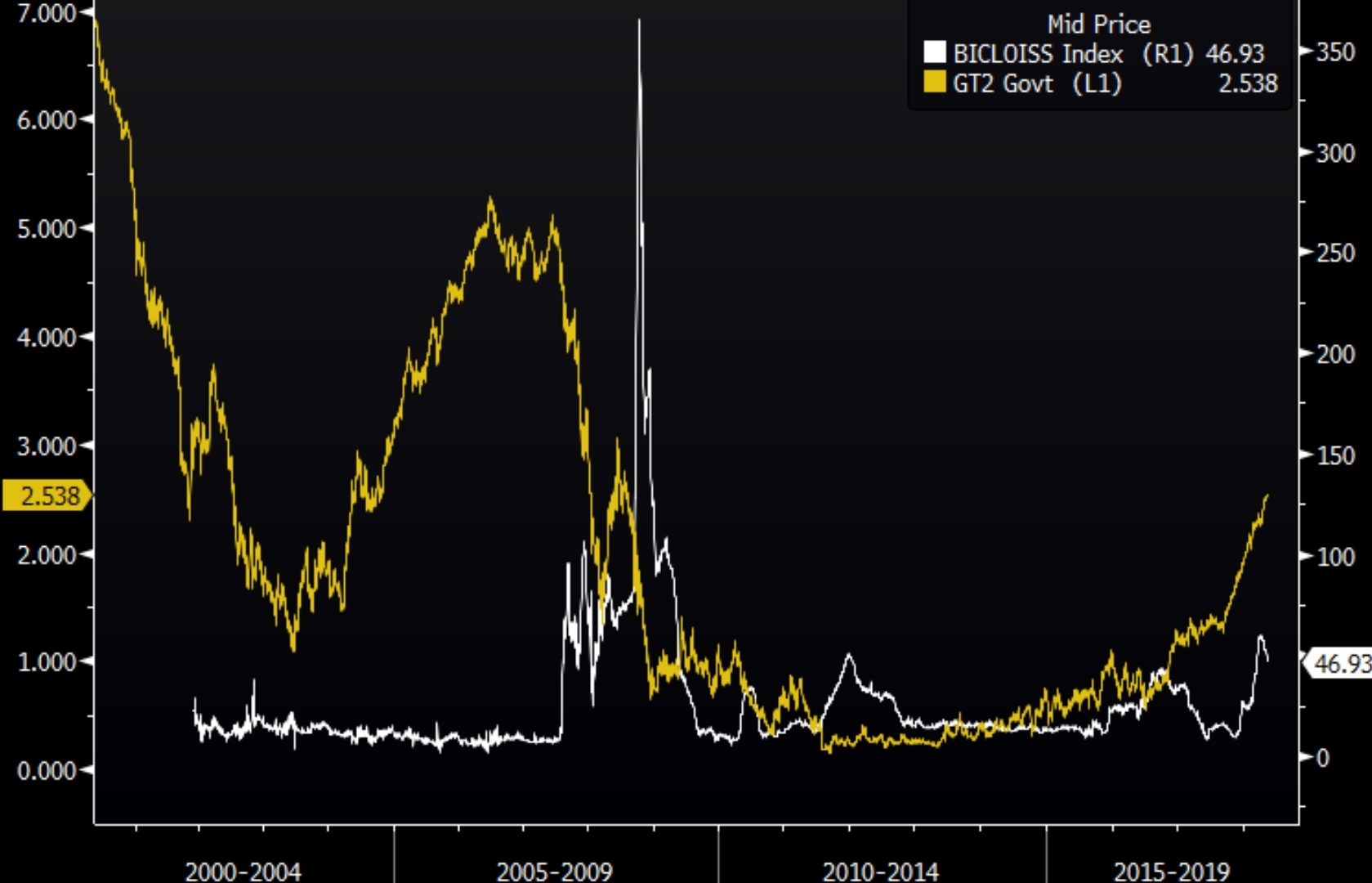

If we look at the spread (= the difference) between Libor rate (London Interbank Offered Rate) and OIS (Overnight Indexed Swap), see chart below,

We notice that, in the last 6 months, this spread had risen rather violently, on a relative basis.

A decade ago, most traders didn’t pay much attention to the difference between two important interest rates… That’s because, until 2008, the gap, or “spread,” between the two was minimal. But when LIBOR briefly skyrocketed in relation to OIS during the financial crisis beginning in 2007, the financial sector took note. Today, the LIBOR-OIS spread is considered a key measure of credit risk within the banking sector.

In fact, Libor is the interest rate that banks charge each other for short term loans. And the OIS is the central bank rate, in this case we will look at the Fed Fund Rate, in the USA.

The key point is below:

During normal economic times, credit risk is not a major factor in determining OIS rate and it’s not a major influence on LIBOR, either. But we now know that this dynamic changes during times of turmoil, when different lenders begin to worry about each other’s solvency.

The bottom line of explanation is the LIBOR-OIS spread represents the difference between an interest rate with some credit risk built in and one that is virtually free of such hazards.

My view:

Funding markets are developing slowly without being too noticed. The above mentioned move represents the early stage of a significant tightening of financial conditions.

Considering that we are in midst of the market being focused on the Quantitative Tightening (QE reversal by the Federal Reserve), the ramifications for the globe could be significant. It will not take much monetary tightening as the last cycle, to achieve the same impact on debt servicing costs. The impulse on global QE is also shifting as the Fed reducing its balance sheet will more than offset the increase from the Bank of Japan and European Central Bank.

Let’s not be too complacent, this “normalization” of monetary policy is not a normal one. See graph below, higher short dated US Government yields (in the yellow line) lead a move higher in financial stress with a time lag of 1 to 2 years. Just like the relation between the flattening of the yield curve and the economy.

Once it gets rolling in the wrong direction, it's game over.

@therealwolf 's created platform smartsteem scammed my post this morning (mothersday) that was supposed to be for an Abused Childrens Charity. Dude literally stole from abused children that don't have mothers ... on mothersday.

https://steemit.com/steemit/@prometheusrisen/beware-of-smartsteem-scam