Mid-Afternoon Vlog - Financial Warfare, ICO's and Market Volatility

Hey Steemians!!

Looks like the war for our minds and pocket books is upon us. If there is anything that I have learned from trading (crypto and stocks) is that if your not humble you will be humbled. Trading is a matter of managing two human emotions Fear and Greed.

To much fear then you won't take risk which cause you to miss out on potential gains (i.e FOMO - Fear of Missing Out). If you are to arrogant and think you know it all the markets will let you know real quick who is really in charge. Just as much as any market can go up it can go down. (FUD - Fear, Uncertainty and Doubt)

With that being said I wanted to supplement this vlog with some articles that I came across that I think are pretty helpful to keep top of mind.

FinCEN: Money Transmitter Rules Apply to ICOs

This just further complicates and already complicated market. It seems like he government keeps putting barriers in place to make it hard to start compliant with regulations.

I don't see why you should need a money transmitter license when you are not transmitting money. The IRS clearly stated that cryptocurrencies are not a currency but are property.

With the advent of SMT on steemit the lines are going to get even more blurred. What separates a utility token from a speculative asset? Well looks like FINCen is just going to take a broad brush and paint all ICO's the same. The is really bad news for crypto

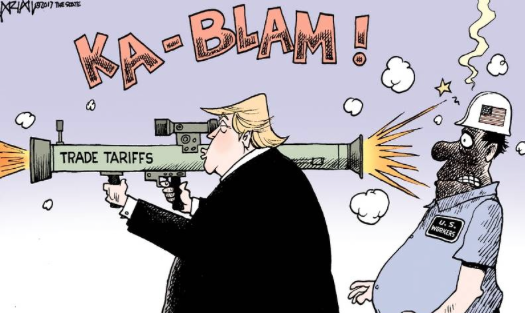

How Trump’s steel and aluminum tariffs could affect state economies

If anyone has ever seen Wag the Dog then you know what this new Trade War is about. More chaos mean more distractions from what is really going on. There is so much information that is being thrown at the populus right now that they not only don't know what to believe but they don't even know how to process actual unbiased information.

In plain speak the price of everything is about to go up. This goes outside of just steel and aluminum but other countries might start to increase their export taxes which will be passed on to consumers. When you have a county that is one of the biggest consumers on the planet you need imports. You can't make everything yourself and having that mentality in a global world will only cause the states to lose their power.

After Trump's top economic advisor resigns, Wall Street prepares for uncertainty: 'Buckle your seat belts'

The market drop last month was the first dip in the roller coaster. Unfortunately traditional and cryptocurrency markets are now very much interrelated. What happens to one will happen to the other.

This might be the start of the transition from centralized to decentralized markets however just because something is decentralized doesn't mean it can't be manipulated. The influx of wall street money into crypto will cause everything to get more volatile. It might get worse before it gets better.

The 42 craziest quotes from Sam Nunberg's absolutely bonkers CNN interviews

Not much more I can say about this guy as he is truly disconnected from reality.

▶️ DTube

▶️ IPFS

I'm sorry it's been a while I commented on your post, I was really down. I just came back 2days ago.

I love this post, it's educative and it's a good guide. So one must balance the trade between FEAR AND GREED. Though, starting any business either cryto or any kind of trade entails risk and to succeed in anything, risk is involved but we must not because things are going well at a particular point in time pour all we have in order to have all the gain.... It must be balanced.

You got a 4.74% upvote from @buildawhale courtesy of @alao!

If you believe this post is spam or abuse, please report it to our Discord #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

You had some good insights in this video. I've never thought about the conflicts in the law regarding how they want us to treat cryptocurrencies. its like, its property when its convenient for them, and then its money whenever its convenient for them. The regulation surrounding these technologies are abysmal. We HAVE o do better, or else other countrys will seize on this opportunity and the United States will be left holding a bag of worthless fiat

You know I'm a risk taker. Took advantage of the drop last month and I came up :)