Warren Buffett's unwanted investment in digital currencies

Warren Buffett's unwanted investment in digital currencies

Warren Buffett, often referred to as the Oracle of Omaha, has never held back from expressing his skepticism about Bitcoin. He once called Bitcoin and other digital currencies "gambling tools" with no intrinsic value.

However, that seems to be changing, as Buffett's investment in Nubank has, albeit unintentionally, pushed him into the crypto industry.

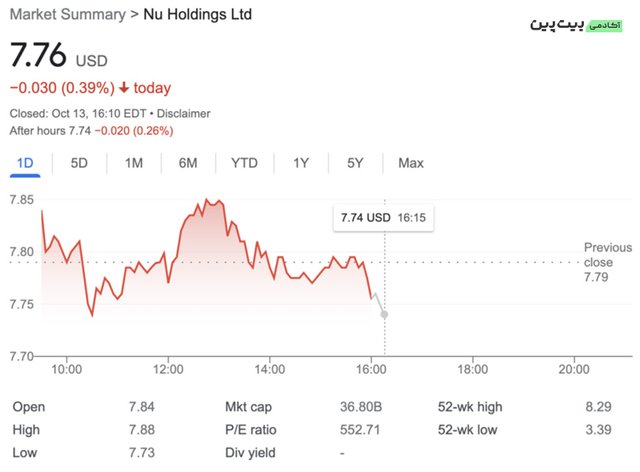

In 2021, ahead of its initial public offering (IPO), Warren Buffett's Berkshire Hathaway invested $500 million in Nubank, a digital bank based in Brazil. This amazing fintech company facilitates traditional banking services and allows customers to trade Bitcoin and other digital currencies.

After the IPO, Berkshire Hathaway invested another $250 million in Nubank, bringing its total investment to $750 million. The investment would be worth $840 million today, assuming Berkshire hasn't bought or sold any shares since the end of the second quarter.

Source:bitpin

Nubank made a bigger push into the crypto industry earlier this year with the launch of its altcoin, Nucoin. Now, with the bank's stock price up more than 100 percent this year, Nubank's market performance has overshadowed other heavyweights in Buffett's portfolio — including giants such as Amazon, Apple, Coca-Cola, Bank of America and Kraft Heinz.

As global financial markets navigate turbulent conditions, Buffett's indirect association with digital currencies through Nubank has become an ironic tool. The investment bolsters Berkshire Hathaway's financial position amid a potential $17.7 trillion market earthquake. In other words, it represents a subtle shift in the way traditional investors interact with the crypto industry.

Despite Warren Buffett's harsh criticism of digital currencies, Nubank's performance underscores the fact that even the most ardent critics cannot ignore the financial potential intertwined with the crypto sphere.

For example, Paul Tudor Jones, a veteran hedge fund manager, believes that given the current challenging political environment in the United States, bitcoin and gold may now occupy a larger portion of an individual's portfolio than usual.

I love gold and bitcoin together. I think they're probably going to take up a larger percentage of your portfolio than they have in the past because we're going through, and are going to go through, challenging political times here in the United States.

While Buffett's stance on bitcoin remains unchanged — going so far as to call it "rat poison," his indirect involvement through a lucrative investment in Nubank is a narrative that sparks a conversation about the evolving dynamics of investing. In the modern financial age, it evokes.

Source :bitpin

That's ironic that by opposing Bitcoin he got himself into supporting it.

Exactly

I hope everyone realizes the power of Bitcoin