Bitcoin Miners Unaffected by Price Decline — Hashrates Spiked Exponentially

BTC Mining Hashrate Unphazed by ‘Crypto Winter’

There has been a massive decline in fiat value for nearly all cryptocurrencies represented within the digital asset universe during the 2018 ‘Crypto Winter.’ During this time, researchers and pundits have declared that when BTC/USD prices dipped below $8K, mining was allegedly unprofitable in some regions. However, as far as blockchain data is concerned mining has grown exponentially even during the last four months when BTC prices found new lows. This year pools such as BTC.com, Antpool, Slush, and Viabtc have increased their hashrates considerably. A factor possibly due to new semiconductors and innovations in mining technology.

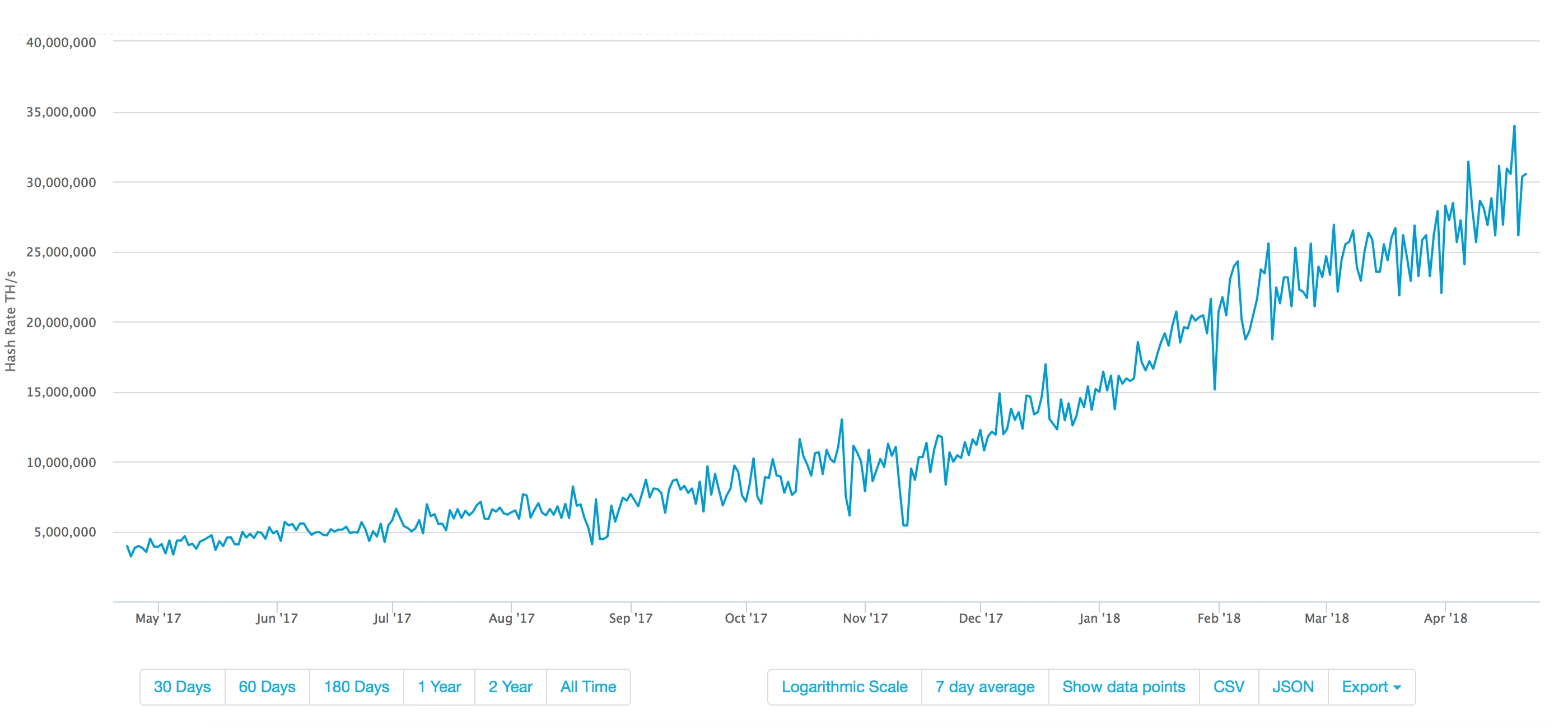

Today the BTC global hashrate is 30 exahash per second. Over the last four months even when the price declined hashrate increased.

