Bitcoin Hitting All-Time Highs By Almost Every Metric

In September of last year I wrote, “If You Haven’t Gotten Into Bitcoin Yet… Now Is Your Chance”.

In that article I gave reasons for why I expected bitcoin to skyrocket, writing, “If you are new to bitcoin this represents an opportunity to get in at what I consider to be a very low and less risky stage than it has been in years.”

At the time it was trading at $230.

It has since more than tripled and is currently trading at $785. In this article, we’ll review bitcoin’s progress and also discuss dilution-adjusted inflation that makes estimates of bitcoin’s value even more accurate.

Bitcoin has been, by far, the best performing currency in 2016, up over 75% this year.

And, in India, where the government just made 80% of cash worthless, bitcoin is trading over $1,000.

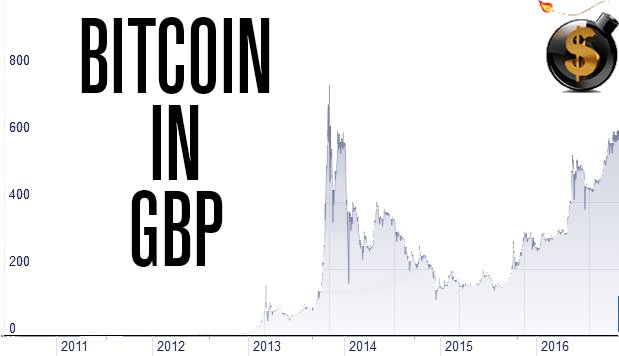

In most fiat currencies, bitcoin is now at or near all-time highs.

In terms of the British pound, being the one of the most prominent, bitcoin has gone up 300% since last summer.

But, even in US dollars, in terms of true market capitalization, bitcoin is at an all-time high.

BITCOIN MARKET CAPITALIZATION

A lot of bitcoin has simply been lost.

For example, James Howell threw his hard drive, worth 7,500 bitcoins (about $6 million today), into the landfill. Those are just some of the more than 2.5 million bitcoins which have been lost forever for this or that reason.

Bitcoin price is at an all-time high. Yet, bitcoin doesn’t price itself like stock market shares.

A dilution-adjusted inflation model in a digital commodity such as bitcoin would take into account not only known lost coins, but, as well, inflation effects when new coins are mined.

Vinny Lingham, who founded one of the most important Bitcoin companies, Gyft, and appears on the South African version of Shark Tank, wrote a post analyzing dilution-adjusted inflation in Bitcoin.

With more bitcoins mined into existence each day, this creates a “continual stock split,” this successful entrepreneur argues. Price mechanisms used to chart popular stocks on financial markets take into consideration this ‘dilution effect’ as more stock is issued.

“If a company is issuing 25 new shares every 10 minutes, clearly this would constitute a stock split (continuously) and therefore the historical price of that stock would need to be adjusted to reflect the stock split (this is how it works today),” Mr. Lingham writes. “However, in ‘Bitcoinland,’ this is ignored.”

Stock certificates are like cash. There is no other way to prove ownership of a stock. So if stock certificates are lost, the company’s market cap is adjusted since those stocks can no longer trade hands, be redeemed or earn dividends.

“The shares are gone and therefore outstanding shares would need to be adjusted,” Lingham writes. “This has happened before, especially pre-electronic trading era.” Unlike stock valuation, bitcoin valuation seldom takes into consideration lost coins.

Around 2.5 million bitcoins are considered lost.

Of the 21 million bitcoins to be mined through approximately the year 2136, more than 15 million have been mined to date, leaving 5 million outstanding coins yet to be mined.

According to Coinbuzz, there have been approximately 2.5 million bitcoins lost/destroyed or missing. Estimates range somewhere between 1.5 million to 5 million bitcoins lost. Mr. Lingham does not believe Satoshi Nakamoto’s coins will be moved and altogether he posits it’s safe to say 2.5 million bitcoins have vanished. When btcburns.cf was online in September 2015, it posited 2.6 million bitcoins had already been lost. That site is now mysteriously offline.

