Investing in Cryptocurrencies

Hello everyone,

In today's article I would like to talk about cryptocurrencies.

A cryptocurrency is a digital asset designed to work as a medium of exchange using cryptography to secure transactions and to control the creation of additional units of currency. Bitcoin was the first decentralized cryptocurrency which was created in 2009 and since then, numerous cryptocurrencies have been created and numerous more cryptocurrencies will be created.

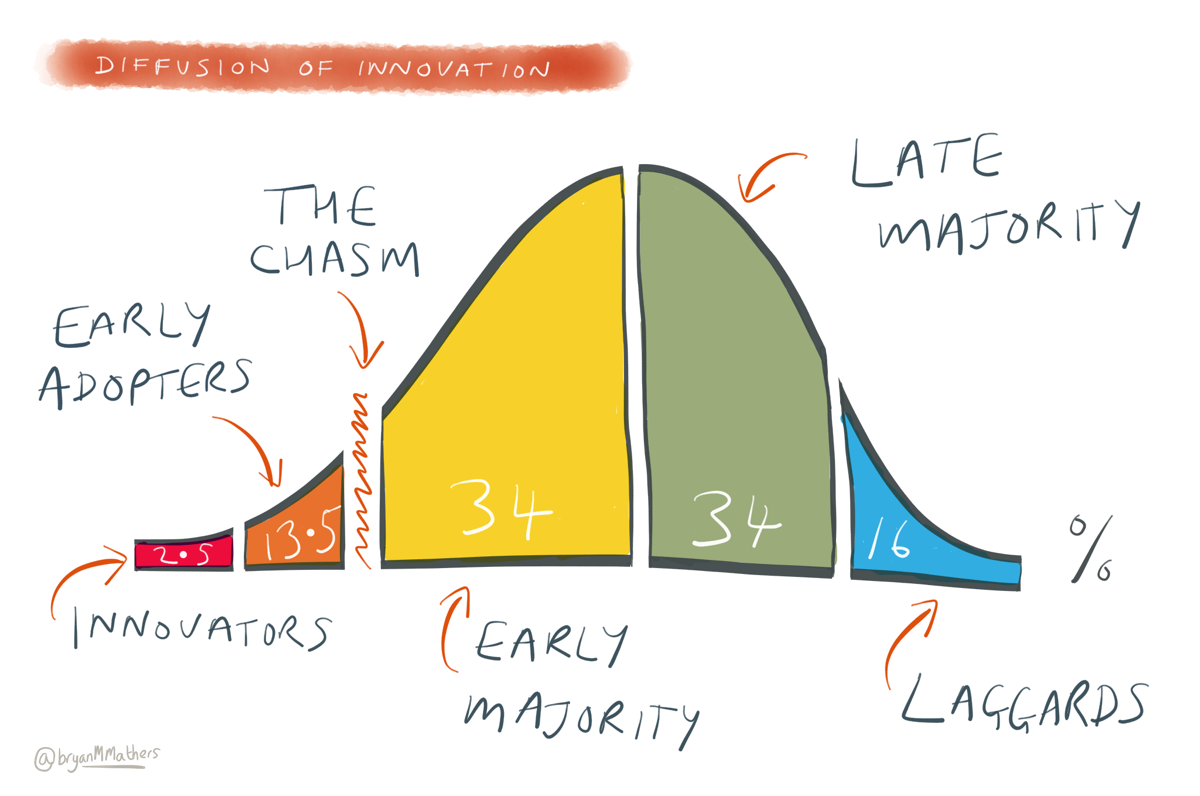

Now – there are many sites on the internet and YouTube channels that cover the cryptocurrency space so I don't want to get into all the details. There are a large number of articles and videos out there that does this already. The cryptocurrency space is new and there is a large and growing amount of speculative activity taking place in it. Every day more and more people are moving money into this space to try to take advantage of the massive capital gains that are possible. Some people believe we are already in a bubble whilst others, including myself believe it's still too new and things are really only just getting started here. In terms of the diffusion of innovation I think we're still at the innovator to early adopter stage.

I do believe that once the average person on the street realises what's going on here and the profound implications digital currencies have to destroy central banks and governments and being power back to the people (where it belongs) - I do believe there will be a mania – a stampede where people move as much of their fiat dollars into cryptocurrencies as possible. We're nowhere near that stage at the moment people. Nowhere near it.

