Great Depression Tariffs in 2018??

Since we are in a time that very much resembles the Great Depression, why not take a dive back into history. During the Great Depression, significant disinflation made its way throughout the U.S. economy. Much of this was from the credit binge of the 1920s, where everyone borrowed to buy stocks, cars, and TVs, to name a few. More than half of the cars on the road at the time were borrowed on credit, and consumer debt doubled during the decade. This debt binge fueled asset prices, creating a wealth gap much like today. Corporate profits were at record highs, while average workers’ wages did not move much. Wealthy Americans (or the top 1%) owned about 33% of all assets. That ratio is much worse today, where the top 1% own roughly 90% or more of all assets.

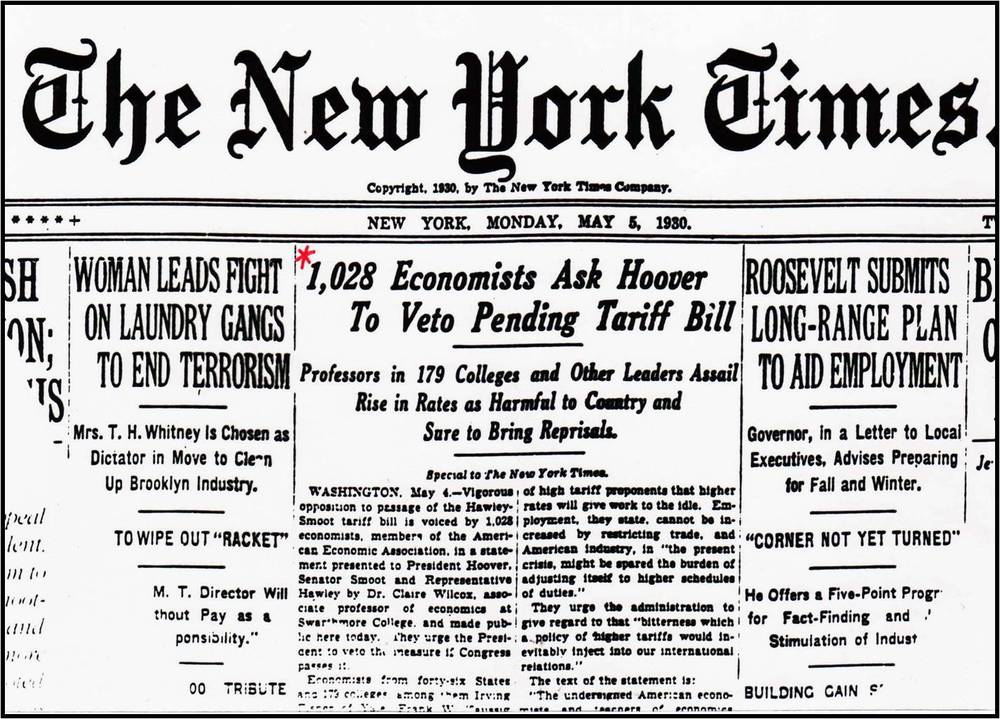

Declining prices left American farmers in tremendous debt, ultimately leading to gross income of $10.7 billion in 1921… during the decade lobbyists from the agricultural industries sought to add more protection to the industry through Congress and the Senate. Only after the debt binge of the 1920s and a stock market crash in 1929 did any legislation actually pass.

The Smoot-Hawley Act of 1930 was signed on June 17th, 1930 by Senator Reed Smoot (Utah) and Representative Willis Hawley (Oregon). This bill actually allowed Congress to implement tariff rates and ultimately raised tariffs by 20%. The bill was met with retaliation from foreign governments and industry and political leaders. Smoot-Hawley added specific rates to certain goods based on the value of the good. The tariff actually made world trade worse, as U.S. imports and exports from Europe fell by 66% between 1929 and 1932. High-leverage farms and agricultural companies ultimately led to many bank failures as prices went up. Global trade slowed significantly, ultimately leading to less profit and more failures. Tariffs throughout history have not worked, and I don’t see them working now. However, when markets are so undoubtedly lopsided that a nation’s trade deficit grows exponentially, something has to be done to even out the massive imbalances. In the short-run this will be good politically but not so economical in the long-run as prices will rise quickly. Ultimately, I believe this will lead to new trade deals with Canada and Mexico down the road.

Cheers,

Colin

Follow me or read at https://crushthestreet.com/articles/breaking-news/great-depression-tariffs-2018-colin-bennett