Valuing US Real Estate - Where You Should Invest Now

How do you value real estate?

That’s probably the most asked question worldwide, when it comes to investing and spending money.

No matter where you go in the world, people understand the value of real estate. It’s one of the few assets that nearly all people agree has an intrinsic value.

But how do you figure out what a property is worth? Is it all in the eye of the beholder?

I’ll cut to the chase and tell you the easy and most consistent way to value real estate:

Price per square foot, if you’re in the United States.

Or price per square meter if you’re in the rest of the world. One square meter equals 10.7639 square feet. So, for quick calculations, you can just multiply square meter measured real estate by 10 to quickly calculate the cost of real estate in square footage terms. For example, a 1,000 square foot apartment that is selling for $100,000 means that it costs $100 per square foot. In square meter terms, it’d cost approximately $1,000 per square meter.

I’m only going to be talking about US real estate here, as it’s easily the most accurate market to track. There are a variety of publicly available data points that allow us to analyze nearly every single city within the US.

With these numbers we can say, “This city is expensive or this city is cheap.”

Or, at least that’s what it seems like…

Let’s look at two examples:

In the city of San Jose, California, the median rent is $3,600 per month while the median home price is $992,000. Those are HUGE costs.

In the city of Birmingham, Alabama, the median rent is $1,100 per month while the median home price is $126,000. That seems much more affordable.

But, where would you rather live? Which city provides the most potential opportunities?

San Jose may be expensive, but it’s also home to high salaries and numerous multi-billion dollar companies.

Birmingham, on the other hand, is not exactly on San Jose’s level.

Looking at two cities at the opposite end of the price spectrum, like Birmingham and San Jose, we can assume that this means you pay more per square foot for the city that is more expensive. Likewise, you’d be paying less per square foot for an inexpensive city.

For renting, we can assume the same in price per square foot terms.

The best way to visualize this is to look at an expensive city and an inexpensive city, to see what you’d get for the same amount of rent.

Here is what you’d get for $1,500 per month in expensive New York City versus inexpensive Wichita, Kansas:

Source: VC

Truthfully, from a consumer’s standpoint, it’s nearly impossible to definitively say that real estate is cheap or expensive.

If we look at the above graphic of what you get in New York City versus Wichita, you could say that Wichita has almost 10 times the value in square footage terms.

But, what if a job in New York City has a salary that is 10 times higher than a similar job in Wichita? In theory, that would mean that living costs are the same, in relation to what the salaries are in each location.

It’s all relative.

Ok, so all of this information is good for the person who is actually buying or renting. A buyer or renter needs to look at their salary in comparison to their housing costs.

The best scenario would be for a person to make a New York City salary while living in a Wichita housing market. (And with the internet, that’s now possible for many people.)

But, what about an investor?

What information should we (investors) be looking at and where should we be buying?

Really, there are two main ways to invest in real estate.

You're either buying for yield (i.e. money in your pocket every month) OR you're buying for capital appreciation (i.e. buy a house for a low price and sell it for a high price for a big profit).

You can also do both. Meaning, you can buy real estate that is yielding a monthly profit, but is also appreciating at the same time. So, in theory, you are getting paid every month while you wait for your real estate investment to appreciate in price.

Then, after a couple years you can sell your real estate investment for a large profit.

This is EXACTLY what we did in Colombia with the Explorer Partnership.

Normally, you want to invest in real estate for yield.

If you are only investing for capital appreciation, then you are essentially speculating. You are buying with hopes of the value of the real estate going up... but you could be wrong.

So, if you buy real estate that is not yielding, or maybe it may have a NEGATIVE yield, then you must have capital appreciation in order to profit.

This strategy is not only risky, but it's foolish. You are essentially making a huge bet. And if you have negative yield (meaning, your monthly yield is LESS than your monthly expenses) then you are paying a fee to wait for that capital appreciation. If that property doesn't appreciate, then you end up paying a monthly fee for nothing... you are literally throwing money down the toilet.

You want to buy real estate that is CURRENTLY yielding. You don't buy real estate and HOPE that it will appreciate in the future or HOPE that it will yield in the future.

You buy under the current conditions. Because you don't have control of the future real estate market.

