Easy Way to Make Money While You Sleep [2022] 4

- Real Estate Investment Trusts (REITs)

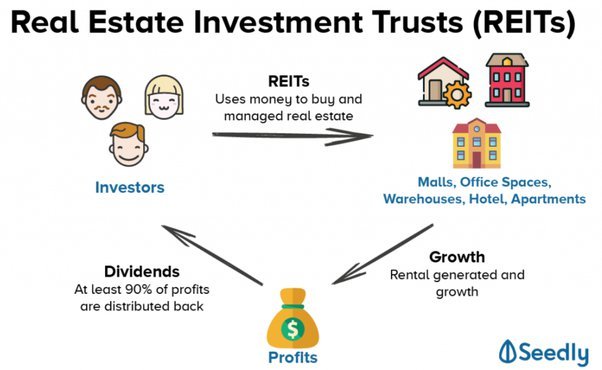

Some folks think about assets Investment Trusts (REITs) to be the mutual funds of real estate. REITs are a set of properties operated by a corporation that uses cash investors offer them to shop for and develop real estate.

you'll be able to like better to invest in trusts that build condos, housing buildings, business complexes, or different facilities.

REITs pay you dividends. These are a fitting income-producing plus for people that need a straightforward thanks to become involved with real estate finance while not having to buy property themselves.

One avenue to probe for investing in REITs is by finance through Streitwise.

Streitwise could be a new era of assets investing. With capital raised by qualified investors, the corporate leverages the best-performing property investments into professionally designed portfolios.

The returns then get distributed associate degreed repaired through an internet REIT- along with your financial gain as their mission.

If you’re trying to get passive income whereas preserving money on hand, Streitwise provides the proper chance for each licenced and non-accredited investors and offers one in all rock bottom fee structures around.

the corporate has provided an 8.4% annualized come back because of its superior property choice and low fee structure, way outpacing comparable Public REITs or bonds.

Qualified investments embrace properties stretching for the most part across America from the geographic region to the West Coast and leveraged supported Streitwise’s analysis.

By putting $5 million of their own cash in these investments Streitwise places an honest deal of skin-in-the game for all sponsors and 100 percent incentive alignment between sponsor and capitalist interests in the slightest degree times.

The service encompasses a minimum investment of $5,000 to start finance in business assets properties. the corporate provides REIT offerings federally-registered with the SEC and offers them to each licenced and non-accredited investors.

finance through an investment vehicle like Streitwise’s investment company offers a good supply of passive financial gain, continual money flow, higher come backs, portfolio diversification and inflation protection.

With an 8.4% annualized return and a coffee fee structure, Streitwise provides one in all the most effective opportunities for passive income in assets investing.

It outpaces comparable REITs and has delivered an annualized dividend return of a minimum of 8% for the last seventeen quarters, with a mean annual rate of 9.44%.

Despite Covid’s result on the final assets market, Streitwise met come back targets through using sturdy credit residence (100% written agreement rent obligations met in 2020), conservative underwriting (51% loan to value, LTV), and a coffee / clear fee structure.

All dividends quoted are web of fees, with fees already taken out. think about exploring Streitwise for your real estate finance wants today.