Try Investing in Litecoin: A Friendly Guide to the Crypto World

Investing in cryptocurrencies has become a popular trend in recent years, and among the wide array of options available, Litecoin stands out as a notable choice. As a peer-to-peer cryptocurrency, Litecoin was designed to offer faster transaction times and a more efficient solution compared to Bitcoin. This article will delve into the world of Litecoin, exploring its features, benefits, and considerations to help you make an informed investment decision.

Understanding Litecoin: A Brief Overview

Litecoin was created in 2011 by Charlie Lee, a former Google engineer, as an alternative to Bitcoin. Often referred to as "the silver to Bitcoin's gold," Litecoin shares many characteristics with Bitcoin but incorporates some key differences. The primary aim behind Litecoin’s creation was to enable quicker transaction confirmations and to make mining more accessible.

Key Features of Litecoin

Litecoin operates on a decentralized network powered by blockchain technology. Some of its noteworthy features include:

Faster Block Generation: Litecoin's block generation time is approximately 2.5 minutes, compared to Bitcoin's 10 minutes. This means transactions are confirmed faster, making it more practical for everyday use.

Scrypt Algorithm: Unlike Bitcoin, which uses the SHA-256 hashing algorithm, Litecoin utilizes the Scrypt algorithm. This difference enables users with less powerful hardware to mine Litecoin, promoting a more decentralized mining ecosystem.

Supply Limit: Similar to Bitcoin, Litecoin has a capped supply. The total supply of Litecoin is set at 84 million coins, four times that of Bitcoin’s 21 million cap.

Growing Adoption: Over the years, Litecoin has gained acceptance from various merchants and payment platforms. This widespread acceptance fuels its potential as a medium of exchange.

The Case for Investing in Litecoin

Before diving into the nitty-gritty of investing, it's essential to understand why Litecoin is worth considering. Here are some fundamental reasons to weigh your investment:

- Historical Performance

Litecoin has experienced significant price fluctuations since its inception. Although past performance is not indicative of future results, the trends suggest that Litecoin has the potential for substantial growth. For example, in 2017, it saw a massive surge, growing over 800% in value within a short timeframe. - Active Development Community

The ongoing development and active community surrounding Litecoin indicate a commitment to continuous improvement. The Litecoin Foundation, alongside Charlie Lee, regularly updates the technology, enhancing features and fixing bugs. This commitment to innovation is a positive signal for potential investors. - Use Case and Utility

Litecoin is not just a speculative asset; it functions as a medium for transactions. Faster transaction speeds and lower fees make it a viable option for everyday use. The increasing number of merchants accepting Litecoin suggests a growing use case, further supporting its long-term viability. - Hedge Against Bitcoin

Many investors see Litecoin as a complementary asset to Bitcoin. As Bitcoin is often subject to extreme volatility, diversifying into Litecoin can provide a hedge against potential downturns. Furthermore, when Bitcoin experiences upward momentum, alternative cryptocurrencies like Litecoin typically follow suit, but with potentially greater gains.

Getting Started with Litecoin Investment

If you’re considering investing in Litecoin, you'll need to familiarize yourself with a few essential steps to get started effectively.

Step 1: Research and Education

Before investing, take the time to educate yourself about Litecoin and the broader cryptocurrency market. Understanding its technology, use cases, and market dynamics will empower you to make informed decisions. Engage with forums, read articles, and follow reputable news sources to stay updated.

Step 2: Choose a Reputable Exchange

Finding a reliable cryptocurrency exchange is crucial for your investment. Some popular exchanges include Coinbase, Binance, and Kraken. Ensure that the exchange supports Litecoin and offers user-friendly navigation and security features. Moreover, consider the fees associated with trading, as they can vary significantly between platforms.

Step 3: Secure a Wallet

Once you've acquired Litecoin, consider transferring it from the exchange to a secure wallet. There are different types of wallets available, including hardware wallets, software wallets, and online wallets. Hardware wallets, like Ledger and Trezor, offer enhanced security, while software wallets may be more convenient for frequent trading. Choose a wallet that aligns with your investment strategy and security needs.

Step 4: Monitor the Market

Keeping an eye on market trends is pivotal in the world of cryptocurrency investing. Utilize price tracking tools and apps to stay informed about Litecoin's price movements. Understanding market sentiment and news events that may impact Litecoin's value will help guide your investment decisions.

Risks and Considerations

While Litecoin presents promising investment opportunities, it is also essential to acknowledge the risks involved.

Volatility

The cryptocurrency market is notoriously volatile. Litecoin's price can fluctuate dramatically based on market trends, regulatory changes, and external events. As an investor, it's crucial to remain emotionally detached and avoid making impulsive decisions based on short-term price movements.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is continually evolving. Government policies can significantly impact the adoption and value of cryptocurrencies like Litecoin. Stay informed about regulatory developments, particularly in your region, as they could influence your investment strategy.

Technology Risks

As with any technology, there may be vulnerabilities in the underlying blockchain or smart contracts. While Litecoin’s technology has been robust thus far, unforeseen issues could arise. Staying informed about updates and security measures will help mitigate potential risks.

Strategies for Investing in Litecoin

Creating a solid investment strategy is essential for success. Here are a few approaches you may consider when investing in Litecoin:

Dollar-Cost Averaging

This strategy involves regularly investing a fixed amount in Litecoin, regardless of its current price. Dollar-cost averaging can reduce the impact of volatility by spreading your investment over time. It’s particularly beneficial for those who want to minimize the effects of sudden price fluctuations.

HODLing

The term “HODL” originated from a misspelled forum post and stands for “Hold On for Dear Life.” This strategy advocates holding onto your investment for the long term, regardless of short-term price changes. If you believe in Litecoin's long-term potential, HODLing may be a suitable approach for you.

Active Trading

If you’re willing to invest time in researching market trends, active trading could be a more hands-on strategy. This approach requires monitoring price movements and executing trades based on technical analysis. While potentially rewarding, active trading entails more risks and may not be suitable for beginners.

Conclusion: Is Litecoin Right for You?

Investing in Litecoin can be an exciting venture, especially for those looking to diversify their portfolios in the crypto space. Its unique features, strong community support, and historical performance make it a noteworthy option. However, as with any investment, it’s crucial to conduct thorough research, understand your risk tolerance, and develop an informed investment strategy.

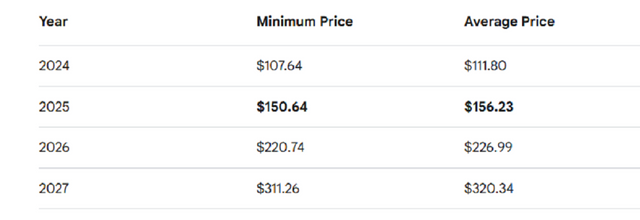

In the ever-changing cryptocurrency landscape, patience and dedication often yield the best results. Whether you choose to HODL, engage in dollar-cost averaging, or explore active trading, staying informed about market trends and technology advancements will empower you to navigate the world of Litecoin. Now that you’ve learned the ins and outs, you can confidently decide whether investing in Litecoin fits your financial goals. Happy investing! Litecoin Forecast Table: