Dividend Increases for February 2019

It’s that time of year for my raise and no not from some boss or employer but from great companies who reward investors by raising dividends once a year. I think I will grow to enjoy these dividend increases each year as I lay back and enjoy this FIRE lifestyle.

Looks like this year companies are not increasing the dividends as aggressively. It seems companies are being conservative with their increases likely due to their weaker projected future earnings outlook. I may have to lower my expectations on dividend growth projections going forward.

Dividend Increases

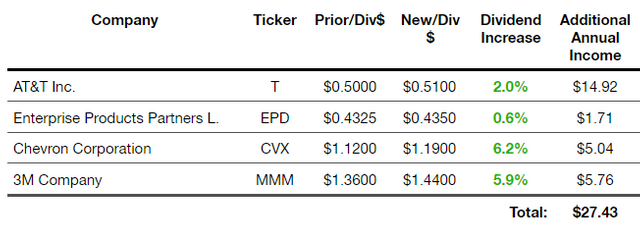

AT&T (T) raised its dividend by 2% from $0.50 per share to $0.51. That added an additional annual dividend income of $14.92 to the LBF portfolio.

Enterprise Product Partners (EPD) raised its dividend by 0.6% from $0.4325 per share to $0.4350. That added an additional annual dividend income of $1.71 to the LBF portfolio.

Chevron (CVX) raised its dividend by 6.2% from $1.12 per share to $1.19. That added an additional annual dividend income of $5.04 to the LBF portfolio.

3M Company (MMM) raised its dividend by 5.9% from $1.36 per share to $1.44. That added an additional annual dividend income of $5.76 to the LBF portfolio.

There is something about watching these dividends grow that bring a warm fuzzy feeling in my stomach. It may not look like much in terms of dollars but what’s important is the continuous growth.

My goal is at minimum earn a dividend growth rate that matches what the average Americans receive in raises each year which comes to around 3% annually. That shouldn’t be too hard looking back at historical trends, but nothing is guaranteed of course. There will be good days and bad.

Summary

In total, a whopping $27.43 per year in extra income thanks to companies raising their dividends. Of course, this does not include the growth from the dividend ETFs (SPHD, FDVV). For the ETFs, I will calculate them once every 6 months to every year.

I hope I am smart enough to purchase more of these great companies at better prices in the future. I love a good bargain and it’s becoming difficult to find good value in the market. A simple quote from Warren Buffet recently comes to mind,

“I will never risk getting caught short of cash.” – Warren Buffett

This quote, as simple as it may sound, really resonates with me. One of the most important lesson I learned in my life is you risk opportunity when you have nothing to seize them with. As important it is to continuously invest, it’s equally important to make sure you have some cash on the sidelines to seize opportunities.

I’m fairly happy with my positions thus far. I always wish I could have bought more at better prices but that is probably a familiar feeling I will be living with for as long as I am investing in stocks. Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com

Hello @insidelook! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko