Litecoin, more than just the silver to Bitcoin's gold. I'm very bullish on LTC after doing my research.

For the original post with full links, pictures, and GIFs, please see here.

The next in our series of commonly asked questions will deal with Litecoin which as of 1/3/18 has the 7th largest market cap of any cryptocurrency. Litecoin has positioned itself as Bitcoin-lite (how apropos) and is defined by quick, secure transactions, and the ability to onboard new features.

Litecoin is one of the most prominent alt coins available in today's market place but was not the first. When it was founded by Charlie Lee on October 7, 2011, several other alt coins (many of which no longer exist) were around and competing with Bitcoin. So what has allowed Litecoin to stick around and become as huge as it has?

Lee took stock of the cryptocurrency environment and made design and programming decisions based on what he saw as features that were improperly implemented in other coins and that could be used to upgrade Bitcoin's model. With that in mind, Lee developed Litecoin to "be the silver to Bitcoin's gold." Unlike the other altcoins at the time, Lee saw Litecoin coexisting with Bitcoin as a complement rather than as a competitor. Much in the same way that both gold and silver can concurrently retain value as precious metals with slightly different though overlapping utilities, Bitcoin and Litecoin could coexist.

Lee thought that while Bitcoin provided one service (gold) that was perfect for high end, large transactions, Litecoin could provide a similar service (silver) that was better tailored for smaller, less expensive transactions. While doing so, Lee also wanted to make sure that Litecoin would not directly compete with Bitcoin. He focused on 2 major design choices to facilitate this:

- Litecoin would have quicker transactions than Bitcoin. Litecoin's block time (the amount of time needed to validate a transaction) was reduced by 75% to 2.5 minutes from Bitcoin's 10 minutes.

- Rather than relying on SHA256 cryptographic hash functions like Bitcoin, Litecoin uses scrypt functions. In theory, this allowed people without dedicated mining hardware to mine Litecoin (though this has since changed with the advent of Litecoin specific miners).

Block times represent the amount of time needed to verify transactions. The longer the block time, the more security is conferred on the transaction and the surer the parties involved in the transaction can be that their exchange was valid. Once the block is created, they can be sure that the transaction will be settled. Most exchanges, such as Coinbase, wait for 6 confirmations (aka 6 blocks) before officially endorsing a transaction. This means that Bitcoin transactions take at least 1 hour to settle.

While this makes sense for large purchases like cars or laptops, Lee believed that for smaller transactions this is unnecessary. He believed that for most transactions, a shorter block time would be sufficient and that one confirmation was usually enough time to be reasonably sure of a transaction's validity.

Lee decided on a 2.5 minute block time. This was demonstrably shorter than Bitcoin's block time, making Litecoin transactions faster, but still long enough to grant assurance that verified transactions are valid. Looking at other alt coins with short block times, Lee noted that many failed expressly because the block times were too short. Block times are made up not only of the time that it takes miners to verify the transaction, but ALSO the time it takes for them to propagate their verification to the rest of the network. It takes time for the miner with the winning solution to tell everyone else that, "Hey, I found the right answer. Stop working on this block and start working on the next one."

This was a large part of the decision making process for Nakamoto in landing on the 10 minute block time. If the block time is made too short, e.g. 15 seconds as it was for GeistGeld, then miners waste time mining orphan blocks. This means that while one person has found a solution and successfully submitted it to the network (and thus expended "work"), other miners are unaware and continue working towards a solution for that block. This leads to extreme waste in processing power, electricity, and time.

Lee's compromise at 2.5 minutes strikes a comfortable balance between security, speed, and efficiency.

But this caused a problem: with shorter block times, Litecoin would be completely mined 4 times more quickly than Bitcoin. To combat this and to stay as true as possible to Bitcoin's model, Lee increased the maximum Litecoin limit to 84 million coins, equal to 4 times the amount of Bitcoin's eventual 21 million coins. In this way, he ensured that Litecoin would continue to grossly mirror Bitcoin in terms of dispersement.

The second major change that Lee made to the Bitcoin protocol was the change from SHA256 cryptographic hashing to scrypt cryptographic hashing. Both of these represent different ways for miners to prove their work (thus the name proof of work) by validating transactions. Without going in to too much detail, while home computers are capable of completing SHA256 hashing, they are very very slow at it and are far outpaced by dedicated hashing machines. Lee decided that he did not want Litecoin to compete with Bitcoin directly in any arena and decided to have Litecoin verification done via scrypt hashing. Scrypt hashing, while computer intensive, is more easily done on CPU. Not only would Litecoin not compete with Bitcoin in terms of utility, it also would not compete with Bitcoin in terms of miners.

