A BRIEF HISTORY OF MONEY

Before the invention of money, people were trading in order to get what they need. As a result of the negative aspects of the trading such as portability, setting price, cultures that existed at different places and times eventually invented money. From that day, we are using it every single day. So what makes something "MONEY"?

Functions and Characteristics of Money

Money is something that functions as a exchange tool, a savings tool, or a value standard, regardless of the shape it receives (gold, banknotes, oyster shell). Money:

• Interchange tool when used for goods and services

• Saving tool when you get it today and use it later

• It functions as a value standard when you use it to measure how much a good or service is

In order to say declare something as “money”, it sees its function in the best way: portability, durability, splittability, stability and acceptability.

• Portability means the ease of moving money from one place to another.

• Durability means you don't run out of money if you forget to take your laundry out of your pocket before washing.

• Severability is that your money can be divided into smaller units.

• Stability is that the value of money does not change much.

• Acceptability agrees when people reflect what money should represent they are willing to exchange money and services with goods.

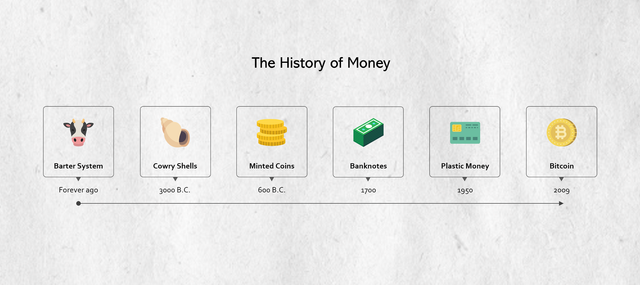

Evolution of Money

For ages, many different times and cultures have replaced money. Salt, tobacco, sea shells, large stones, precious and worthy metals, leather and cigarettes are some of them.

Immovable Money

Yap Island in the Pacific is known for its absolutely immovable money. Large, round stones weighing hundreds of pounds are used as exchange tools.

Commodities

When relatively little minerals, metals or agricultural products are used as exchange tools, they are considered as commodities. Gold and silver coins are coins. An advantage of commodity money is that it can be used with tools other than money. In the 1980s, many women were dressed up as China's Pandas, or Canada's Maple Leaf, with jewelery of gold coins. American colonists did not only drink tobacco, but used it as money. The salt was once found to be so little that the Roman soldiers were paid with salt. On the other hand, the usefulness of the commodity brings a disadvantage to its use as money. If a country has to use a commercial property as money and equity, the money may be too valuable to spend.

Representative Money

Representative money emerged as an alternative to commodity. One of the characteristics of gold is its high density. Business transactions that require large amounts of gold have been unacceptable because gold is extremely heavy, and therefore difficult to transport. Goldsmiths, have solved this problem. Representation money was born with receipt cuts in exchange for gold they received safety. Instead of exchanging physical gold, all he had to do was exchange gold for receipts. When they wanted the real gold, they could give them their receipts and get their gold back. After many years of accepting this, people were more comfortable with the idea of paper money.

Non-convertible Fiat Money

Because people were already in love with representative paper money, the next name in the evolution of money was not a difficult step to understand. What is needed to make paper money convertible? Many times in history, the representation of the representation of money into gold or silver has been halted by war or other crises. In 1933, President Franklin Delano Roosevelt signed a presidential order that transformed the dollar from a form of representative money into a non-convertible nominal currency. Non-reversible nominal currency is paper and virtual money, which are essentially worthless and cannot be compensated for or supported by a real commodity. This is money because the state says so and we are willing to accept it. The US dollar, Euro pound, yen and most countries' currencies follow the definition of a non-convertible nominal currency.

Gold Standard

In accordance with a gold standard, the money is supported by a fixed amount of gold. You can change your money with real gold. The gold standard prevents over-printing and devaluation by allowing a country to print as much money as it can support the amount of gold it owns. The downside is limiting economic growth. While the production capacity of an economy is growing, money supply should also grow. Because the gold standard requires that money be supported by gold, the shortage of metal restricts the economy to generate more capital and grow.

Today, the money that cannot be translated is only money because the government says it is and people accept it. In order for people to accept, they must trust that the money will not be worthless or that the government that supports it will not fall. In this case, people do not lose their trust in the money supply, the central bank of the country should carefully check its presence so that money does not become too abundant or scarce. The fiat money comes to you like science fiction. It is essentially worthless and can only be redeemed for more of the same kind of money. The system works because the government says the system is functioning, and everyone believes it. It's the trust that supports the money. The idea of money is still odd when you think about bank depositing, online bill payment, debit cards and checks. You can work, pay bills, do your shopping on the market and you can live your life, even days, weeks without touching money, and without smelling it in the economy can work well. Money is a dream. Consider your bank account. The bank vault contains no small banknote stacks with your name on it. In your current account, your savings account is nothing but information stored on computers.

Discovery of the current system

The current irrevocable standard of currency available today provides a solution to the weakness of the gold standard. The most important defect of the gold standard is the creation of a border in economic growth. According to Economist Adam Smith, the asset is not the function of the amount of gold or silver a country possesses, but rather the sum of goods and services produced by an economy. There is a sense that the amount of money that an economy has, in some way, reflects its capacity to generate assets. As businesses grow, they need money to buy the tools, factories and equipment needed to meet production needs and create demand for their own goods and services. Since money supply is not supported by something real or concrete, it can only increase as the economy grows.

The fiat money sounds like science fiction, today's money. It is essentially worthless and can only be redeemed for more of the same kind of money. The system works because the state says the system is ok, and everyone believes it. It's the trust that supports the money. Since money is supported with confidence, the shake of this trust is disastrous.

CRYPTOCURRENCY

Here comes our favorite one, cryptocurrencies. There are still lots of arguments about cryptocurrencies. “Is cryptocurrency real money?”, “Does it have a real value?”. Experts are still arguing about the definition of cryptocurrency. Lets have a look at the definition of money.

“In order to say declare something as “money”, it sees its function in the best way: portability, durability, splittability, stability and acceptability.” As I mentioned in the first paragraph. So, lets discuss the cryptocurrency.

-Is it portable?

-Definitely.

-Is it durable?

-Yes, it is.

-Does is splittable?

-Yes, it is.

-Does it stable?

-For now, there are some problems about stability but also Turkish Lira, Venezuelan Peso etc. do not have stability. Moreover, there are some stable coins too. So our answer is yes.

-Is it acceptable?

-Surely. There are lots of companies that accepts bitcoin as payment method.

I believe cryptocurrencies are the new method of money and it will grow every single day. What you think? Please feel free to comment!

Good job man . Congralations .

Nice post brother, let's hope!