Over the last seven days, BTC miners have held a fairly consistent 30 exahash per second. From December 2017 up until April 2018, the BTC chain’s hashrate has increased significantly. According to estimates, Chinese mining pools make up most of the BTC hashrate (80%) as eight of the top ten pools are based in China.

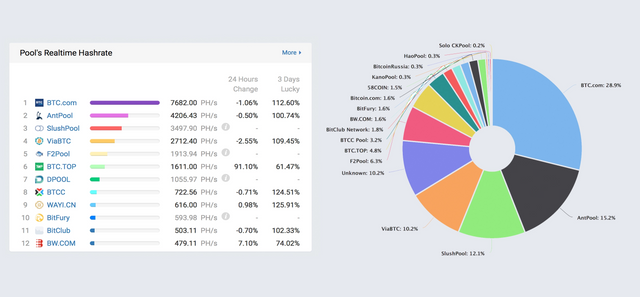

Chinese mining pools make up more than 80 percent of the BTC global hashrate.

The top five pools command close to 75 percent of the global BTC hashrate with BTC.com taking the cream of the crop. BTC.com now captures 28.9 percent of the BTC hashrate today, with Antpool’s 15.2 percent following behind. There are a total of seventeen known mining pools pointing their resources at the BTC chain and one unknown operation controls 10 percent of the network.

