Investor In Focus: Taylor Chang

A $100k stock market loss in 2007 as the Global Financial Crisis struck was the prompt Taylor Chang needed to find a more secure form of investment. Where such a setback may have thrown many off-course, Taylor hadn’t spent the previous seven years working three jobs to see his dreams disappear. Instead, he turned to property.

Taylor came to Australia from Taiwan in 1999. While he didn’t come from a wealthy family, his parents had enough money to pay for his ticket to Sydney - but after that he was on his own.

“Life was tough,” Taylor says. “I had to support myself to get through university and pay my living expenses by working different jobs.”

In addition to his eventual qualification as an accountant and career in finance, Taylor’s been a chef, delivery driver and cleaner. He’s always worked a minimum of two jobs and there was one year worked five.

“I wore a suit during the day in the office, at night changed into the chef’s uniform and pulled on a t-shirt when I was cleaning,” he says. “I was solely focussed on saving every single dollar and always said yes to work.”

Taylor’s commitment to earning came when he realised that he needed to have at least three properties in his portfolio to enjoy “the fruit which property can bring.”

“Working multiple jobs to purchase multiple properties made me realise that property investing is easy and achievable by anyone, as long as you have determination and desire to fight for the life you want to live.”

Taylor’s the first to admit that this intensive focus on wealth building cost him friends, however they’ve come back to him in recent years for help to build their own portfolios.

“It was a tough road at the time,” he says. “I was in a dark room not knowing what I was doing.”

In 2007 Taylor bought his first property - a Waterloo unit - with the savings he’d managed to preserve during the GFC, but says he’d never make the same mistake again.

“It was a brand new property which I paid premium price for, which was a big mistake in every property investing book,” he says.

Despite framing the experience as a mistake, it helped Taylor realise he didn’t want units or apartments in his portfolio.

“If I hadn’t got in at the time, I wouldn’t have searched for the bigger things. Every pitfall led to another success behind it.”

He likens this realisation to the analogy of that first strong desire when you’re young and put all your energies into wanting and hoping for a bike. As you get older you want a motorbike, but soon you realise you don’t want that either. Now, your biggest wish seems childish, but it was all you knew at the time.

For Taylor, one such awakening was that he only wanted houses in his portfolio.

“Apartments and units can only do so much,” he says, citing the potential of the land on which houses sit in terms of knock-down / rebuild, subdivision or putting an extra dwelling at the back of the property.

With four properties sitting in his portfolio, Taylor says it’s currently going through a period of stabilisation. It’s not that he hasn’t looked for something else, however a six month period of chasing property in Brisbane was without success.

“I couldn’t find anything I could comfortably purchase,” he says. “The downturn in mining didn’t paint the right picture.”

Following a decade of property investment, Taylor found he was so often sharing the benefits of his own experience, that he started a boutique mortgage broking business in 2015.

“I’m so grateful that I’ve met many people on this journey who’ve helped me to become the disciplined property investor I am today,” he says. “Now other people come to me for property advice. I feel blessed I can share my valuable story in a way to contribute to people’s life and it feels strangely wonderful.”

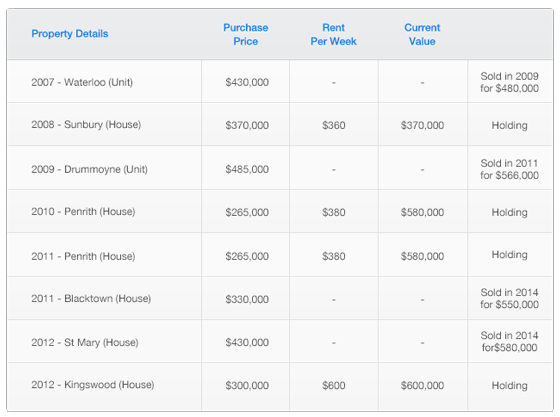

Taylor's Property Portfolio

Original article: http://www.apimagazine.com.au/property-investment/investor-in-focus-taylor-chang