Lost bitcoins could amount into billions of dollars. Services have already appeared such as Wallet Recovery Services. Many bitcoins were “burned” when altcoins used “proof-of-burn” in order to distribute coins, like Counterparty’s CXP and Chancecoin.

When these lost coins are applied to the equation deriving bitcoin’s value, a new bitcoin price story reveals itself.

“Bitcoin’s [All-Time High] is not $1151, but in fact $700 (and this adjusts, the longer it takes to get there, given the number of new coins issued daily),” writes Lingham. “The same way that the Apple share price all time high is not $800 (they did a 6–1 stock split — so it’s $133).”

Lingham predicted Bitcoin would end the year at above $1,000. But, “It’s on an net market cap adjusted basis - so therefore imputed market cap will be over $15bn - which will most certainly be an ATH for Bitcoin…”

Based on its dilution-adjusted valuation, Bitcoin is at all-time highs.

BITCOIN’S FUTURE LOOKS BRIGHT

Having been banging the drum for bitcoin since it was $3 in 2011 I have been barraged by bitcoin haters who constantly tell me it is a scam.

Well, that “scam” is now at all-time highs five years later.

Is it too late to get on the bitcoin bandwagon?

ABSOLUTELY NOT! In many ways it has barely begun. The best time to buy bitcoin was eight years ago.

The second best time is now.

This is an evolution in money and banking. Countless companies and people around the world have taken to bitcoin in the last few years and I expect that to skyrocket.

There is simply no easier, faster and cheaper way to transfer value around the world today than bitcoin.

More companies come online every day offering services to make bitcoin even easier to use.

One is a company called Wirex which offers a bitcoin debit card that you can use at any store or ATM like you would a normal card. Of course, like almost anything nowadays, it is not available to Americans. But companies like Coinbase (click here for more) also offer a bitcoin debit card that is available to Americans.

I had the opportunity a few months ago to sit down with the founders of Wirex and you can see that interview here.

You can get your Wirex bitcoin debit card by clicking here.

If you don’t know much about bitcoin and want to learn more click here.

Should you put all your money into bitcoin? Not unless you don’t have a “risk” gene in your body… it is still under a decade old, after all. But, should you start educating yourself about it and start using it?

To answer that, just ask yourself if you would have liked to know about the internet in 1993 or 1994 in order to be ahead of the crowd and begin investing in it?

If the answer is yes then the answer to bitcoin should be yes. Start here.

Flagged as autoreposted non-original content, falsely labeled as exclusive, that is heavily autovoted and does not drive engagement, participation, or distribution of rewards. This also serves as an implied upvote to all of the hundreds and thousands of actual, actively engaged steemit users.

Thank you for posting @dollarvigilante. Yes....September of last year is memorable with your post at that time. What an introduction. It has been a good year.

All the best. Cheers.

Bitcoin has been very good to my family this year. I am looking forward to seeing what happens in 2017. We use our Wirex card all the time.

World needs more families like yours and Jeff's @hilarski @dollarvigilante ! And we'll get there! We are growing! Keep up the great work brothers! And GO BITCOIN GO!

ha, i like how you point out the fiasco in India. You can count on governments to continue causing instability, so BTC's future looks bright...

yep and yesterday i was capable of hitting screenshot of https://steemit.com/bitcoin/@kingscrown/bitstamp-btc-price-779-00-usd-last-time-so-high-was-1040-days-ago 779 price live ;)

Also hitting a potential medium term reversal to sub 700s.

Best performing currency of the year is simply not true, there are many altcoins that increased by much more than 3x in price.

I meant of the major, widely used currencies.

Yes, I do agree that overall it is always a stable investment but it is looking like BTC will have a slight drop in the near future. It's already starting to happen now.

Bitcoin will crash when Ethereum replaces it

eth will crash when steem replaces it