What I would like to talk about in this article is how I am personally investing in this speculative space and what strategy i'm utilizing to ensure that I am guaranteed to get the market return – whatever that market return may be. I have written this article as I have not found any other articles yet that have made the link between index fund investing and cryptocurrency investing.

In 2007 there was a book published by John C Bogle – the good guy of wall street, the creator of Vanguard – the company that brought us the first index fund. The books called “The Little Book of Common Sense Investing”. It's an excellent book and I highly recommend you get yourselves a copy and read it if you have not already done so. In the book Bogle talks about how successful investing is all about common sense. It's simple but it's not easy. He talks about how simple arithmetic suggests, and history confirms, that the winning strategy for stock market investing is to own all of the nations publicly held businesses at very low cost and by doing so you're guaranteed to capture almost the entire return they generate in the form of earnings and dividends growth and the best way to implement this strategy is indeed simple: Buy a fund that holds this market portfolio, and hold it forever. Such a fund is called an index fund. The index fund is simply a basket (portfolio) that holds many, many eggs (stocks) designed to mimic the overall performance of any financial market or market sector. Classic index funds, by definition, basically represent the entire stock market basket, not just a few scattered eggs. Such funds eliminate the risk of individual stocks, the risk of market sectors, and the risk of manager selection, with only stock market risk remaining. I read Bogles book back in 2007. I opened an account with Vanguard right away and have been an index fund investor ever since.

There is a large amount of research out there that confirms the index fund approach is the winning strategy. Warren Buffet – one of the worlds richest men advises investors to buy and hold an index fund. I should note here that he is not however a fan of cryptocurrencies. You can google this and see what he has to say about them.

Now let's make the link between index fund investing and cryptocurrency investing.

