A Survival Guide During Slow Stock Market Times

Hello Steemit Friends

Slow Market Survival

nobody likes desirous about a slow stock market, but many times it does occur so you better be all set. Yes, yes i do know; its not fun, its no longer unique, and its no longer more often than not time when merchants are making enormous gains. Nevertheless, it is an foremost and inevitable part of buying and selling so that you better to be taught to survive in the course of the awful instances as its excellent in your coaching as for those who are going to be my subsequent millionaire buying and selling assignment scholar you have to study to adapt to one-of-a-kind market environments.

Considering the stock market is cyclical, its very predominant to recollect your sport plan for when the market will get gradual as it does occur every so often. Listed here are some pointers for how to keep sane when the market appears to be standing still, too many traders get impatient and do stupid things that price them gigantic so dont let that occur to you!

- Understand that the market strikes in cycles. It is probably not probably the most interesting fact of buying and selling, however the market is ever evolving. More than a few causes together with the economy, the time of the year, and world pursuits can play into shares and the way they participate in. As a dealer, it can be frightening and disorienting to have an understanding of that the market has shifted. Should you have been working a designated setup that has been working well, a change available in the market can throw your process off steadiness.

Simply figuring out that the market can, and can, shift is a large part of slow market survival. Which you cant take it in my opinion, and that you could not alternate it. Accepting it versus fighting it is quite a huge part of the fight adapt or perish.

- Don't forget whether or now not buying and selling is an efficient notion. Actively buying and selling in the course of instances when the market is gradual is not perpetually a good suggestion. Its a threat that will have to be strongly considered. This is a key side of slow market survival.

Overtrading in slow times generally is a unhealthy selection, no longer best to your account, however on your state of mind. When the market is thriving, that is the time to get in there. Nonetheless, when the market could be very still, you're seemingly just going to debris along with your possess mind and self confidence as a dealer, to not mention grind your account down. Mostly, an aspect of watchful waiting can also be priceless.

- Understand the way to respect market alterations. One of the biggest keys gradual market survival is with no trouble being ready to admire that the market has shifted. Think it or not, it is not at all times immediately evident; it could simply seem like you are having some off days. However when you have been reliably making profits utilizing particular setups and it doesnt look to be working anymore, in spite of your satisfactory efforts and cautious research, it might not be you: it possibly the market.

Recognizing market changes is some thing that yo will be taught in time as a trader. The capacity to establish market shifts will allow you to be proactive about altering your buying and selling ways so to survive.

Adapt to the market. Past without problems recognizing market changes, its essential to grasp when its time to make a change for your buying and selling headquartered on the state of the market. One method to stay on top of this is via monitoring your profitable percentages. If your percentages are happening constantly, it is a signal that it is time to adapt. Be honest with yourself: is it simply you getting lazy, and not doing your study? If so, it can be time to get yourself again into following good habits. Nonetheless, in the event you are being dependable, learning, doing research, and working trustworthy setups and your percentages are still going down, it is usually imperative to adapt to satisfy the market the place it stands.

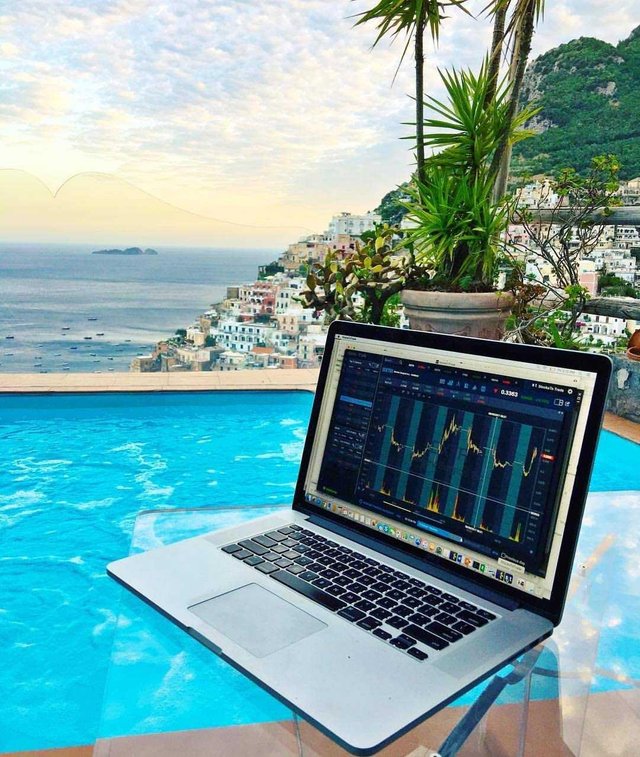

Appear at who is making earnings. The market could get slow, but it is not at a standstill. Any one continues to be profiting. If you want to continue buying and selling throughout sluggish market instances, one manner that individuals of the Tim Sykes Million challenge workforce would use is to quite gain knowledge of the market to examine not most effective who's profiting, however how for example study from my latest millionaire student here as he banking properly nowadays!