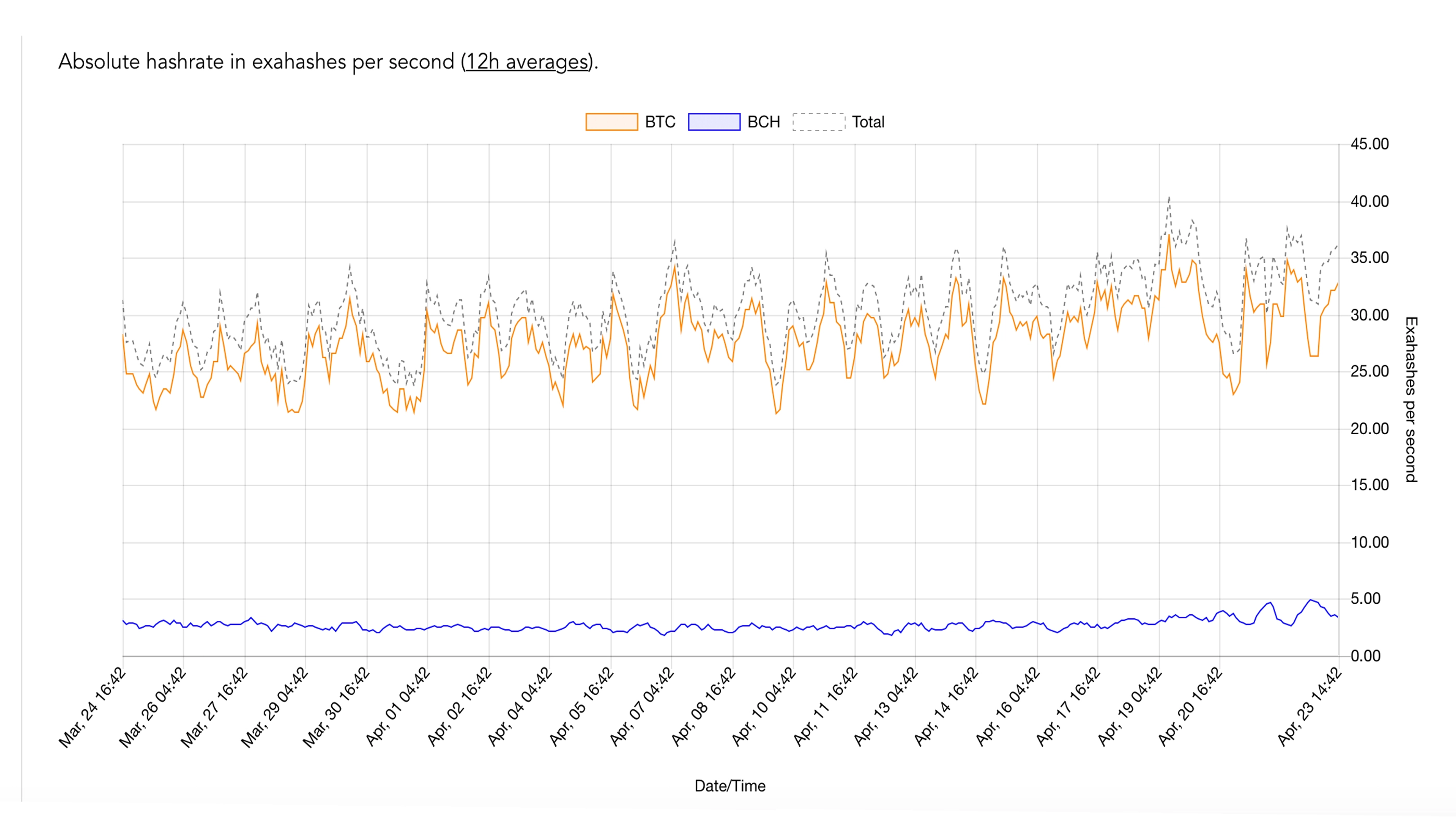

Bitcoin Cash Hashrate Explodes

The Bitcoin Cash network has also increased its hashrate significantly as well, as BCH miners are now processing between 3.6-5 exahash per second. Just a few months ago the BCH hashrate was between 0.5-1 exahash per second. At the time of writing due to the 60 percent bitcoin cash price increase, it is 1.7 percent more profitable to mine BCH than to mine on the BTC chain. Presently the Bitcoin Cash Difficulty Adjustment Algorithm (DAA) is operating at 14.8 percent of BTC’s difficulty. March and the month of April were the biggest hashrate spikes for BCH since the DAA was fixed last November.

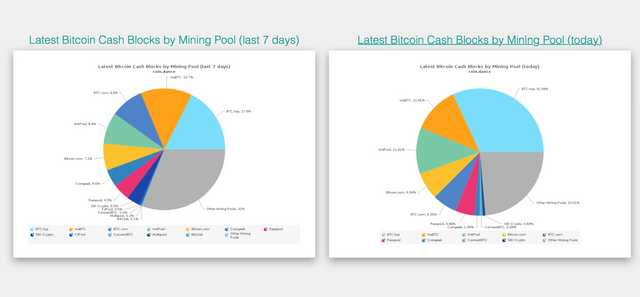

BCH has roughly thirteen known mining pools and 2-3 unknown mining operations pointing their resources at the chain. The biggest BCH mining pools over the last seven days include BTC.top, Viabtc, BTC.com, Antpool, and Bitcoin.com. Over the last week, the 2-3 unknown mining pools have captured 31 percent of the BCH network hashrate. Roughly 60 percent of the BCH global hashrate stems from China, as bitcoin cash has a more diversified spectrum of countries within its hashrate distribution.

