Using Bitcoin to save money on international bank transfers - part 1

TL;DR: In this 2 part series I explain how to use Bitcoin for international remittances, thereby avoiding the expensive fees charged by the traditional banking system. Part 1 covers the steps involved in this process. Part 2 demonstrates how an Excel spreadsheet can be used to calculate the exact amount of money you will save over traditional methods.

If you're an expat like me, living in a foreign country, chances are you like to send money home every now and then to your native land. Maybe it's for savings, to provide for family back home, or (as in my case) to pay credit cards & student loans. Whatever the reason, chances are also good you grumble over the high costs of international money transfers.

The modern banking system is ridiculously bloated and full of outrageous fees that make no sense, considering that all you're doing is moving bits of data around to different computer systems. When I do a money transfer from Japan to the United States, I pay several fees:

- My remittance service takes a 2000 yen flat fee per transaction.

- I get dinged again on the exchange rate, which my remittance service sets about 1% higher than the market rate so they can skim some off the top.

- The receiving bank in the US charges a wire transfer acceptance fee of $40

All told, I lose about $60-$70 in fees. Per transaction. Making sending money home an expensive proposition, something I only do once a month and is only economical for large amounts.

Well, I'm tired of getting robbed by the banks every time I want to move some of my hard-earned money around. Enough is enough.

Let me guess: you found a better way to do remittances?

You bet I did! In the last several years, technological advances have paved the way for the rise of a new digital form of money, known as cryptocurrencies. Bitcoin is the most widely used cryptocurrency, although there are many others (Steem and Steem Dollars for example). Of course you can use Bitcoin to buy things, just like regular money. But it has several other useful properties, one of which is you can move it around from account to account very cheaply. This has allowed a vibrant cottage industry of service providers to spring up around Bitcoin, offering services analogous to traditional banking but much more efficient, with cheaper fees.

Bitcoin is the perfect vehicle for performing remittances between countries. To do so, you require service providers that can act as a gateway between the cryptocurrency world and the traditional banking world of fiat (dollar, yen, pound, euro, etc) currencies. Assuming, of course, that you get paid in a fiat currency and can't do 100% of your daily transactions with Bitcoin yet (which is a safe assumption for most people at present).

There are many different gateway services available. The exact ones you use will depend on which country you live in, and where you intend to send your money. I recommend doing some research on Google to determine what options fit your circumstances.

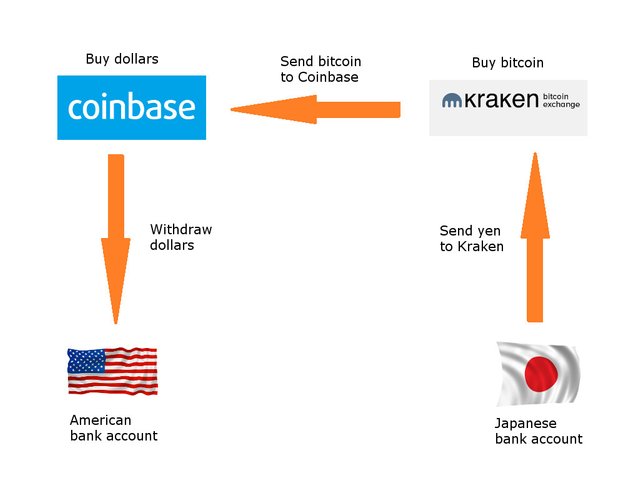

The gateway services I use are Kraken and Coinbase, as they can connect very easily with my Japanese and American bank accounts. At a high level, the remittance process I follow is illustrated in the following diagram:

- Use Japanese ATM to transfer some yen into my Kraken account. The yen usually appears in Kraken within an hour of initiating the transfer from any bank ATM.

- Using the Kraken web site, buy Bitcoin with my yen and then send the Bitcoin onward to my Coinbase account.

- Using the Coinbase mobile app, buy US dollars with my Bitcoin and withdraw to my US bank account.

- Wait for the money to appear in my US account. It typically takes a few days for the transaction to go through.

Note that I always perform steps 2 & 3 on my iPhone after visiting my local bank branch, during lunch break on payday. And I use 2 service providers because I haven't been able to find a single service that can connect to both bank accounts (Kraken and Coinbase require you to register for a particular country in order to access domestic banking services for that country, so at registration time I chose Japan for Kraken and US for Coinbase).