Copying an extra dealers strategies will rarely work out for the satisfactory. Nonetheless, that you would be able to acquire plenty of concept and course from different merchants who're creating wealth when the market is sluggish. So if you will find who is earning profits, try to evaluate how they are doing it so as to adapt their methods to suit your own routine.

Know what to appear for. Peculiarly as a brand new dealer, it can be difficult to grasp what to seem for in a trade. That is authentic all the time, however surely when the market is sluggish. Sadly, there is now not one convenient reply to this: a variety of it comes with remark and expertise. However over time, you will to identify what varieties of trades work in more than a few market stipulations. Take notes and study out of your experience. The market will come back up to pace, however in time, it's going to end up sluggish once more. Understanding what to seem for in trades in all varieties of market stipulations is a truly priceless thing for traders be definite to observe this entire free consultant to be trained decide upon the quality shares to alternate and most likely this software is critical too!

Enhance your capabilities base. So, when you are no longer actively buying and selling when the market is slow, what are you doing? Individuals of the Tim Sykes Millionaire challenge received be surprised to listen to what I have got to say. Gain knowledge of!

When the market is sluggish, you have an opportunity to develop your knowledge base, study up, and reinforce your buying and selling information. Because of this when the market bounces again, you will be a better trader.

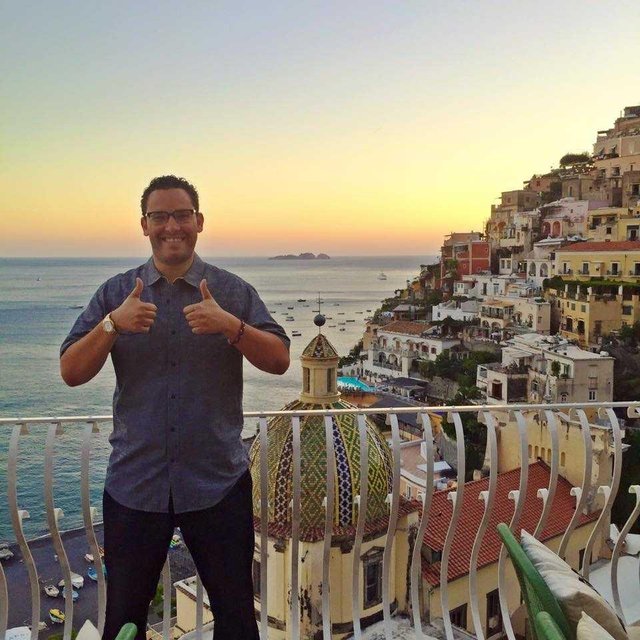

- Enjoy the day without work. When the market is moving at a speedy p.C., you must preserve up with it as there are plays galore, but it surely will also be arduous. So when the market is sluggish, be certain to experience your day without work!

Rest up, go travel or exercise, spend time with associates and household, have interaction in movements which can be meaningful to you. The market shouldn't be going to be slow ceaselessly, so enjoy this rest while that you can and take advantage of out of it!

Surviving a slow market is challenging for traders of all phases, from the rookies to the historic pros. Nevertheless, by following these recommendations you will be ready to strengthen your overall outlook and mind-set for the period of these gradual occasions to be able to journey something waves the market sends your method and this is a part of your experience to becoming my next millionaire trading challenge scholar as figuring out when to not trade is an key aspect of your total knowledge.

Hello @timothysykes.com!

I noticed you have posted many times since you began your journey on Steemit. That is great! We love active partipants.

I do want to point out that the Introduceyourself tag is meant to be used once only to introduce yourself to the Steemit community. You have now posted 5 times using the introduceyourself tag. Please see this link for more information Tag Spam?

Please take this into consideration and help build a great platform!