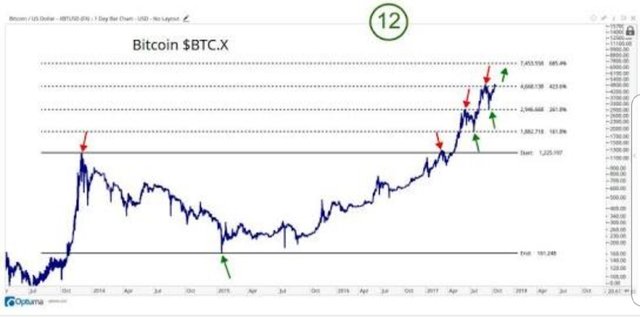

Bitcoin Price Pullback Before $8K Again

Bitcoin (BTC) could be in for a minor price pullback, having clocked a 39-day high above $7,500 earlier today, technical charts indicate.

On Tuesday, BTC crossed the inverse head-and-shoulders neckline resistance of $6,838 with strength, confirming a short-term bearish-to-bullish trend change.

So, a rally to $7,900 (inverse head-and-shoulders breakout target) could be on the cards. However, the move may not happen in the next 24 hours as the retreat from $7,562 to $7,370 indicates the bulls are keen on booking profits, having pushed BTC higher by more than $1,300 in the last 72 hours.

Further, the technical charts are also reporting intraday overbought conditions, meaning a price pullback could be in the offing before the rally continues. Moreover, investors who missed the initial move higher would have the opportunity to board the BTC freight train on any price pullback.

A minor correction, if it occurs, could end up recharging the engines for a sustained rally to $7,900–$8,000.

The above chart shows BTC has pulled back from near 100-day moving average (MA) hurdle of $7,613. Still, the bias remains bullish as the cryptocurrency has found acceptance above the 50-day MA.

The short-term moving averages (5-day, 10-day) are rising in favor of the bulls and the 5-day MA has cut the 50-day MA from below, confirming a bullish crossover.

What's more, the relative strength index (RSI) has also adopted a bullish bias (above 50.00).

As a result, BTC is more likely to extend the rally to $7,900–$8,000 in the short-run and confirm a successful reentry in the pennant pattern. That would be a major blow to BTC bears as the bearish pennant breakdown in June had signaled a revival of the sell-off from the record high of $20,000 reached in December.

A move back inside the pennant pattern would signal a long-term bearish invalidation. Meanwhile, a break above the pennant resistance, currently seen at $8,210, would strengthen the odds of a long-run bullish reversal.

View

BTC price is seen rallying to $8,000 in the short-run, albeit after a healthy pullback to $7,000.

The technical correction will likely help BTC chart a more sustainable rally to $8,000.

Only a daily close (as per UTC) below $6,839 (inverse head-and-shoulders neckline) would abort the bullish view.

A close below $6,080 (July 12 low) would shift risk in favor of a drop to $5,755 (June 24 low).

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.thecryptodesk.com/bitcoin-price-risks-pullback-before-testing-8k-again/

👦Awsome post my brother...Please 🔁 my top 1st Post on my blog👷#mgsc

Congratulations @makemony! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!