KABN: BREAKING DOWN WALLS BETWEEN THE CRYPTO ECONOMY AND MAIN STREET PAYMENTS

Blockchain Technology is arguably today one of the biggest innovations to have hit the world after the Internet boom. Today blockchain aims at revolutionizing every sector of human endeavor from medicine to health, engineering and technology, commerce and industry, banking etc. With the rise in the number of crypto-currencies and the attendant increase of financial flow into fin-tech start-ups as the wave of "New Money" is beginning to blow across the world.

In 2014, the Ethereum Foundation raised ~31,500 BTC ($18 million at the time) in the first public crypto-asset crowd sale, setting the record for the biggest one-time crowdfunding initiative of the Internet Age. As of July 2018, over 100,000 of ERC20-compatible tokens have been provisioned on the Ethereum main network. Before Ethereum, there was less than $100 million total of combined equity/token investments of total equity and token investments. Token offerings have generated approximately $20 billion to date.

With these humongous flow of financial resources into crypto-currencies and crypto-related projects, the traditional financial institutions such as banks have grappled with the challenge of how to integrate fiat with these crypto-currencies, this problem amongst others enthusiasts believe is key to mass adoption of crypto-currencies. This is where KABN comes in.

INTRODUCING KABN

KABN is a NEO financial service platform servicing Millennial and Gen-X retail investors. The Company offers cost-effective compliance services in exchange for acquiring leads to issue Visa card accounts and access to the corresponding KABN banking wallet. KABN monetizes card holders through card transaction fees as well as through loyalty and affiliate commissions. In December 2018, KABN launched its flagship product, a bank-grade, Always On, identity verification and validation compliance solution with international support. KABN has created a “B2B2C” (Business-to-Business-to-Consumer) infrastructure and patent-pending technology allowing clients and consumers to take actions, in management’s opinion that formerly required complex and time-consuming attestation, and instead leverage turn-key Smart Contract registries.

STATEMENT OF THE PROBLEM:

KABN aims to address the following challenges that KABN has identified in the market:

● Corporate Clients (“Clients”) require international compliance solutions.

● Clients require KYC/AML screened, "good-to-go" consumer customers..

● Clients want to avoid liability for storing sensitive data.

● Millennials and Gen-X consumers increasingly want to spend crypto on everyday items (over $100B in stranded cryptocurrencies).

● Millennials and Gen-X consumers want differentiated personalized offers and discounts.

● Retail investors want access to early stage opportunities.

THE KABN SUITE

KABN ID: From the perspective of Corporate Clients, KABN ID is the system by which clients screen for and store user identity and compliance data. From the perspective of customer’s point of view, KABN ID is the frontend by which they initially provide their identity and compliance data and also by which they can effortlessly, satisfy compliance requirements if participating in subsequent KABN ID-enabled client offerings by pressing “confirm”. Consumer only have to onboard once, which eliminates the friction of having to fill out forms, upload documents, wait on approval, etc. for every subsequent required screening process. Clients outsourcing the compliance process to KABN ID save a great deal of time and overhead, while ensuring that it has quality, fully-cleared and "good-to-go" and consumers. Clients accessing the Network Whitelist are able to bolster their consumer-base or help jumpstart their initiative’s traction in the early stages. Simply put, when customers use KABN ID identification system once, subsequently they need not fill out forms in other Identity verification systems which employ the KABN architecture, rather they only just verify their identities against the data already existing in the KABN database, thereby saving time and energy.

KABN CARD: The KABN Card program intends to address a lack of liquidity for cryptocurrencies and other digital currencies. To achieve this, KABN’s banking platform will provide a core funding account as well as named sub-accounts tied to crypto exchanges and other service providers. KABN will link these subaccounts via API which will include a back-end settlement process, to KABN’s sponsoring financial institution(s). Users will be able to sell their crypto and collect the fiat from inside the app’s “crypto account”. The “crypto account” will only be linked in order to process the sale of the crypto for fiat and won’t show individual details such as how much of any given cryptocurrency the user has in their various partner wallets. The process would work in a similar way to how Facebook authorizes applications (ie. logging into an authorized application, such as another social media platform, through Facebook). In this case, the user would essentially login to their partner crypto account through the KABN app, and KABN would store those details for future direct logins instead of having to constantly re-enter the login information for each authorized application. From then on anytime the user wishes to sell crypto, they would do so through the app and are automatically notified when clear fiat (fiat without any hold periods) hits the app account. All transfers would be deposited in whatever currency the user chooses from the list of available currencies the partner app provides.

KABN KASH: The KABN Cash program will connect card holders with affiliate offers that puts cash back onto their KABN Card.

