Growth stocks again take over the place of value stocks

Growth stocks again take over the place of value stocks

During the last months of 2018, many investors exchanged their growth stocks for value stocks. And that was not surprising, because value stocks can generally also be classified as defensive shares. And the demand for such shares is increasing in times of uncertain trading times. However, that time is already behind us.

- Value shares can be described as shares of listed companies that have generally participated for a while and have proven in the past that they can also pay dividends in bad times. Growth shares, on the other hand, are shares of listed companies where the stock price is mainly driven by high sales expectations (such as the Netflix, Facebook and Tesla shares).

Growth stocks are loved again

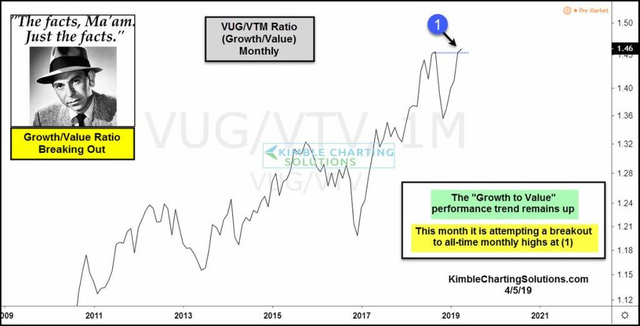

During the past few weeks, interest in growth stocks has flared up again. The graph above, from Kimble Charting, even shows that in a few weeks the Growth / Value Ratio has risen again to above the level of last year. And that could possibly be a good sign for the stock markets as a whole, because the Growth / Value Ratio has been on the move since the start of this Bull Market.

With this important ratio, is this new record high a precursor to a new record price on Wall Street?

Facebook

Skype live:technicalwavetraders

Twitch

Risk Disclosure

TRADING IS NOT SUITABLE FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND CAN CAUSE YOU A COMPLETE LOSS OF YOUR FUNDS!

Trading foreign exchange on margin carries a HIGH LEVEL OF RISK, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose!

The high degree of leverage associated with trading currencies means that the degree of risk compared to other financial products is higher. Leverage (or margin trading) may work against you resulting in substantial loss. And feeling a sensation similar to getting sucker punched in the stomach.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

It's going to be difficult for the S&P500 to get above 2900