Legally Yours : Malaysia's Central Bank's Response is No Response

The Government of Malaysia announced that the formal trade of cryotocurrencies through its registered exchangers namely Luno, Coinhako, Xbit and PinkExchange record a trade of RM75,000,000 which at its current price of approximately RM75k/Btc, would mean that 1,000 btcs are traded monthly. Of course this assumption would be incorrect because there are other cryptos that are being transacted and not just BTC. But the illustration is for simple understanding and for ease of calculation.

Malaysia has 9 licensed exchangers, RM75 million a month is only taking into account the 4 main exchangers and there is the unrecorded transaction that does not go through the exchangers. The amount would be astronomical. In short, it is not surprising that part of Malaysia's economy is fueled by crytocurrencies.

The Impact of the Economy

Given the impact of cryptocurrency that is being circulated and ingrained in the economy one would expect that the government take immediate action to regulate the crypto trade but so far that we have seen, the initial promise to issue a regime of regulation is now an invitation to consider making individual 'reporting institution' and this public consultation will be closed on the 12th January, 2018.

The role of the Central Bank under the Central Bank of Malaysia Act 1958, it has a statutory duty to do as follows:-

- The principal objects of the Bank shall be

(a) to issue currency in Malaysia and to keep reserves safeguarding the value of the currency;

(b) to act as a banker and a financial adviser to the Government;

(c) to promote monetary stability and a sound financial structure;

(ca) to promote the reliable, efficient and smooth operation of national payment and settlement systems and to ensure that the national payment and settlement systems policy is directed to the advantage of Malaysia; and

(d) to influence the credit situation to the advantage of Malaysia.

We are still far away from a proper regulatory system. We are still in the dark on the direction of cryptcurrency in Malaysia. The regulation promised in December, 2017 is still at the stage of collation of public responses. Would it not be better to quickly adopt a monetary policy and regulation to ensure that the businesses running in Malaysia can know the perimeters of their legal obligations if they wish to dabble in cryptocurrencies.

The entire fiasco fuels one nagging question, does the authority know what they are looking for? The entire statement issued in to the press has no real value except restating a piece of legislation that is already in force and applicable even in the absence of specific regulation relating to cryptocurrency.

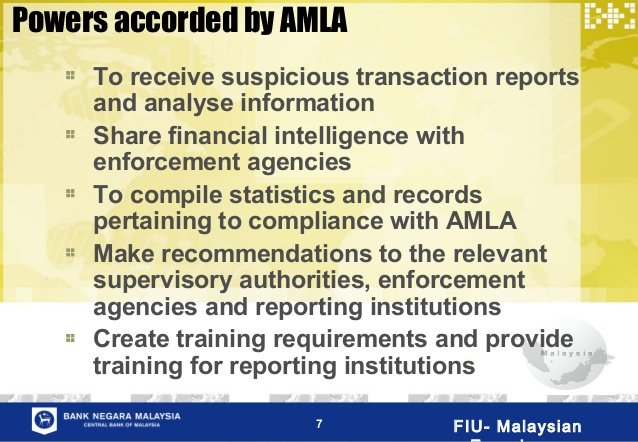

Under the Anti Money Laundering, Anti Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA), there is already an obligation to report and assess risks associated to countering money laundering and also combating terrorism. In short, even if a regulation is to be put in place, what change in law does it facilitate?

Regulatory Mechanism

Clearly the government and its Central Bank has to keep itself updated to the world's changing financial landscape. To merely shout regulation and compliance without any practical effect will make exercise a futile one.

In many jurisdiction, cryptocurrencies are already openly adopted as part of the financial landscape. Although the general method of adoption is not through recognising it as a legal tender but to consider it as an asset would be a great way forward. There is so much hype over how the new economy is affecting the entire financial industry but the lukewarm effort taken in imposing a proper system to recognise and regulate the industry is far from satisfactory. It is now time to seek help from those in the know. There is no shame in doing so.

I upvoted you’re content I hope you check out my profile aswell that would make my day!!

Keep up the good work.

BNM will soon realise that they cannot stop financial innovation. Crypto is the new innovation and they must quickly adapt to it. Furthermore, crypto is way more people centric