Let's look at these steps in more detail:

1. Move yen to Kraken account

Kraken makes this very easy. They own a bank account in Japan, coincidentally at the same bank I use. All I have to do is transfer some money into Kraken's account using a normal bank ATM. Once Kraken detects the money sitting in their account, they credit the deposit to my online account on Kraken's web site.

2. Buy Bitcoin with my yen

This is where things start to get a little tricky. If you haven't used a service like Kraken before, the process can seem quite convoluted the first time you try it. But it's really not, and after doing it a few times you'll become comfortable with the routine.

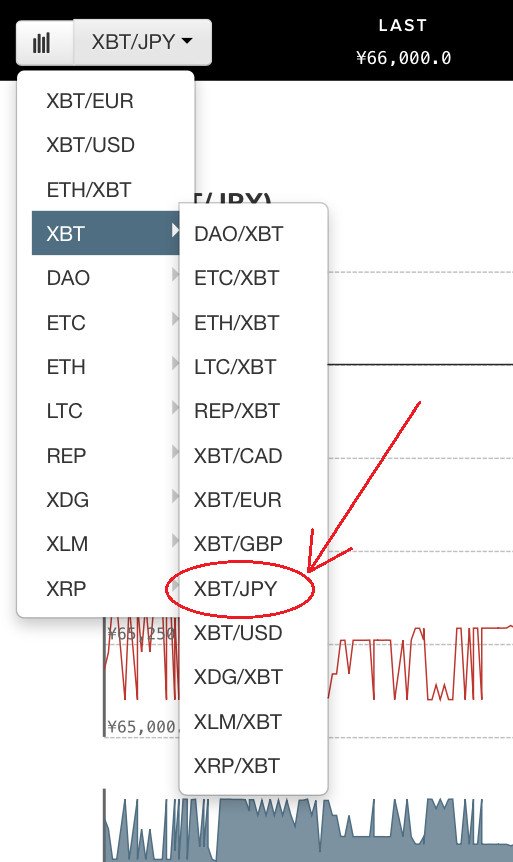

Kraken is a full-fledged cryptocurrency exchange, meaning that it allows you to buy & sell many different cryptocurrencies and exchange them for fiat. The currency symbols in the main menu indicate what you are buying and selling. In this case, I choose XBT/JPY (most crypto services use BTC as the symbol for Bitcoin, but Kraken defies convention by using XBT).

Before we go on, here's some trader terminology for you to learn:

- Bid - the highest price that people are willing to pay, or bid, to buy Bitcoin.

- Ask - the lowest price at which people are willing to sell Bitcoin. Also called the offer.

- Spread - the difference between the bid & ask prices.

- Order - an instruction placed by an exchange user to buy or sell a certain amount of Bitcoin at a certain price. Note that orders may not get filled, or executed, right away depending on the price / quantity you specify.

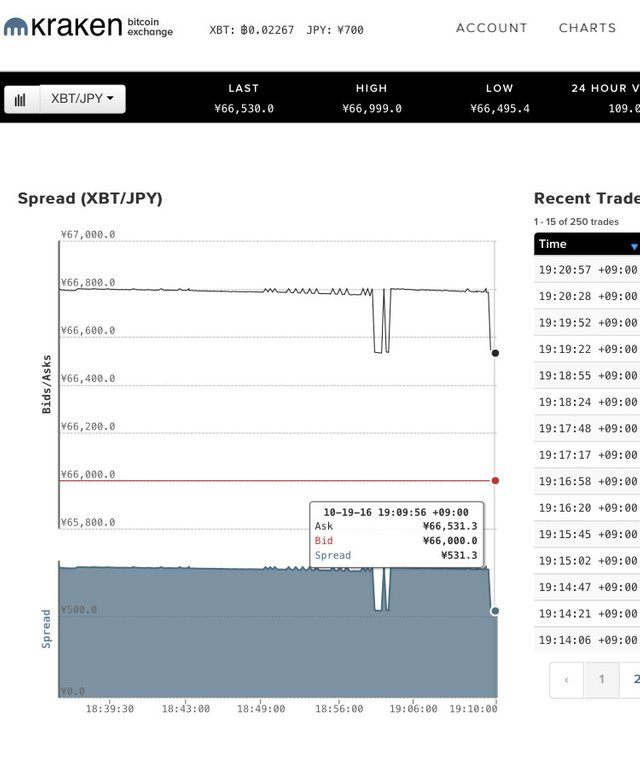

Now we are ready to take a look at the XBT/JPY chart, and in particular the spread:

The graph depicts how the bid & ask change over time (the lower red line is the bid and the top black line is the ask). As this is an active trading market, people are always entering new orders or canceling existing orders, which cause the prices to fluctuate according to supply & demand.

