Mysterious Eastern Kingdom Deciphering the Japanese encryption industry

Japan is one of the key countries in the field of crypto finance. Bitcoin.com is headquartered in Japan and the crypto exchange Mt. Gox was established in Japan. The name of the bitcoin creator Satoshi Nakamoto comes from Japanese. In Japan cryptocurrencies are generally legal.

But what do we know about Japan's growing cryptocurrency industry? What can I buy in Japan with cryptocurrency? Where to buy? What is the attitude of the Japanese authorities towards cryptographic assets after passing regulatory legislation?

Recent changes in the structure of Japanese state institutions such as the appointment of the famous politician Takuya Hirai who supports the blockchain as the Minister of Science and Technology will facilitate the further development of blockchain technology in Japan.

Mrs. Watanabe

Japanese merchants are generally considered to be extremely cautious and conservative preferring to invest in low-yield risk-free assets such as state bonds.

However a recent study by Deutsche Bank showed that despite the conservative historical record a large number of Japanese cryptocurrency traders are no longer cautious they have chosen high-risk high-profit investments. Analysts at Deutsche Bank AG said that “investor investors are shifting from foreign exchange leveraged trading to cryptocurrency leveraged trading.”

They portrayed an investor behind the soaring bitcoin – the so-called Mrs. Watanabe a common term used to describe a housewife in charge of family finances. Japanese women are unique in family financial power and are usually in charge of family investment and the encryption industry is no exception.

On April 10 2018 the Japan Financial Services Agency (FSA) published data on Japan's domestic cryptocurrency transactions in the previous fiscal year in the world statistical report.

Based on data collected from 17 cryptocurrency exchanges Japan has 3.5 million individual investors each year and has traded more than $97 billion. Most of these traders are Japanese businessmen around the age of 30 and 144000 of them like financing transactions and cryptocurrency futures.

Market review

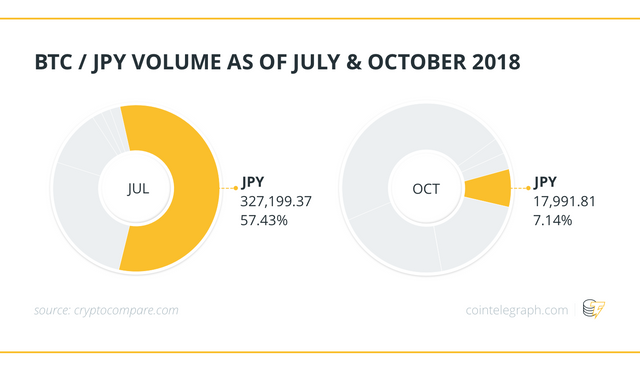

In the middle of 2018 Japan dominated the global BTC transaction volume. According to the CryptoCompare website in July this year bitcoin and yen trading accounted for almost 60% of all transactions in Bitcoin indicating that Bitcoin is unprecedented in the country. Even after the "stablecoin" in the market appeared in the market late this summer while the USDT became the leader the yen is still one of the four currencies with the largest trading volume of bitcoin although this figure has fallen to 7% 8 times lower than the summer value. Since 2014 Bitcoin’s annual transaction volume has increased from $22 million to $97 billion. At the same time bitcoin transactions (such as futures) the main asset grew even more from $2 million to $543 billion over the same period.

Even considering the recent events the Japanese still seem to believe in Nakamoto's creativity and Bitcoin does not seem to lose its popularity. Of course the diversification of crypto assets is also being practiced – Japanese ordinary traders' portfolios include ETH XRP BCH and EOS tokens.

In addition the “transaction mining” technology announced by several cryptocurrency exchanges has become more and more popular in Japan – all of which are traded on local exchanges. Coinja even introduced a special trading robot in its analysis application CoinView that can "dig" the coin. This function is called "Hummingbird" and is currently being actively promoted in Japan and abroad.

In addition in Japan there are almost no peer-to-peer transactions between individuals and 99.9% of transactions are conducted through exchanges.

The history of Japanese digital currency is inextricably linked to the two largest cryptocurrency hacking incidents.

The first was in 2014 when the Mt. Gox exchange was hacked and the attacker successfully stole 850000 bitcoins for a total value of $473 million. When the news came out the price of Bitcoin fell by 20% to close at around $483. It took the entire market a year to restore the previous market value.

Legal regulatory framework

This incident also produced a "conditional positive" effect. After the bankruptcy of Mt. Gox regulators took seriously the issue of regulating cryptocurrency transactions in the country which led to the emergence of a series of bills.

A long time later in early 2018 the market experienced a second major shock – hacking pointed to NEM's hot wallet which is aimed at Coincheck one of Japan's largest password exchanges. On January 28th criminals managed to extract the highest amount in the history of password crimes - more than $500 million.

The hacking attack caused a devastating blow to the entire Japanese encryption infrastructure as the entire POS application of the "mobile payment air regi" belonging to the Japanese company Recruit Lifestyle was connected to the exchange. The app is used by more than 260000 Japanese stores to perform transactions.

The damage caused by this hacking attack to the global encryption economy totaled more than $1 billion seriously affecting the kinetic energy of all cryptocurrencies. From that moment on the government began to intervene and the direct regulation of cryptocurrencies began to become more important.