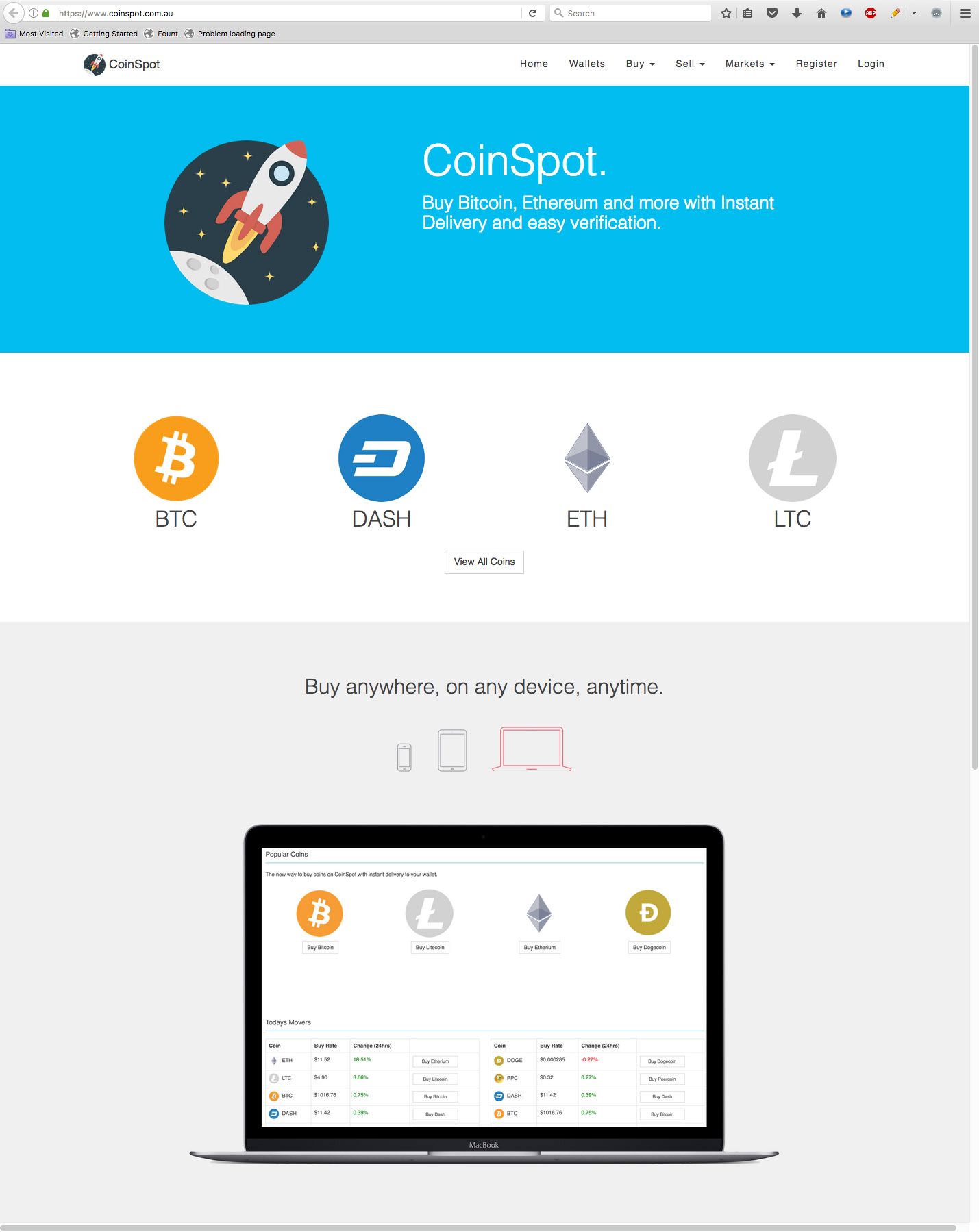

What I have done is I have opened an account with coinspot.com.au which is a cryptocurrency exchange.

There are exchanges in a number of countries so do check out which ones are available in your country of origin. Coinspot offers approximately 42 cryptocurrencies ranging in market capitilization from $28 million right up to $90 billion that investors can purchase. Out of these 42 cryptocurrencies I have mostly divided my money into equal amounts and I have purchased 41 of them – every cryptocurrency except bitcoin as i'm holding my bitcoin myself in my wallet on my Macbook Pro instead. I have approx $5,000 in alt crypto coins and I also own 1 bitcoin so that takes my portfolio up to around $10,000 as of August 26th 2017. I intend to invest around $20,000 in total into cryptocurrencies by the end of this year. My plan is to then do a rip van winkle and go to sleep on this for at least the next 5 years just like I have done with my other investments.

I'm just going to buy and hold these cryptocurrencies – not trade them. At most I will lose $20,000. At best I believe I will make between 10 to 100 times my original investment. So in 5 years I expect my cryptocurrencies will either be worth zero or they will be worth $400,000 to $2 million. This is a high risk, high return activity where I will gain the market return – whatever return that may be. To be sure – I will not be actively trading my cryptocurrencies. Set and forget. I place the probability of cryptocurrencies succeeding in the future as 100% but I do not know which of the cryptos will succeed and which will not. I can make educated guesses but they would be exactly that – guesses. That's why I'm adopting the index fund approach. Own the market of a basket of the cryptocurrencies that hold the most promise at the lowest cost possible.

One of the reasons I'm making these investments in this space is because I'm now 38 years old and for the past 18 years I have consistently contributed to my defined benefit pension plan and I already have enough money in it to retire relatively comfortably in Thailand.

If I was ever to receive a redundancy package from my employer, along with my other investments I would have enough capital to start a business in Thailand and have enough income coming in to live well from my guaranteed pension. Taking a risk now with cryptocurrencies with a small % of my overall net worth I believe is a good idea with considerable upside potential. After a large amount of research into the cryptocurrency space I believe if I didn't take a risk here at this time of the birth of cryptocurrencies I would look back in five years time and kick myself. One of the things that gives me great confidence is none of the brainiacs I work with have any cryptocurrency investments, nor do any of the people I count as friends, nor do the taxi drivers, hair dressers or any of the other random people I ask about them in Australia and certainly none of the people I come across in Thailand own any. Getting into the space is still difficult and time consuming, even understanding it is difficult and there is a large amount of misunderstanding from people about what cryptocurrencies are and how much they will change the world as we know it over the next 10 years. To me that speaks volumes about where we are in terms of the diffusion of innovation. It's like we're in 1994 in terms of the development of the world wide web and internet.

The image below is a spreadsheet from the dollar vigilante with the gains that have been made in each cryptocurrency and the dates they recommended subscribers to buy into them. Bitcoin being the largest gainer by far. With the index fund strategy I'm following, all it will take is for just one of the coins in the basket I have purchased to boom in value like bitcoin has and I will be sitting very pretty.

As I have said – there are a large number of articles and videos on the web about cryptocurrencies. So many of these will be full of speculation, conjecture, theorizing, hypothesizing and so on. The truth is – nobody really knows which cryptocurrencies will succeed or fail over the next 5-10 years. Let me repeat that:

Nobody really knows which cryptocurrencies will succeed or fail over the next 5-10 years.