One important point that may seem counter-intuitive at first: if you want to guarantee your order will execute, you buy Bitcoin at the ask price, and sell Bitcoin at the bid price. Just take a moment and think about that until you are convinced it's true.

Pro tip #1 - When doing money transfers, always buy at the ask price. I am transferring my hard-earned money to the US, not trying to be a trader and timing the market to eke out more savings. I just want to complete the transfer process as quickly as possible.

Pro tip #2 - Be wary of the spread. The larger the spread, the smaller your savings will be when remitting money using Bitcoin. A spread of around 500 yen or less is pretty good (roughly $5). Anything higher than 1000 yen and I would hesitate. Check the spread just before going to the bank to ensure it's a good time to start a remittance.

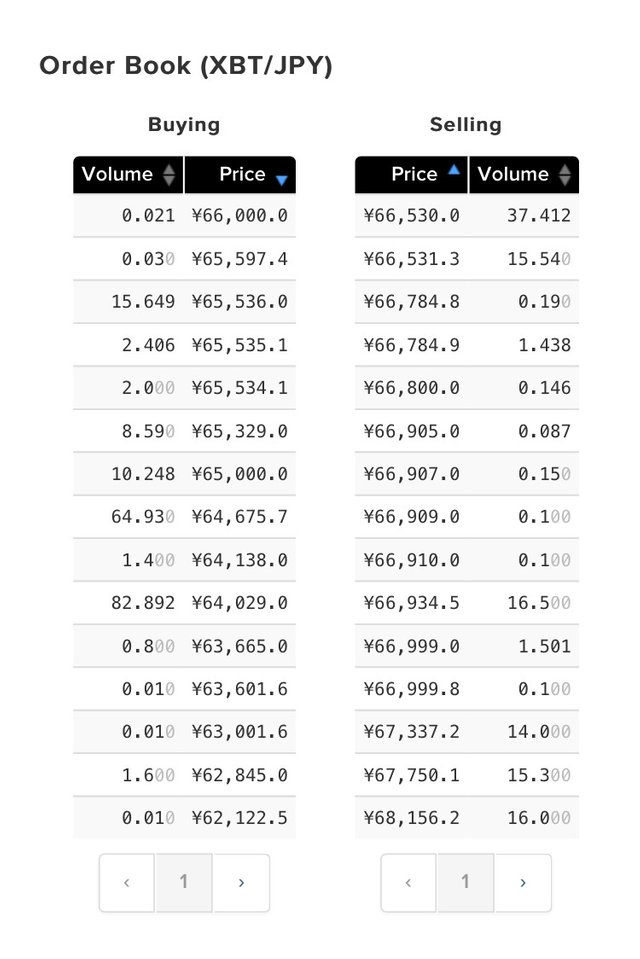

After confirming the spread and ask price, we need to look at the order book:

The order book is a complete list of all open orders at all prices. The bid & ask prices are referred to as the "top of the book", meaning the bid is the best price on the buy side of the order book, and the ask is the best price on the sell side. In this picture 66,000 yen is the bid and 66,530 yen is the ask. The spread is 530 yen, so it's an OK time to buy.

The volume number indicates how much Bitcoin is available at that particular price level. Let's imagine I want to buy 2 XBT (remember XBT is Kraken's symbol for Bitcoin). I'll be buying at the ask price of 66,530 yen per XBT. From the order book we see there are 37.412 XBT available at that price. Perfect, more than enough for a 2 XBT order to be filled.

But what would I do if the volume number said, say, 0.5? In that case, if I placed a 2 XBT order, I would get only 0.5 XBT, and the remaining 1.5 XBT would sit there as a new order on the bid side of the order book, until somebody else decided to sell more XBT to me at that price. In other words, if there's not enough volume to execute my whole order, it will end up partially filled and I'll have to wait to get the rest.

To guarantee my whole order will execute, I'd have to place it at the next highest price on the sell side of the order book, at 66,531.3 yen. If I did that, I would get some of my Bitcoin for the cheaper price of 66,530 and the remainder at 66,531.3.

Pro tip #3 - Always make sure there is enough Bitcoin available on the order book at your chosen price to guarantee your order will fully execute.

