The Unforgiving Truth Behind Breaking Even

Hey all,

I want to bring something back up that I've mentioned briefly in the past, but go a little more in depth. This is a very basic concept to understand, but many people either don't fully grasp its concept or have just never thought about it before. While this is a very basic concept to understand, it is crucial for you to know the true value of your investments at all times. I believe the best way to explain the math behind breaking even would be through an example:

Let's say you invest in an asset that is valued at $1.00. After holding your investment for some time, you notice that it is now valued at $0.50. This means from your initial buy-in price, you are now down 50%. What do you need to now break even back up to a dollar? You need an increase of 50% right? Because -50% + 50% = 0%, right?

No.

Let's do the math real quick. Your asset's current value is $0.50. Let's add 50% back to that. What do you notice? We are only at a value of $0.75. We're only halfway to our initial price! The truth of the matter is, if you are 50% down in an investment, you need the investment to rise 100%, or go 2x, just to break even.

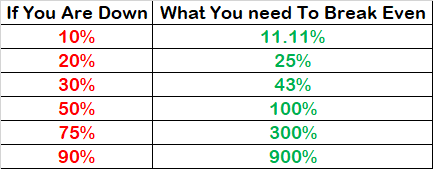

What is very important to understand from this example is that it is much harder to gain back money lost after your investment goes down in value. Below I've listed out percentages you'd need to gain back just to break even on a losing investment.

Keep on informing and making Steemit great.

Craig

Appreciate you stopping by!

Thanks for the easy table to break even, I actually bought some BTC on December so you can imagine I'm down about 50% I think (o_o)