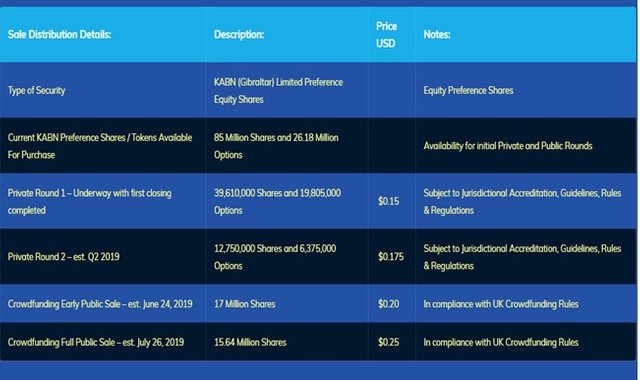

TOKENOMICS

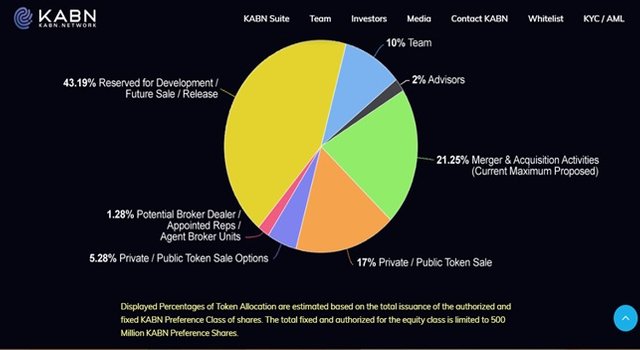

TOKEN ALLOCATION

KABN FEATURES:

● Proprietary Technology – Ireland based infrastructure.

● Web based solution for mobile / tablet / desktop.

● Bank grade KYC/AML processing.

● Global document validations for over 1,600 ID templates from over 180 countries.

● Multi-language support (in progress).

● Managed chain of custody for Personally Identifying Information (PII).

● Platform links blockchain wallet(s) to identity.

● Biometric multi-factor authentication (in progress).

● US Patent pending process for validating PII with the use of Blockchain Registries.

● Continuous AML monitoring for financial crimes and related adverse media.

● Continuous compliance monitoring to renew or expire documents.

● Forensic wallet review capabilities.

● Separation of (PII) and Functionality in compliance with GDPR.

● GDPR and Privacy Shield (US – pending) Compliant.

● Blockchain based registry manages ID and other “Markers”.

● Accredited participant validation for US / Canada and for European Source of Wealth.

● Screened response time generally within 3 business days.

● Settings to manage account / preferences / offers.

● Webhooks for 3rd party Application development or multiple points of integration

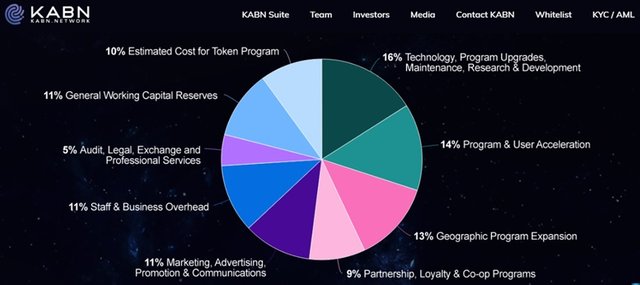

ESTIMATED USE OF PROCEEDS

KABN BENEFITS:

● Turn-key solution saving time and resources.

● Strict control of PII - documents kept with licensed providers.

● Instant KYC / AML processing for known customers.

● One-time registration and ongoing monitoring - meets all legal requirements.

● Separates PII from technology and remains compliant with jurisdictional privacy requirements.

● Issuers can bring future token offering to already approved customers that have a propensity to buy into STO's and reach qualified participants.

● Blockchain registries provide up-to-date information on-chain.

● Customers can provide further "aggregate" information to receive early access to STO's and other commercial offers (under GDPR privacy provisions).

● Privacy Shield (US – pending) means US customers follow the same principles as global privacy community.

● Additional benefit to STO participants (affiliate programs / access to early STO programs) KABN Advantages:

● No refresh or ongoing costs.

● Eliminates need for costly technical integrations.

● Single-source system for all active KYC and ongoing AML monitoring.

● Single-source system for all accreditation / source of wealth.

● International support for documents and languages.

● Lower data and PII management costs.

● STO’s/Exchanges need only to “PING” the Blockchain registry to allow or deny regulated actions such as purchasing tokens.

● Compliance with the most stringent privacy and personal information requirements for all jurisdictions.

● Keeps PII data on hand current and flags changes in status.

● As a Gibraltar Company, AML flags are reported immediately.

● Customers don't have to worry about multiple ID document requests and sharing with unknown parties – One and Done.

● Clients don’t have to worry about secure document storage and potential GDPR violations.

● API for 3rd party developers

CONCLUSION

It is believed that KABN fulfills the growing need for compliance solutions for next generation financial technology startups, exchanges, security token issuers and other financial service providers. KABN leverages this network of pre-approved members to provide financial services to cryptocurrency enthusiasts and others that are looking for more intuitive ways to manage online and conventional fiat transactions. Built on this compliance layer, KABN offers a suite of financial services, including relationships with banking partners, to issue a KABN-branded Visa card linked to a multi-currency banking wallet for day-to-day use and a KABN loyalty platform which allows KABN members to benefit from purchases made at e-commerce websites and brick and mortar stores affiliated with the program.

KABN’s neo financial service platform not only allows for more seamless compliance and participation in investment opportunities but KABN management contends that the suite of financial services breaks down walls between the crypto economy and main street payments.

USEFUL LINKS ABOUT KABN

KABN Official Website : https://www.kabntoken.com

WhitePaper: https://www.kabntoken.com/wp-content/uploads/2019/03/KABN-Company-Overview-Summary-V1.2.pdf

Facebook: https://www.facebook.com/kabnnetwork/

Twitter: https://twitter.com/kabnnetwork

LinkedIn: https://www.linkedin.com/company/kabn/

Telegram: http://kabn.network/telegram-links.php

Bounty0x Username: Wingleness

Congratulations @swingle! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!