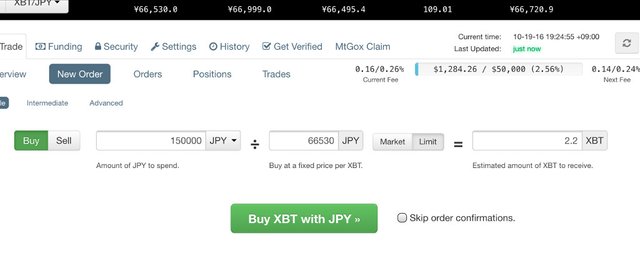

Okay, so I've checked the spread and the order book, and finally settled on a price. Now it's time to place the order:

This part is pretty simple. Simply enter the amount of yen to spend, the price you want to pay, and click the big green button. Oh, and make sure you select limit order, not market order (limit order ensures the order will execute only at the price specified, and no other).

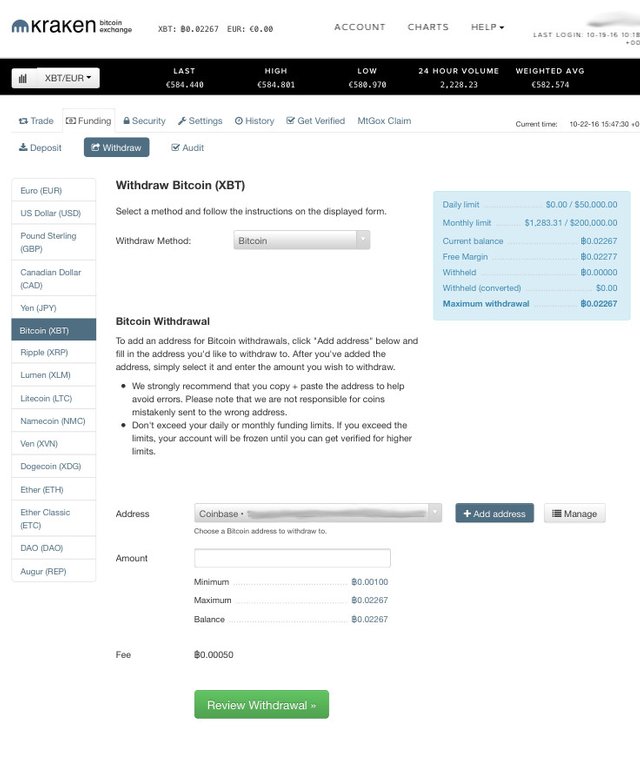

Once my order executes, I'll have a bunch of Bitcoin sitting in my account. The last step here is to withdraw the Bitcoin to Coinbase so it can be turned into US dollars and complete its journey to my US bank account.

A word of caution here: when selecting the withdraw method choose Bitcoin, NOT BitGo Instant! BitGo Instant can only be used if the destination address supports it, and in this case I'm not sure if Coinbase does. You will have to click the Add Address button and copy & paste in your Coinbase account address from the Coinbase web site / app.

Wow, that's a complicated process.

It seems daunting if you're new to cryptocurrencies, but as I said, it gets easier with time. Performing these actions is like learning to ride a bicycle: it takes a while to get the hang of it, but then it becomes an automatic process that you barely even think about. Let's summarize the above steps:

- Select XBT/JPY from the main menu.

- Look at the currency chart to verify the spread & ask price.

- Check the order book to make sure there's enough volume at the ask price to cover your desired amount of XBT.

- Place an order to buy XBT.

- Once your order is filled, withdraw the XBT to your Coinbase account.

Okay, moving on:

3. Buy dollars with my Bitcoin

After initiating the transfer from Kraken, it can take anywhere from 30 minutes to an hour for the Bitcoin to arrive in your Coinbase account. Once it does, it's time to buy some US dollars. This is essentially the reverse of the process I performed on Kraken. Thankfully, Coinbase makes it dead easy. Like Kraken, Coinbase has a full-featured cryptocurrency exchange operating behind the scenes, but unlike Kraken it hides all that complexity from the average user.

