Is Cryptocurrency a Good Investment?

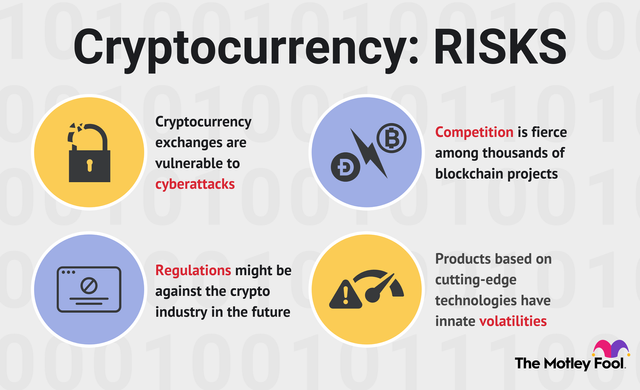

Cryptocurrency exchanges, more so than stock exchanges, are vulnerable to being hacked and becoming targets of other criminal activity. Security breaches have led to sizable losses for investors who have had their digital currencies stolen, spurring many exchanges and third-party insurers to begin offering protection against hacks.

Safely storing cryptocurrencies is also more difficult than owning stocks or bonds. Cryptocurrency exchanges such as Coinbase (NASDAQ:COIN) make it fairly easy to buy and sell crypto assets such as Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH), but many people don't like to keep their digital assets on exchanges due to the risks of allowing any company to control access to their assets.

Storing cryptocurrency on a centralized exchange means you don't have full control over your assets. An exchange could freeze your assets based on a government request, or the exchange could go bankrupt and you'd have no recourse to recover your money.

Some cryptocurrency owners prefer offline "cold storage" options such as hardware wallets, but cold storage comes with its own set of challenges. The biggest is the risk of losing your private key; without a key, it's impossible to access your cryptocurrency.

There's also no guarantee that a crypto project you invest in will succeed. Competition is fierce among thousands of blockchain projects, and many projects are no more than scams. Only a small percentage of cryptocurrency projects will ultimately flourish.

Regulators may also crack down on the entire crypto industry, especially if governments view cryptocurrencies as a threat rather than an innovative technology.

The cutting-edge technology elements of cryptocurrency also increase the risks for investors. Much of the tech is still being developed and is not yet extensively proven in real-world scenarios.

Cryptocurrency adoption

Despite the risks, cryptocurrencies and the blockchain industry are growing stronger. Much-needed financial infrastructure is being built, and investors are increasingly able to access institutional-grade custody services. Professional and individual investors are gradually receiving the tools they need to manage and safeguard their crypto assets.

Crypto futures markets are being established, and many companies are gaining direct exposure to the cryptocurrency sector. Financial giants such as Block (NYSE:SQ) and PayPal (NASDAQ:PYPL) are making it easier to buy and sell cryptocurrency on their popular platforms. Other companies, including Block, have poured hundreds of millions of dollars into Bitcoin and other digital assets. Tesla (NASDAQ:TSLA) purchased $1.5 billion worth of Bitcoin in early 2021. By February 2022, the electric vehicle maker reported that it held almost $2 billion of the cryptocurrency. MicroStrategy (NASDAQ:MSTR) -- a business intelligence software company -- has been accumulating Bitcoin since 2020. It held $5.7 billion in the cryptocurrency by the end of 2021 and said it plans to buy more with excess cash generated from operations.

Although other factors still affect the riskiness of cryptocurrency, the increasing pace of adoption is a sign of a maturing industry. Individual investors and companies are seeking to gain direct exposure to cryptocurrency, considering it safe enough for investing large sums of money.

Is crypto a good long-term investment?

Many cryptocurrencies such as Bitcoin and Ethereum are launched with lofty objectives, which may be achieved over long time horizons. While the success of any cryptocurrency project is not assured, early investors in a crypto project that reaches its goals can be richly rewarded over the long term.

For any cryptocurrency project, however, achieving widespread adoption is necessary to be considered a long-term success.

Bitcoin as a long-term investment

Bitcoin, as the most widely known cryptocurrency, benefits from the network effect -- more people want to own Bitcoin because Bitcoin is owned by the most people. Bitcoin is currently viewed by many investors as "digital gold," but it could also be used as a digital form of cash.

Bitcoin investors believe the cryptocurrency will gain value over the long term because the supply is fixed, unlike the supplies of fiat currencies such as the U.S. dollar or the Japanese yen. The supply of Bitcoin is capped at fewer than 21 million coins, while most currencies can be printed at the will of central bankers. Many investors expect Bitcoin to gain value as fiat currencies depreciate.

Those who are bullish about Bitcoin being extensively used as digital cash believe it has the potential to become the first truly global currency.

Ethereum as a long-term investment

Ether is the native coin of the Ethereum platform and can be purchased by investors wishing to gain portfolio exposure to Ethereum. While Bitcoin can be viewed as digital gold, Ethereum is building a global computing platform that supports many other cryptocurrencies and a massive ecosystem of decentralized applications ("dApps").

The large number of cryptocurrencies built on the Ethereum platform, plus the open-source nature of dApps, creates opportunities for Ethereum to also benefit from the network effect and to create sustainable, long-term value. The Ethereum platform enables the use of "smart contracts," which execute automatically based on terms written directly into the contract code.

The Ethereum network collects Ether from users in exchange for executing smart contracts. Smart contract technology has significant potential to disrupt massive industries such as real estate and banking and also to create entirely new markets.

As the Ethereum platform becomes increasingly used worldwide, the Ether token increases in utility and value. Investors bullish on the long-term potential of the Ethereum platform can profit directly by owning Ether.

That's not to say Ethereum doesn't have competition. A number of "Ethereum Killers," including Solana (CRYPTO:SOL), Polygon (CRYPTO:MATIC), and Avalanche (CRYPTO:AVAX), are all built to handle smart contracts and use a blockchain system capable of processing more transactions per second. The speed has the added advantage of being less expensive for users as well. But Ethereum is the most broadly adopted platform for using smart contracts.

Should you invest in cryptocurrency?

Owning some cryptocurrency can increase your portfolio's diversification since cryptocurrencies such as Bitcoin have historically shown few price correlations with the U.S. stock market. If you believe that cryptocurrency usage will become increasingly widespread over time, then it probably makes sense for you to buy some crypto directly as part of a diversified portfolio. For every cryptocurrency that you invest in, be sure to have an investment thesis as to why that currency will stand the test of time. If you do your research and learn as much as possible about how to invest in cryptocurrency, you should be able to manage the investment risk as part of your overall portfolio.

If buying cryptocurrency seems too risky, you can consider other ways to potentially profit from the rise of cryptocurrencies. You can buy the stocks of companies such as Coinbase, Block, and PayPal, or you can invest in an exchange like CME Group (NASDAQ:CME), which facilitates crypto futures trading. Although investments in these companies may be profitable, they do not have the same upside potential as investing in cryptocurrency directly.