Each would ostensibly have its own mining clientele.

Since its creation, Litecoin has become heavily adopted throughout the cryptocurrency community. It first reached a $1 billion market cap in November 2013. As of January 2018, its market cap is just over $13 billion. On December 20, 2017 Litecoin founder Charlie Lee sold all of his Litecoin holdings to remove any perceived conflicts of interest.

Smaller cheaper approximation of Bitcoin

Litecoin approximates Bitcoin in many ways but surpasses it functionally. As mentioned above, Litecoin was built as an enhanced Bitcoin clone, the silver to Bitcoin's gold. With that in mind, Litecoin is superior to Bitcoin in 3 major ways:

Faster transactions

As mentioned above, Lee envisioned Litecoin being used for day to day transactions where the relative loss of security caused by smaller block verification times would be offset by the relatively smaller value of the transactions for which it was responsible. With that in mind, he designed Litecoin to have much faster transactions than Bitcoin. Indeed, Litecoin's blocks (the measure of how quickly transactions are being verified) has remained constant at around 2.5 minutes.

Bitcoin's block time averages about 4 times as much as Litecoin's and during times of heavy traffic can be about 10 times slower.

Because of the faster block times, Litecoin is able to handle many more transactions than Bitcoin. Because of this, there is less relative demand for each block. Miners can only verify a certain number of transaction in each block. Since there are 4 times as many blocks as there are for Bitcoin, they have the ability to verify 4 times as many transactions.