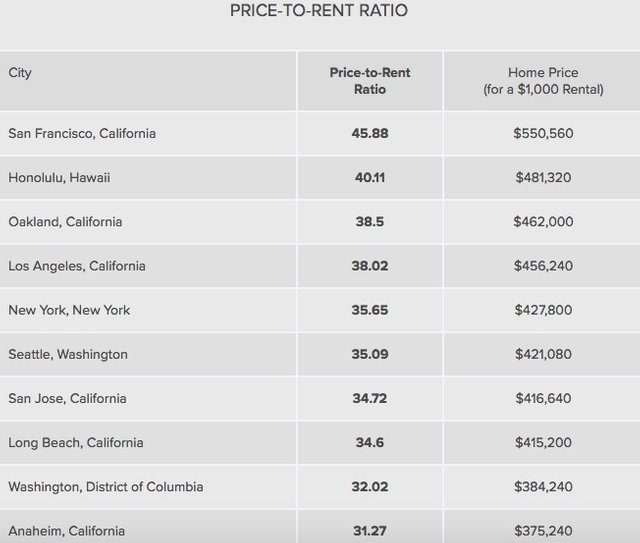

When investing in US real estate for yield, we should use the Price-to-Rent Ratio.

Essentially, this ratio is determined by how much a house costs to buy versus how much you can rent it our for.

In general, you will NOT find this type of real estate in major metro areas.

Cities like San Francisco, New York, Los Angeles, or Seattle are full of people buying real estate expecting to profit from capital appreciation. They are NOT buying for yield.

That's because major cities see price appreciations that are more correlated to the strength of the national economy, which means that these properties are more susceptible to the cyclical nature of the market.

Of course, the entire US housing market is affected by the larger economy, but these major cities see a disproportionate amount of wealth towards the top of a market.

San Francisco and San Jose are a perfect example. The tech industry is absolutely crushing it right now, and the housing prices in those areas are reflective of that.

People are making lots of money in those two cities and they are dumping that cash into the housing market.

What's going to happen when the tech market turns around?

Housing prices will probably decline in relation to the buying power of the local population, as their salaries decline.

Check out the price-to-rent ratio for the top 10 US cities:

Source: SA

Meanwhile, check out the price-to-rent ratio of the bottom 10 US cities:

Source: SA

Looking at this list of cities we can see exactly where the best yield is located.

Ideally, you want a city that has lower real estate prices with higher rental rates.

For major cities in the US, this information is readily available on sites such as Trulia, Zillow, or Redfin.

All you need to do is divide the purchase price of a home by the annual rental cost. So, if a home cost $100,000 and rented for $1,000 a month, that would cost $12,000 a year to rent. We could then determine the price-to-rent ratio like this:

$100,000 / $12,000 = 8.3

If you find any price-to-rent ratio under 15, I think you're probably looking at a great property.

For the rest of the world there are many locations with a price anomaly... meaning that the data is not readily available.

So how do you figure out how to find these cities?

We go back to the price per square foot valuation... and then we look at average rental prices for that same location. This is a much more granular approach, but it gives very accurate data. (Especially when you use price per square foot, so you can compare to the US market.)

You can do this for any city in the world.

Here is how you do it:

- Choose a city.

- Pick 20 random properties that are for sale of similar location, build, and size. Determine the price per square foot. Just divide the asking price by the square footage.

- Pick 20 random properties that are for rent that are similar to the first 20 random properties that are for sale. Determine rental price per square foot. Just divide the per month rent by the square footage.

- Now you have both the average price per square foot for properties that are for sale and the average price per square foot for properties that are for rent.

- Once you have both of these averages (the price per square foot for real estate that is for sale AND for rent), then you can compare to other major cities.

Is this a lot of work? For sure. You'll have to make a spreadsheet and start crunching numbers.

Love to see others talking real estate. I use the 1% rule for a quick calc. Monthly rents need to equal 1% or more of the purchase price otherwise I already know it will not cash flow.

There is an excel calculator I give away on my website that does all the work for me though. scaredycatguide.com if you wanna check it out.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.codyshirk.com/valuing-us-real-estate/

Congratulations! Your post made this weeks Top 5 Real Estate Posts on Steemit This Week . Keep up the good work!