Metavault.Trade Decentralised spot & perpetual exchange.

Overview

The assets used in the platform for swaps and leveraged trading make up the MVLP index. Any index asset can be added to the liquidity pool (LP) by the user, but the MVLP must be removed from the LP in order to burn.

MVLP holders are rewarded with MATIC and esMVX tokens.

To provide the necessary liquidity for leveraged trading, MVLP tokens were created. As a result, MVLP holders are liquidity providers and can benefit from losing trades made by leveraged traders. Instead, they lose money as leveraged traders make money from their trades.

Redeeming and Minting

By visiting the "Buy" page from the header and clicking on the "+ LIQ." and "- LIQ" buttons in the MVLP box, MVLP can be created and redeemed.

You will see a list of all MVLP attributes on the screen that appears after clicking this:

Price.

Wallet holdings.

APR.

Total supply.

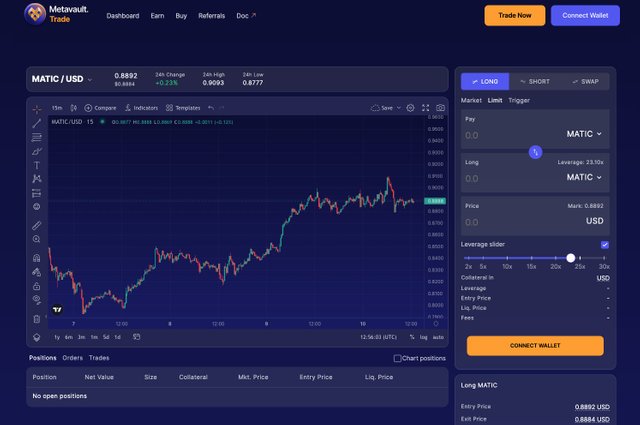

Trading

Metavault. Trade is an advanced, unregistered decentralized exchange. All you need to start trading on Metavault. Transactions in Web3 wallets.

Metavault. Trade Setting Slippage

Slippage is the difference between the strike price and the expected price.

There is no price impact on trades due to the quantity provided by the Metavault.Trade team, but it can slip due to fluctuations between submitting your trade and confirming it on the blockchain.

By selecting the position in the header and the Settings button from the drop-down menu, you can change the maximum slip resistance of the thread.

Liquidations in Part

The price will be where the loss amount is very close to the collateral amount if the market reacts negatively to your trade.

The price at which (collateral - losses - loan fees) is less than 1% of the value of the position used to determine the liquidation price. The position will be closed automatically if the price of the token crosses this threshold.

It is important to keep an eye on your liquidation price as it will change over time due to borrowing fees, especially if you use more than 10x leverage and hold the position for more than a few days.

After losses and expenses are deducted, your account will be refunded.ư

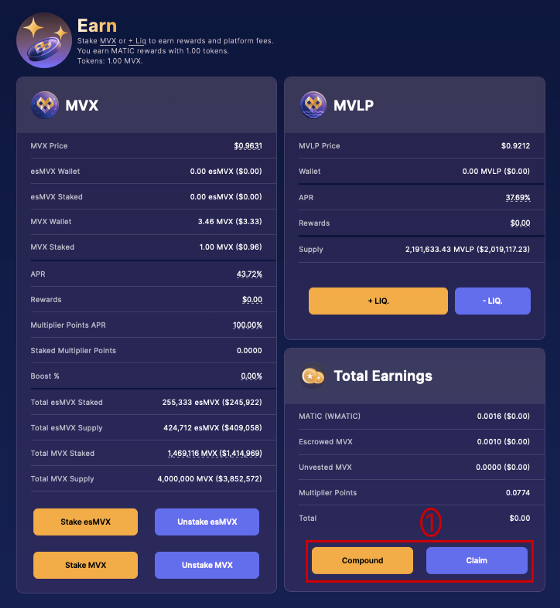

Staking

Three reward categories are produced by spiked MVX:

MATIC

esMVX

Multiplier Points

The accounts staking MVX receive $MATIC, which is 30% of the swap and leverage trading costs.

Treasury Resources

The liquidity of MVX-USDT LP is provided and obtained by the Protocol (MVX Treasury). Every Friday, all commissions from this trading pair are converted into USDT and credited to MVLP as liquidity for MVX Treasury Protocol.

Metavault. Trade token Supply

The total supply includes 10,000,000,000 MVX. A 28-day period restricts mining beyond this limit and will only be taken into account if the requirements of the protocol require an increase in supply.

The number of tokens distributed through other DEXs, invested in, burned, and used for marketing indicates how the circulating supply changes.