March 7 2014 - The Japanese House of Lords promotes the legalization of Bitcoin. The resolution does not treat Bitcoin as currency or securities under current banking laws and recognizes that there is no law prohibiting individuals or legal entities from exchanging goods or services for Bitcoin. At the same time the relevant departments began to discuss the possibility of taxing bitcoin.

May 4 2016 - After a long debate and discussion Japan officially recognized Bitcoin and digital currency as "a payment method for illegal currency" (Japan Payment Services Act PSA for short). 2 - 5). In addition the law on the establishment of foundations was revised. Under the new regulations all Japanese cryptocurrency exchanges must be officially registered and listed in the Japan Financial Services Agency (FSA) to provide cryptocurrency transactions to residents.

April 1 2017 - After a year of preparation a historic bill was passed. The Japanese government is the first country in the world to grant the status of legal payment for most cryptocurrencies. Since then cryptocurrency is no longer considered a commodity asset and therefore no longer subject to VAT VAT. Previously accounted for 8%.

At the same time the law on cryptocurrency exchanges came into effect to protect consumers from fraudulent transactions and help them distinguish between safe and unreliable exchanges. According to the law all encrypted exchanges must obtain a license from the FSA by September 2017. It presets the operational requirements for certain transactions including high standards for network security customer account isolation and authentication. In addition in order to obtain a permit to engage in such activities a non-refundable contribution of $300000 must be paid in a lump sum. In fact this is very close to BitLicense which was launched by the State of New York in 2015.

To date 16 local exchanges including Bitflyer Bitbank Bittrade and Bitocean have received FSA financial trading licenses. About 16 exchanges have obtained the temporary status of “quasi-operators” – a special type of exchange that began their activities before the introduction of the licensing system.

Another important measure of the new requirements is the Global Anti-Money Laundering Initiative. As part of this policy the agency banned anonymous cryptocurrencies such as Monero or Dash as they may be used for fraudulent purposes. This official law came into effect on June 18.

What is the impact on ordinary cryptocurrency traders?

On the one hand after the legalization of Bitcoin and other tokens 8% of the value-added tax is removed from the total tax amount. However traders are not completely free from tax-related obligations.

In February 2018 the State Administration of Taxation of Japan revised this issue. Traders now have to pay 15% to 55% of the tax to the government while foreign exchange and trade promotion profits are subject to a 20% tax.

The amendment triggered a double reaction among market participants some of whom began to consider moving their activities to other countries. In an interview an influential Japanese cryptographer Higashi shared his anger over Japanese taxation which he believes “seriously harms the industry” “It makes no sense to use bitcoin as a payment method in Japan. Technically you can buy a car with Bitcoin now but since there is a tax it makes no sense."

On the other hand Japan's cryptocurrency transactions now receive full legal protection from the state for its activities and assets. To this end Japanese regulators have issued business improvement instructions related to anti-money laundering (AML) and “know your customer” (KYC) requirements to six major cryptocurrency exchanges.

Due to the high visibility of cryptocurrency in the country and its legal status the topic of blockchain and digital currency has been widely reported by the media. In addition there are many so-called “message boards” among traders who are widely used to promote information search – bringing together news from various sources in Japan and abroad. This approach allows the reader to successfully navigate and make the right predictions in the context of the news.

Cryptographic payment

In Japan large companies including airlines hotels and retail chains and thousands of small sellers accept bitcoin payments. In order to make a payment a payment terminal integrated with the encrypted currency exchange is required. In Tokyo especially in the Roppongi area especially in restaurants and bars you can pay in Bitcoin. For example at the Hacker Bar you can buy coffee with BTC and discuss the basics of the encryption industry with a barista.

Currently in Japan 100% of the life without legal currency is still impossible. Buying tickets renting houses and purchasing most of the goods especially European and American goods can only be purchased in yen. However there are indeed a large number of cryptocurrency networks available.

In addition to Bitcoin Japan also has a recognized "local" cryptocurrency.

MonaCoin (MONA) is the first Japanese cryptocurrency to have the most active community on the Internet. This is one of the few currencies in the world to buy online/offline products. MonaCoin is accepted by large restaurants and shops.

Cardano (ADA) is another very popular cryptocurrency in Japan sometimes referred to as the "Ethereum Killer" or "Third Generation Blockchain." Cardano plans to issue a debit card that can be transferred from the Daedalus wallet to the ADA. In this case the tokens will be automatically converted into Japanese yen or other local currency. These ADA cards can be used to withdraw money from ATMs or shop at the store.

New Japanese businessman

Japan is a country with a unique spirit culture and market and its government is innovating during the cryptocurrency boom. The introduction of legislative amendments has enabled a new type of Japanese businessman to emerge – cryptocurrency traders who pay large amounts of dividends to the Treasury each year.

Legalization has led to a significant increase in the popularity of blockchain technology in the country. Bitcoin and tokens can be discussed on TV stations and major news media. Promising blockchain start-ups can be seen everywhere with state agencies conducting technology research and ordinary people can send and receive cross-border transfers without fear of being fined by the government or being attacked by fraudsters.

In addition market players from other Asian countries such as South Korea and China have begun to enter the Japanese market bringing in more budgetary capital inflows. Analysts expect that in 2018 cryptocurrencies may contribute 0.3% to Japan's gross domestic product (GDP) and the annual financial report will reveal the final result of digital currency for Japan.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.cryptogrind.co.uk/blockchain-technology/the-mysterious-east-decrypting-japanese-crypto-traders/

Do you like 名探偵コナン?

Posted using Partiko iOS