What we do know for certain however is that cryptocurrencies are here to stay. The genie has been released from it's bottle and there's no going back.

The first internet era was an era of information but the second is an era of value and now that we can transmit value digitally this opens up a whole new world of possibilities that were simply not possible before. At the end of this article I have included a number of links to material I believe is essential viewing and reading for those of you that are interested in this cryptocurrency space. Please do check those links out as they're really important – they represent the best of the videos and articles I have come across during my time researching the cryptocurrency space.

I will leave you with these thoughts – I believe people are driven by greed and fear. All my experience with people tells me this is true. Further more – I have lived long enough to witness first hand how people behave when opportunities are available to make large amounts of money from speculation. Property bubbles around the world are one such example of what happens when people have large amounts of credit made available to them to speculate in commodities. I believe cryptocurrency speculation will take a hold of a large proportion of the population because it offers the average person on the street an opportunity to get rich in a way that has never before been possible. By getting in early you can benefit from the stampede as people clamor over one another to get in quick and make a killing. You will know when the market has reached a top because everyone and their dog will be talking about cryptocurrencies the way they talk about getting rich in housing in Australia.

Almost 1.8 million Australians own an investment property. The nation has an absolute obsession with property investment and it's easy to get the numbers on how many people own investment properties. Try researching how many Australian's are cryptocurrency investors. You wont even find the data. Tell me – are we early to the party or late?

The bottom line is that most cryptocurrencies are an example of deflationary currencies that go up over time. They cannot be inflated away in the manner that fiat currencies are. How will people behave in a world of cryptocurrencies when they see the prices of everything going down consistently over time instead of up? How will people behave when they see their fiat dollars going down all the time and cryptocurrencies going up?

In a world of people owning and using cryptocurrencies - I believe there will be less speculation and more saving because the incentives people will have will be to actually save money and not speculate. It will give power back to the people where it belongs and away from the central banks and governments of the world.

The blockchain technology that makes all this possible will give power back to the people. I for one welcome this brave new world.

Until next time - All the best everyone,

The Pretender Thailand

Exchange where I have a cryptocureency account:

coinspot.com.au

Bitcoin wallet I use:

http://bitcoin.com/

How the blockchain is changing money and business: https://www.ted.com/talks/don_tapscott_how_the_blockchain_is_changing_money_and_business

The Dollar Vigilante:

https://www.youtube.com/user/TheDollarVigilante

Andreas Antonopoulos Bitcoin channel (exceptional must see videos):

https://www.youtube.com/user/aantonop/videos?sort=p&flow=grid&view=0

Andreas Antonopoulos Canadian Senate Testimony on Bitcoin (probably the most important video I have ever seen in my lifetime):

The Internet of Money (must read book):

https://www.amazon.com.au/Internet-Money-Andreas-M-Antonopoulos-ebook/dp/B01L9WM0H8

The Little Book of Common Sense Investing (must read book):

https://www.amazon.com/Little-Book-Common-Sense-Investing/dp/0470102101

A Random Walk Down Wall Street

https://www.amazon.com/Random-Walk-Down-Wall-Street/dp/0393330338

Bitcoin Documentary:

Today Show – What is the Internet anyway?

Introduction to Bitcoin and Blockchain Technology (excellent course):

https://www.pluralsight.com/courses/bitcoin-decentralized-technology

Free to Choose Milton Friedman (part 1 of 10):

Bitcoin Will Hit $1 Million in 5-10 Years, Says PayPal Director:

https://www.cryptocoinsnews.com/bitcoin-will-hit-1-million-5-10-years-says-paypal-director/

John McAfee Claims Bitcoin Will be Worth $500,000 in Three Years:

https://www.cryptocoinsnews.com/john-mcafee-claims-bitcoin-will-worth-500000-three-years/

Bitcoin Will Hit $1,000,000 Experts Predict $1 Million Dollar Valuation Per BTC:

Some good stuff here.

Yes, we are in the innovator stage of crypto-currencies, however, the timeline till massive adoption is most likely less than 10 years.

Banks and the Infernal Revolting Screws are turning up the heat. They are already charging higher and higher fees. Soon they will be charging percent on just holding currency.

Since so many already use PayPal, and most already use debit and credit cards, massive adoption is just a small step for most.

The only thing that bitcoin really needs to do is make wallets user friendly. As in, being able to confirm that you are sending to the correct address before hitting send.

Really nice read! I am glad to discover cryptocurrency now and that I invested before everyone starts talking about it.