The MVX allotments are:

1.2 million for marketing, partnerships and community development

6 million reserved for rewards (as esMVX which can be converted over time to MVX)

1 million for liquidity on Uniswap (reserve held in the MVX-Multisig)

300,000 for MetavaultDAO team (linearly vested over two years with a three-month cliff)

- 1.5 million allocated to presale

Metavault. Trade Presale

MVX token price at launch: 1 USDT

GMX community sale = 200,000 MVX at 20% discount (0.8 USDT/MVX), 200 slots

Whitelisted public presale = 1,000,000 MVX at 10% discount (0.9 USDT/MVX), 500 slots

Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

Total $ to be raised in presale: 1,060,000 USDT + Metavault DAO Treasury allocation from MVD -> MVX sale

500,000 USDT paired with 500,000 MVX initial liquidity V3 Pool

60,000 USDT as marketing budget

500,000 USDT as initial MVLP liquidity (owned by the MVX Treasury)

The Metavault protocol owns the liquidity, which is kept in the multi-signature wallet.

Metavault. Trade Bridging

Tokens are bridgeable to MVX via the following bridges:

Multichain.org

Connext Bridge

Celer Network

Synapse Protocol

Details of Multichain.org

By clicking the "Connect to a wallet" option in the header, you can connect your MetaMask wallet.

To choose the network from which to bridge, click the button in the header to the right of the "Connect to a wallet" button.

By clicking the "Swap" button in the menu on the left, navigate to the Swap section.

Choose the token you wish to swap, and make sure the origin network is chosen correctly.

Change the app's menu at the bottom from "Router" to "Bridge" if the asset isn't shown in the dropdown menu.

Make sure to choose the Avalanche mainnet as your destination and enter the amount you wish to swap.

Change and sign the agreement.

Details of Connext Bridge

By clicking the "Connect" button, you can connect your MetaMask wallet.

Pick the source network.

Choose the token to bridge, the recipient address, and Avalanche as the destination chain.

From the corresponding dropdown boxes, select the crypto to trade and the crypto to swap into.

Fill in the appropriate fields with the amount you want to swap or the amount you want to swap to.

After signing the transaction, click "SWAP."

Celer Network (cBridge)

By clicking the "Connect Wallet" button, you may connect your MetaMask wallet.

Using the dropdown menu next to "From," choose the origin network.

Choose Avalanche from the dropdown menu next to "To" to serve as the destination network.

Select the crypto to exchange.

Enter the amount you wish to send.

Change and sign the agreement.

Details of Synapse Protocol

Connect your MetaMask wallet by pressing the “Connect Wallet” button.

Select the origin network from the dropdown menu next to “From”.

Select Avalanche as the destination network from the dropdown menu next to “To”.

Choose the crypto to swap and the crypto to swap to from the respective dropdown menus.

Enter the amount you want to swap or the amount you want to swap to in the respective fields.

Press “Bridge Token” and sign the transaction.

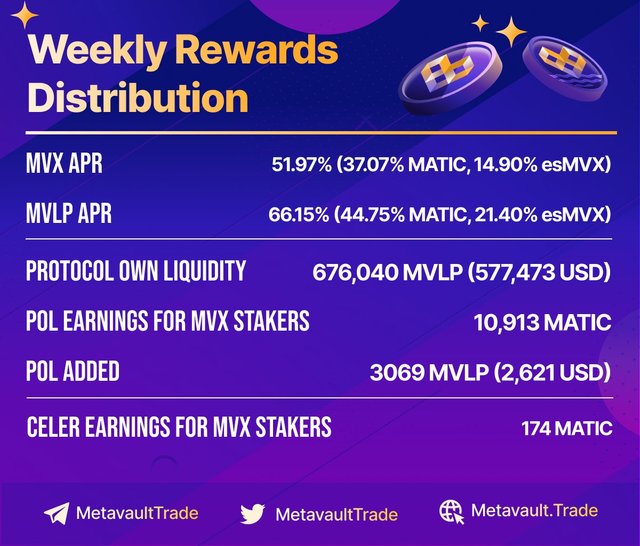

Distribution Rate

Distribution rates change on a monthly basis.

June 2022: 50,000 esMVX for MVLP provider & 50,000 esMVX for MVX staker

July 2022: 60,000 esMVX for MVLP provider & 60,000 esMVX for MVX staker

August 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX staker

September 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX staker

Important information about Metavault. Trade.

Website : https://metavault.trade/

Twitter : https://twitter.com/MetavaultTRADE

Telegram : https://t.me/MetavaultTrade

Discord : https://discord.com/invite/metavault

#PROOF OF REGISTRATION

Forum Username: LouieAlfredo

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3437864

Telegram Username: @Niemeyerv

Participated Campaigns: blog

ERC-20 Wallet Address: 0xcdF7343d6251524bcF23e98e4F55FC23e1A8d702