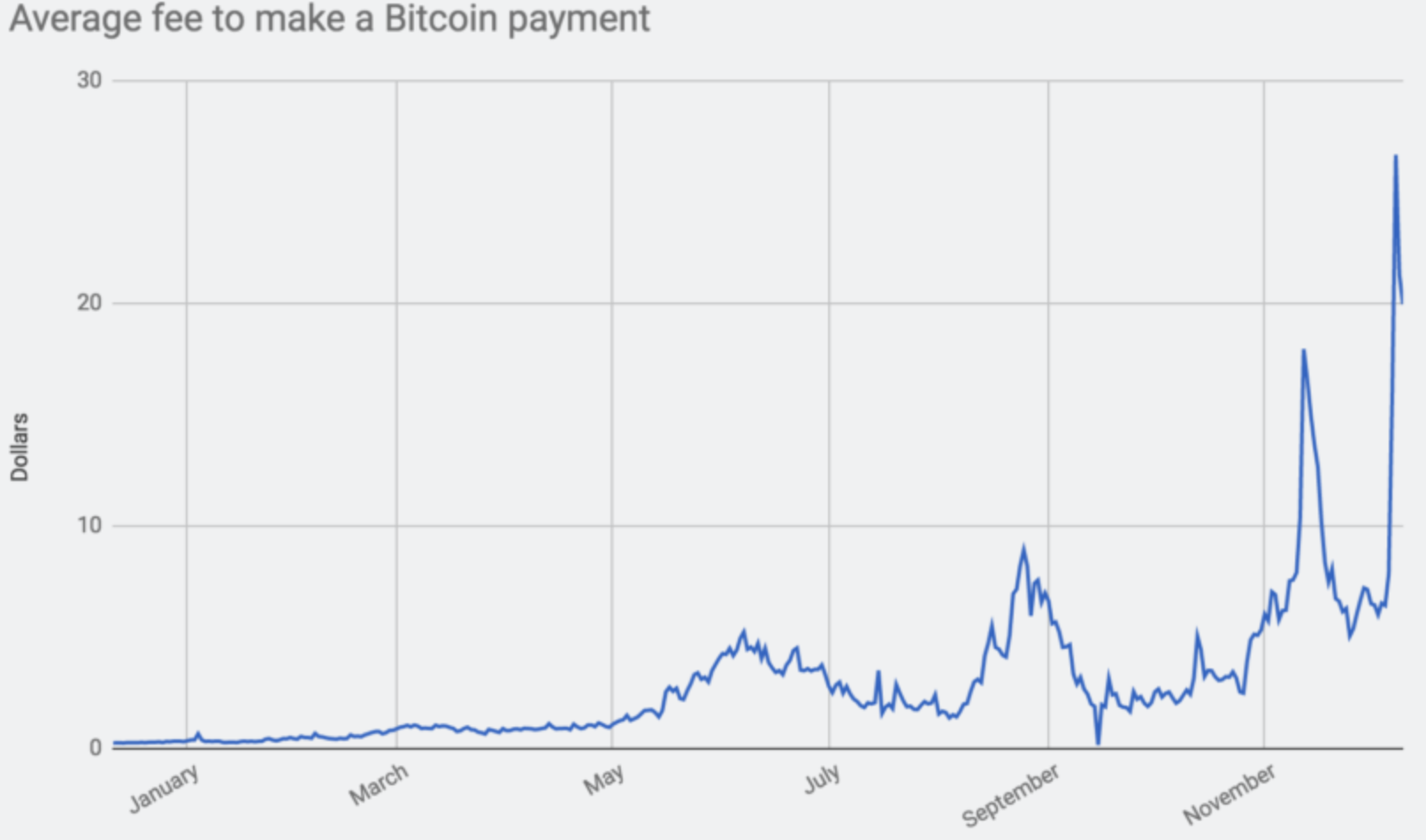

One of the problems that has plagued Bitcoin recently is that there has been a flood of proposed transactions. Miners preferentially verify transactions that have higher fees associated with them. It's all capitalism. People follow the money and if you're willing to pay a bit more to have your transaction verified, you're more likely to have it picked up by miners. Given the relatively limited bandwidth for these transactions, people have been forced to input increasingly higher fees. Bitcoin's fees, which as recently as March 2017 were around $1, are now at least in the mid $20s.

Litecoin has been relatively better at keeping fees low. In keeping with the paradigm set out by Charlie Lee, this is all done to maintain the silver to gold relationship. While a $25 fee to transfer Bitcoin may be reasonable for purchases worth hundreds or thousands of dollars, it is completely unreasonable for purchases worth tens of dollars. So, while the extra security afforded by Bitcoin may make those fees worth it, Litecoin is able to provide slightly less security with MUCH lower fees.

The chart above shows that while Litecoin's fees have gone up recently (with the huge increase in demand and interest in cryptocurrencies), the fees have remained less than $1.5. Reasonable.

Another area in which Litecoin excels is innovation. Charlie Lee has embraced features and updates that will keep Litecoin competitive. Specifically, he endorsed the onboarding of SegWit and the Lightning Network. SegWit is an upgrade that, among other things, allows for more information to be stored in each block of verified transactions. This added space is valuable in that it allows for more transactions to be relayed more quickly and more cheaply. It also allows for certain off chain solutions. Let me explain.

Until now, all cryptocurrency transactions have occurred on the blockchain. The draw of cryptocurrencies after all is the security provided by the blockchain. As discussed above, this is great for big transactions because the value being exchanged makes the fees, energy, and computing power expended in securing them worth it. What about for small transactions? Say you wanted to buy a cup of coffee? Even better, say that you go to the same coffee place every day and buy a cup of coffee. Imagine having to pay fees to the miners who are expending time and energy to verify micro-transactions. It just doesn't make sense.

One solution is the Lightning Network. In effect, the Lightning Network allows small transactions to be bundled into larger transactions and submitted to the blockchain together. This is done to avoid an unnecessary accrual of fees and to prevent overburdening of the network.

Let's walk through the steps:

Party A is a dude who likes coffee. Party B is a coffee shop.

(1a and 1b) Parties A and B set up a payment channel. This is a multi signature address that requires both of their signatures to work. In this case, Party A sends some small amount of Litecoin to this wallet and signs, stating the he will pay the fees set by Party B. Party B signs and states that these are his fees and that he will accept payment from Party A.

(2) The payment channel and its parameters are broadcast to the blockchain. This ensures that both parties are held to the same standards and that neither party can back out.

Party A ends up buying a bunch of coffees over a set period of time from Party B.

(3) These small purchases are accrued into one larger debit and broadcast as one transaction to the blockchain. In this way, the small transactions are not broadcast individually and do not incur fees on their own.

(4) Once resolved on the blockchain, Party B is paid based on the original parameters set in (1a) and (1b).

(5) This is essentially a packaging of many small payments into one slightly larger payment from Party A to Party B. The network is less taxed because the majority of the transactions occurred OFF the blockchain but both parties are secure because the transactions are ultimately made permanent ON the blockchain.

The implementation of the Lightning Network opens up a host of possibilities and can facilitate even smaller and more rapid transactions within the Litecoin network. While these proposals have been awaiting implementation on the Bitcoin network, Lee has stated that Litecoin may speed implementation on its own network to encourage faster adoption within Bitcoin.