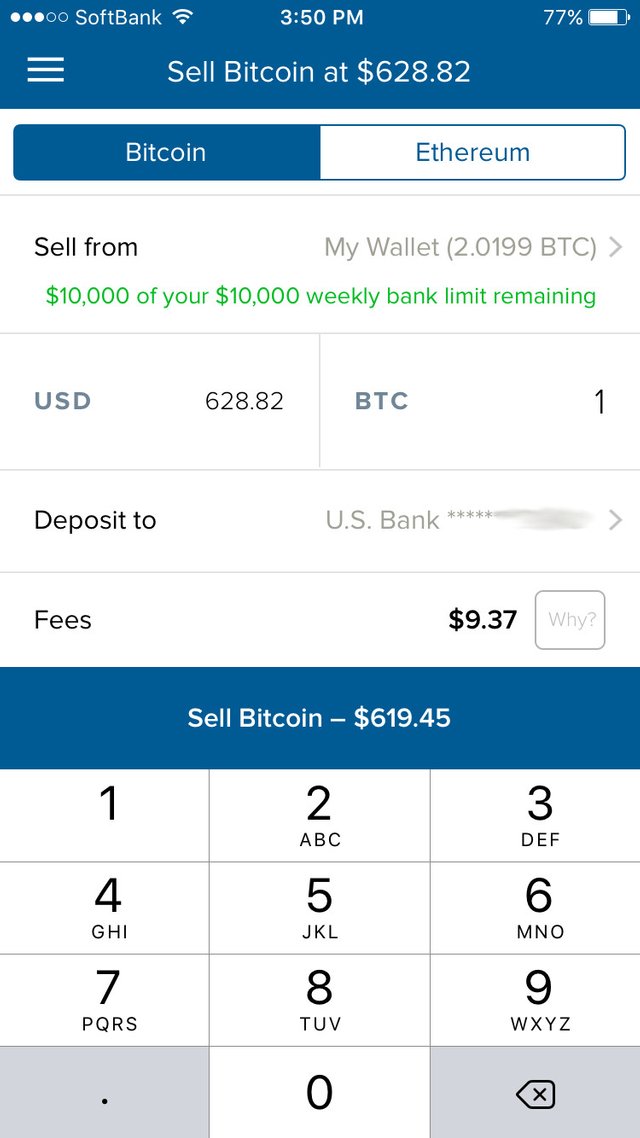

I prefer to use the Coinbase mobile app for iOS. The app's sell screen looks like this:

All you have to do is type in the amount of Bitcoin you want to sell, make sure the "Deposit to" is pointing to your bank account, and press the Sell Bitcoin button.

Coinbase has a rather large fee compared to other cryptocurrency services. It varies depending on your country, but for me it's 1.49% of the total dollar amount of my transaction. This is by far the most expensive step in the remittance process, but it's still a good deal cheaper than the traditional banking system. Also, I'm a big fan of Coinbase and if I've got to pay fees to someone, I'd rather have it go to Coinbase than a big blood-sucking bank.

Pop quiz time!

Let's see if you've been paying attention. Here's 2 questions to test your knowledge. I'll give 1 Steem Dollar as a prize to the first person who can answer these questions correctly in the comments:

- The price per Bitcoin in the above picture is $628.82. Is this the bid price or ask price? Knowing that Coinbase is a cryptocurrency exchange behind the scenes, and thinking back to what we know of bid / ask prices on Kraken, you should be able to reason through the answer to this question.

- If you buy Bitcoin instead of selling it, would you expect to get: a) a price higher than $628.82, b) a price lower than $628.82, or c) the same price ?

4. Wait for dollars to show up in my US bank account

Once you've hit that sell button on Coinbase, that's it. You're done. Sadly, it will take several days for the money to arrive in your bank account, but that's life. You just have to wait. So make sure to plan accordingly and send money home well in advance of any bills that need to be paid. I usually leave myself a buffer of about a week just to be on the safe side.

So is it really worth it? How much money can I save by remitting with Bitcoin?

Oh yes, it's worth it. Most of the time. There have been months where the spread on Kraken wasn't that great, and I just didn't feel motivated enough to bother with the whole Bitcoin process. As for exactly how much money you can save, that will be the topic of next week's post. In part 2 I will use an Excel spreadsheet to calculate exactly how much you'll save vs. traditional remittance methods. Originally I intended to make that part of this post, but I'm sure you're tired of reading by now so I will stop here.

Links for more info

Part 2 of this article: https://steemit.com/money/@cryptomancer/using-bitcoin-to-save-money-on-international-bank-transfers-part-2

Kraken's web site: https://www.kraken.com/

Coinbase's web site: https://www.coinbase.com/

10 useful mobile apps to help you become a cryptocurrency wizard: https://steemit.com/technology/@cryptomancer/10-indispensable-mobile-apps-for-crypto-enthusiasts

For more posts about cryptocurrency, finance, travels in Japan, and my journey to escape corporate slavery, please follow me: @cryptomancer

Image credits: The first two images in this post are amalgamations of various graphics from Pixabay under Creative Commons CC0 . The Kraken and Coinbase logos in the 2nd image are taken from the respective web sites of those services. All other images are screenshots taken from my iPhone.