The Entire Cryptocurrency Ecosystem Has Seen Hashrates Spike

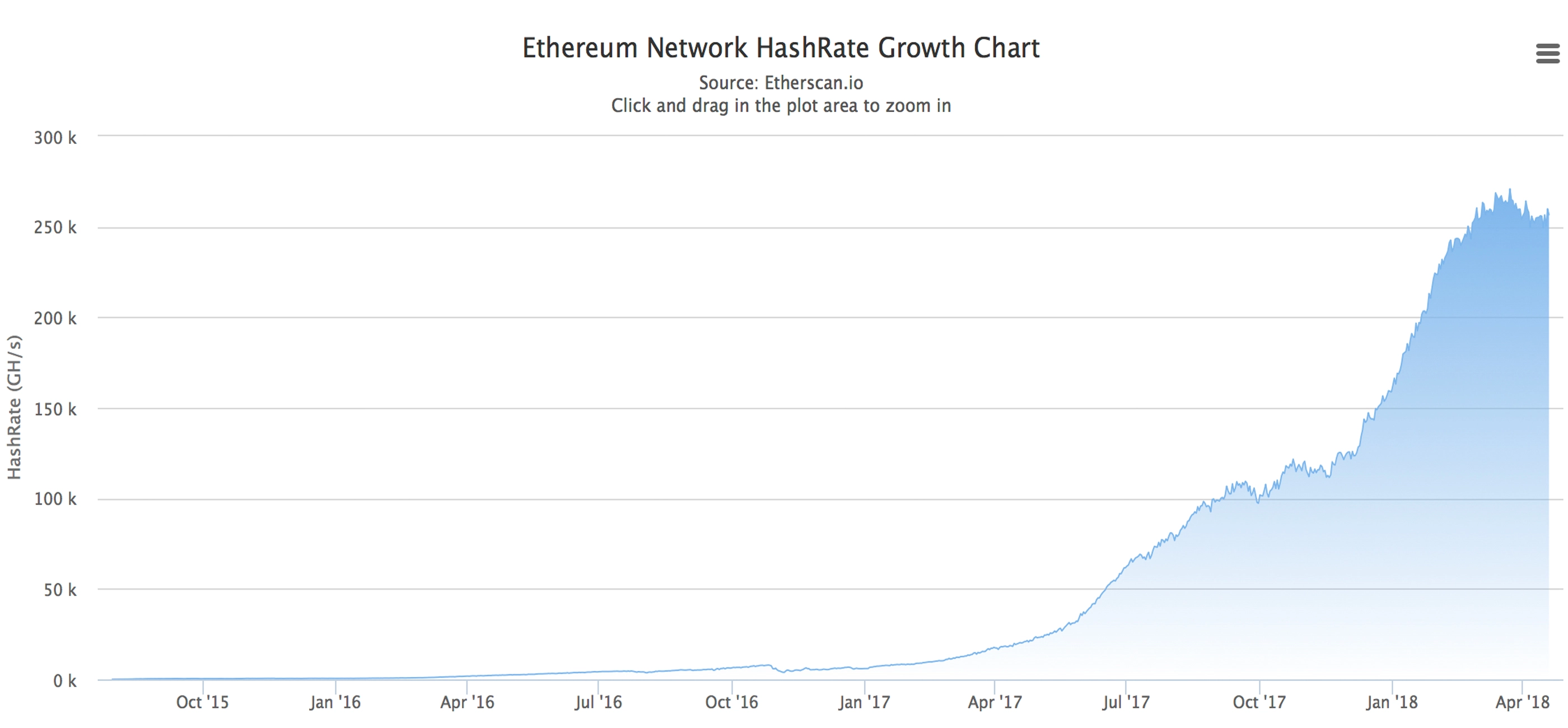

Overall there is a lot of computational power directed at both of these two networks, and they eclipse the entire landscape of 1500+ other digital asset hashrates. Although the processing power for those cryptocurrencies has increased as well over the last four months. Since January 2018 until now, the Ethereum network’s hashrate has grown immensely during the ‘Crypto Winter.’

The same thing for the Litecoin network, as its hashrate has exploded during its 4-month price downswing. This trend has taken place across nearly every single cryptocurrency that uses a POW-type of consensus algorithm. Most all of the cryptocurrency hashrates worldwide have spiked considerably this past January through April 23, 2018. It’s safe to say all these theories of miners shutting down machines soon, and ‘losing their shirts’ is pretty far fetched.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thecoinleader.com/news/bitcoin-miners-unaffected-by-price-decline-hashrates-spiked-exponentially