Finally, the implementation of the aforementioned off chain solutions would open up the possibility of atomic swaps. Atomic swaps allow for the easy and near instantaneous exchange between cryptocurrencies. This is a big deal because rather than relying on large third party exchanges, investors can simply exchange between cryptocurrencies through a decentralized network, lowering fees, and quickening response times. Because Litecoin is built off of Bitcoin's architecture, implementation of atomic swaps between the two will be relatively simple. Furthermore, executing this will allow Litecoin to more closely reach Lee's vision of Litecoin being the silver to Bitcoin's gold in the sense that it very easily facilitates arbitrage.

Say that a vendor only accepts Bitcoin and you only have Litecoin. No problem, atomic swap between the two and the transaction goes off without a hitch. Say that Bitcoin's price is stagnant and that Litecoin is taking off. No problem, atomic swap between the two, hold Litecoin for a bit, and then switch back to Bitcoin. Say that Bitcoin's network is overburdened and has massive delays. No problem, atomic swap between the two, and make your transfer with Litecoin (which has faster transactions anyways).

Silver is cheaper than gold

There's something to be said for the fact that Litecoin, both by coin as well as by market cap, is significantly cheaper than Bitcoin. Not only does its marketcap signal that there is likely room for growth ($13 billion market cap compared to well over $100 billion for Ripple, for example), but the price per coin of just over $200 makes it affordable for more people. There is a certain draw for people to be able to own a full coin. Lay investors may be turned off to the fact that instead of being able to purchase a full Bitcoin, most are only able to afford a fraction of one. While owning a fraction of a coin makes little practical difference, the mental advantage of being able to own multiple Litecoin cannot be overstated. In terms of upside combined with stability combined with name brand, Litecoin provides an enticing package for investors entering the market today.

Still, not all is sunny for Litecoin. While the above mentioned SegWit and Lightning Network make Litecoin even more enticing, it will also significantly enable Bitcoin and make its transactions faster and fees lower. Will this squeeze Litecoin out? I don't think so but it may push Litecoin into further niche territory. Additionally, while SegWit and the Lightning Network have proven successful in test cases, they have not been fully put into place (though this is expected to happen some time in 2018).

Furthermore, it is unclear what really distinguishes Litecoin from other coins. If another network were to implement similar upgrades to Litecoin in the way that Litecoin implemented upgrades to Bitcoin, Litecoin would be overtaken. The quality advantage that Litecoin maintains is static and the barrier to overtake it are not insurmountable.

Unfortunately for Litecoin, it simply does not have the same cachet that Bitcoin has. Without the advantage of fast and cheap transactions, there is not much draw to Litecoin. It is not the market leader like Bitcoin. It is not a platform like Ethereum. It does not have the confidentiality or security or other use that other coins have. It is simply a smaller, more facile Bitcoin. While this provides great utility now, it is not impossible to imagine a competitor overtaking its potentially narrowing use.

Conclusion

Litecoin distinguished itself from other cryptocurrencies by copying and improving upon Bitcoin's formula. By positioning itself as the silver to Bitcoin's gold, Litecoin has carved out a place for itself as the go to coin for easy, quick, secure transactions. At the time of this writing, Litecoin's price is hovering around $240 with a gross market cap of around $13 billion. Given the movement that we've seen for other cryptocurrencies recently, I believe that Litecoin is poised for a massive run. Litecoin provides many of the advantages of Bitcoin - security, some name recognition, parseable source code, while also providing faster and cheaper transactions. For users that wish to make large purchases, Bitcoin may be the way to go. User of cryptocurrencies, however, increasingly turn towards real use cases and Litecoin can provide them. Litecoin can today be used for small purchases with only nominal fees and the speed with which it settles those transactions is impressive. With the development and placement of SegWit and the Lightning Network, Litecoin should become even more attractive and draw even more users. I'm extremely bullish on Litecoin.

<a href = "

<a href = "

<a href = "

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@Cryptocurrencydoctor/what-is-litecoin-more-than-the-silver-to-bitcoins-gold-i-m-bullish-after-doing-my-research-fc43c4691407

Whenever the price of cryptocurrency is rallying, people start spending a lot more.

As a portfolio manager, when do you start advising to your clients that they have some cryptocurrency exposure? When will there be an index fund, a mutual fund of cryptocurrencies? It will happen.