The Basics of Investing in Physical Silver. The Best Crypto Hedge (Complementary Investment).

If you want to invest in physical silver, In my opinion, you have three major categories of silver to choose from; Nationally Minted Silver (NMS), Privately MintedSilver (PMS) or Manufactured Silver Goods, such as jewelry and Silverware. In this post I’ll discuss what I see as the benefits and drawbacks of each one of these options, and which you should put your paper money in.

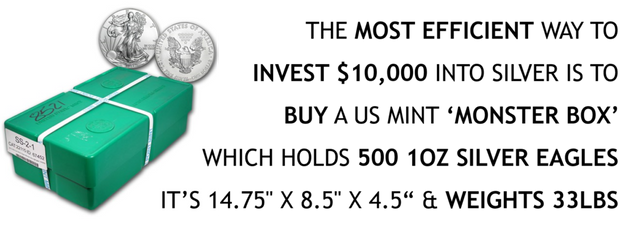

The first, and probably the most popular form of silver for investment, is Nationally Minted Silver, it can be in the shape of Coins or Bars and is produced by a government or sovereign nation state. While silver used to be used in everyday change, today governments typically mint them only for resale and not for actual circulation. This is made obvious by the large difference in the coins printed value and it’s metal value. For Example, This Silver Eagle has One Dollar Printed on it, but it’s worth at least $16 due to it’s silver content.

Like many countries, the US actually used silver in their regular circulated coins, up until 1964. So If you have some old change lying around, grab it and Check out this website Coinflation.com. There you can find out how much those coins are actually worth, you might be pleasantly surprised For instance this 1964 quarter is worth $3 in silver alone.

These coins are also sometimes referred to as ‘Junk Silver’, because they only have 50-90% silver, therefore would require melting to get to ‘Investment Grade‘ .999 pure. But keep in mind that most modern NMS such as US $1 American Eagles are now made using .999 silver, and are considered investment grade.

The Second Type of physical silver you can invest in is called Privately Minted Silver, also sometimes referred to as Silver Bullion. It can come in the in the form of Coins or Bars and is manufactured and stamped by a privately owned mint. These silver pieces can be minted as Commemorative or as Blanks, and as with NMS they must stamped .999 to be considered Investment Grade.

The Third and Final way to invest in physical silver is to buy Silver Goods, Like Jewelry or Silverware. They vary in quality and silver composition, though most are usually marked with a 925 (meaning 92.5% silver content) or they might be stamped “Sterling Silver”.

So now your probably asking yourself, what’s the best one to buy? What are the benefits of each?

While Jewelry & Silverware are beautiful & actually useful. They are the least efficient way to invest due to range in silver content and it’s irregularity in size. Though you might not realize, size plays a significant role when it comes to silver investing as large objects makes it difficult to invest significant sums of money, without having to buy a huge treasure chest, that is.Though many times the artistic value of a piece may out-weight the silver value. So if you’re an art collector this might be a good path, but for most this will not be the most effective method to take advantage of the potential market upside for silver.

If asset portability is something that is critical for you, you might want to consider gold. At the time of this writing 1 oz of Gold cost the same as 83 oz of Silver (as shown in the photo above), therefore takes up 83 times less space (actually even less as gold is a more dense material). But keep in mind the historic Gold:Silver ratio has been ~20X, even in the last 50 years its’ averaged ~55X, that’s why I believe silver is 35-75% undervalued. More on that in future posts.

Between Nationally & Privately minted Silver, its a bit more difficult to tell which is the better option, and is more of a personal choice.

When making your decision, you want to consider two main factors ‘Liquidity’ (How fast can you sell something) and ‘Profitability’ (How much can you make on when you sell it).

From a liquidity perspective NMS is the clear winner, as country or government that minted the coin, guarantees it’s silver content and quality. (Though of course there are fakes out there, as with anything). PMS while also typically stamped, is usually more heavily scrutinized by buyers due to the lack of the manufacturers credibility, though there are some mints that are considered more reputable than others, but still not as reputable as national mints. So if you want to be able to sell your silver quickly I recommend that you stick to well established nationally minted coins from the US or Commonwealth countries (basically all the coins that have the queen on the backside).

But from a profitability perspective, it’s a bit tougher to tell. When you’re buying, NMS typically sells for $1-3 over spot and PMS is usually only $0.25-1 over spot. But when you are selling you can usually get $1-2 over spot for you NMS, while you might only be able to sell you PMS for Spot price or below. So with NMS you pay more upfront but get payed more when you sell and usually the opposite with PMS. Profitability on silver goods is always circumstantial, but sometimes the only places that will buy it immediately will offer you spot price (or lower, as melting it down to .999 bars does carry a cost).

Silver Investment Comparison Chart

Another thing to keep in mind is that many silver coins and bars actually have collectible or numismatic value which will impact/increase the price outside of the spot price, assuming you can find the right buyer.

Similar to silver jewelry I typically try to stay away from collectible silver due to it’s lack of clear future resale value.

On the other hand I do enjoy purchasing collectible silver peaces that I really like and that bring me pleasure, like this Commemorative round with Vladimir Putin, holding a burning $100 bill, with the tile “Winter is Here”. Well maybe not yet, but more on the worthlessness of fiat currency a bit later.

upvote for me please? https://steemit.com/news/@bible.com/2sysip

Congratulations @alwaysimprove! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Round of 16 - Day 4

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @alwaysimprove! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!