Noone won the quiz?

Cool, I get to participate!

If I understand the situation correctly, it is:

a. Bid price, that is you're selling at the highest price, that people are willing to buy at.

b. If you were buying instead, the answer would be A, since it is same as at the Kraken example, you'll be buying at the lowest price that people are willing to sell at. And the difference between them is spread.

Is this correct? 8)

Bingo, you've nailed it, that is indeed the correct answer! I was beginning to think nobody would get it. Congrats, you get the prize. :-)

I use Bitcoin to send my G/F money in Poland which she swaps it out to Zloty v.quickly. The remittance market is growing for Bitcoin, hence cutting out the middle man much more :)

Indeed it is, good news for people like us that need to make regular remittances!

Isn't what Ripple is claiming to do.

Ripple is not my area of expertise, but my general understanding is that it is an inter-bank settlement network which has the potential to greatly improve efficiencies in the technology used by banks to transact with one another. I think it will be a while before tangible benefits for consumers emerge from the experiments currently underway, but to answer your question: yes, in the long run, Ripple could make international remittances much cheaper.

It is exciting to see that the financial industry has taken notice of Bitcoin and is now learning how to make use of the underlying blockchain technology that Bitcoin is based on. Will be interesting to see what comes of it!

Great article!

UPvoted and I will recommend this to be featured in the Steemit NewsPaper.

Thanks for sharing!

Thanks Quinn. Glad you liked it!

I LOVED it and feel its legitimately more valuable than 90% of the posts on Steemit!

Did you see that my recommendation to the Steemit Newspaper was accepted and you were featured?

SteemON!

I did, I'm very happy it was accepted and thanks again for the recommendation! Steem on right back at ya!

Excellent post! Viva la Bitcoin. Great graphics. Great presentation.

Anything that undercuts the bloated banks and saves me money has my vote!

Amen to that! Thanks for your support as always!

Great piece and thanks for sharing. Happy to upvote and share this on Twitter✔ for my followers to read. Stephen

Much appreciated Stephen, glad you enjoyed it and hope your followers do as well.

Great article @cryptomancer, thanks upvoted.

I've been helping Mom get her CoinBase wallet verified this week and since we're on CoinBase too it just made sense. Seems they've implemented some stingy buy limits now.

She's limited to only $300 per week which is quite frustrating since explaining to her all about Bitcoin and how awesome it is for sending money overseas!

Well, that's the best we can do for now. Thought I'd comment in case anyone else was planning on moving money with CoinBase and isn't verified yet.

Oh and pop quiz!

1. I think it's Bid price right? We'd sell our Bitcoin at bid price.

2. It's B, we will buy at the lowest ask price anyone will sell.. right?

Thanks for helping me learn some trader lingo! :)

You're welcome, I'm pleased the article is useful to you. Coinbase limits start out low when you first join, but over time as you use the service the limits gradually increase. It won't take long for them to go up if you transact frequently, so don't be discouraged!

Regarding the quiz, I'm sorry but you answered one of the questions incorrectly so you don't get the prize. Nice try though!

Thanks and darn! Lol I'll keep studying that trader talk!

Great post! In fact, it was so good that we decided to feature it in our latest newspaper. Read it here: https://steemit.com/steemplus/@steemplus/steemplus-saturday-october-22-the-daily-newspaper-that-pays-you-to-find-high-quality-content

For me personally bank transfers are still a better value than crypto, but I transfer a very large sum once or twice per year. In the end I pay <0.2% in fees.

If I used Bitcoin I'd pay much more given that there are several third parties in the middle required to convert to fiat. Perhaps one day in the future I won't need to convert back to fiat to actually spend my money, then crypto will have the banks beat hands down.

That's a good point, how much you save also depends on how much you send, when dealing with percentage based fees. For very large amounts, as you say, bank transfers can still be a better deal. Personally, I find I can optimize my savings by sending anywhere from $1000 to $1500 per month. Past $2000 or so, it tends not to be worth it.

I dream of the day when crypto will be a universally accepted payment option everywhere. If only Amazon.com would start accepting it, I'd pay that way all the time!

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal