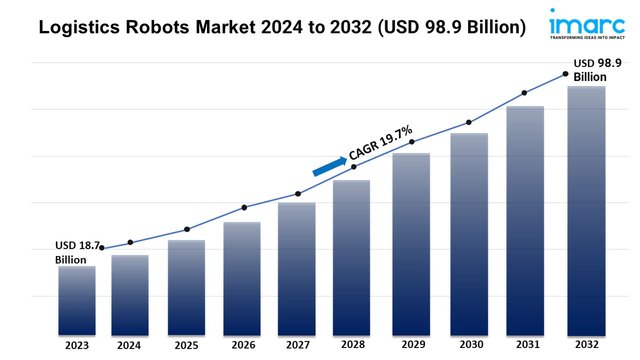

Logistics Robots Market Report Size, Growth, Analysis Report 2024-2032

Global Logistics Robots Market Statistics: USD 98.9 Billion Value by 2032

Logistics Robots Industry

Summary:

- The global logistics robots market size reached USD 18.7 Billion in 2023.

- The market is expected to reach USD 98.9 Billion by 2032, exhibiting a growth rate (CAGR) of 19.7% during 2024-2032.

- United States leads the market, accounting for the largest logistics robots market share.

- Hardware accounts for the majority of the market share in the component segment.

- Automated guided vehicles hold the largest share in the logistics robots industry.

- Pick and place remain a dominant segment in the market, driven by their high demand in sorting and packaging operations within logistics.

- Factory logistics robots represent the leading operation area segment.

- E-commerce represents the largest segment.

- The increasing labor shortage is a primary driver of the logistics robots market.

- Advancements in robotics and artificial intelligence (AI) and sustainability and energy efficiency concerns are reshaping the logistics robots market.

Request for a sample copy of this report: https://www.imarcgroup.com/logistics-robots-market/requestsample

Industry Trends and Drivers:

- Advancements in robotics and artificial intelligence (AI):

The continuous advancements in robotics and artificial intelligence (AI) are encouraging the adoption of logistics robots across various sectors. Modern robotics are becoming more sophisticated, with robots capable of performing tasks that once required human intervention, such as complex sorting, picking items with varied shapes and weights, and handling fragile goods. AI plays a crucial role in enhancing the efficiency of these robots by enabling real-time decision-making, route optimization, and predictive analytics. AI-driven logistics robots can adjust to their environment, learn from previous operations, and improve their performance over time. These technologies also allow for seamless integration of robots into existing systems, enabling greater automation in areas like inventory management, demand forecasting, and order tracking.

- Increasing labor shortages and labor costs:

Many distribution centers need help to recruit and retain enough workers, especially during peak operational periods when demand is highest. Additionally, the rising minimum wage laws and labor costs is increasing the financial burden on companies to maintain large workforces. Logistics robots provide an effective solution to these challenges by automating labor-intensive tasks like loading, unloading, sorting, and transporting goods within the warehouse. This not only helps to alleviate the labor shortage but also reduces the long-term costs associated with hiring, training, and managing human workers. Moreover, robots can operate around the clock without breaks, enhancing operational efficiency and reducing the reliance on human labor for mundane, repetitive tasks. By incorporating robots, companies can redirect their workforce to higher-value tasks, improving productivity while keeping operational costs in check.

- Sustainability and energy efficiency concerns:

With increasing pressure on companies to reduce their carbon footprint, logistics operations are focusing on energy-efficient and environment-friendly solutions. Logistics robots contribute to this goal by optimizing energy usage through efficient use of power, reduced idle time, and improved routing within warehouses. Many modern robots are designed to use less energy while performing tasks at a higher speed, contributing to more sustainable operations. Furthermore, robots can help reduce waste by improving accuracy in processes like picking and packing, leading to fewer returns and damaged goods. The ability of robotics to enhance operational efficiency while supporting sustainability goals is making them an attractive investment for companies looking to meet both economic and environmental objectives.

We explore the factors propelling the logistics robots market growth, including technological advancements, consumer behaviors, and regulatory changes.

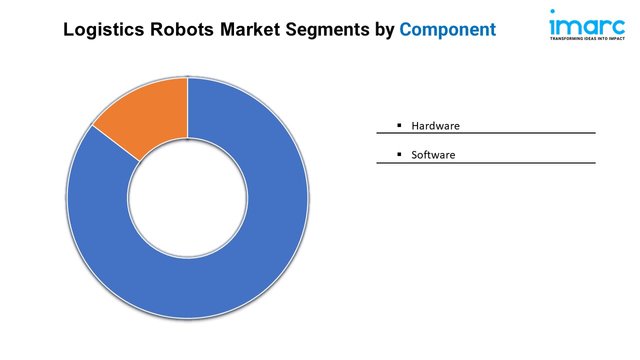

Logistics Robots Market Report Segmentation:

- Hardware

- Software

Hardware exhibits a clear dominance in the market, driven by the essential role of physical robotic systems and machinery in logistics automation.

Breakup By Robot Type:

- Autonomous Mobile Robots

- Automated Guided Vehicles

- Robotic Arms

- Others

Automated guided vehicles represent the largest segment, as they are widely used for efficient material handling and transportation in warehouses and distribution centers.

Breakup By Function:

- Pick and Place

- Loading and Unloading

- Packing and Co-Packing

- Shipment and Delivery

- Others

Pick and place hold the biggest market share attributed to their high demand in sorting and packaging operations within logistics.

Breakup By Operation Area:

- Factory Logistics Robots

- Warehouse Logistics Robots

- Outdoor Logistics Robots

- Others

Factory logistics robots account for the majority of the market share due to their critical role in streamlining internal manufacturing and supply chain processes.

Breakup By End Use Industry:

- E-Commerce

- Healthcare

- Retail

- Food and Beverages

- Automotive

- Others

E-commerce represents the largest segment accredited to the growing need for faster and more efficient order fulfillment.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

United States dominates the market owing to its advanced technological infrastructure and the rapid adoption of automation in logistics operations.

Top Logistics Robots Market Leaders:

The logistics robots market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- ABB Ltd.

- Asic Robotics AG

- Clearpath Robotics Inc.

- Fanuc Corporation

- Fetch Robotics Inc.

- Kion Group AG

- KUKA Aktiengesellschaft (Midea Group Co. Ltd.)

- Omron Corporation

- Toshiba Corporation

- Yaskawa Electric Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163