A Strategy for Investing with a Credit Card

A Strategy for Investing with a Credit Card

If you asked most people, they'd tell you that investing using debt is incredibly risky, and I'd have to agree. You never want to use money that isn't yours to begin with. However, with enough financial education, a good plan, and the right set of tools, it is very possible to use credit cards to give yourself more leverage and create more cashflow for yourself.

What I am advocating in this article is not to go deeply into credit card debt and hope that you invest in something that will earn more than a 16% interest rate on the card. I am talking about using 0% introductory interest rate credit cards, and being able to pay off the card using your ordinary income before the 0% rate period ends. That way, even in a worst case scenario, you aren't left in a tough spot where your investment didn't perform well enough and you aren't able to pay off the debt in time to avoid the high interest rates.

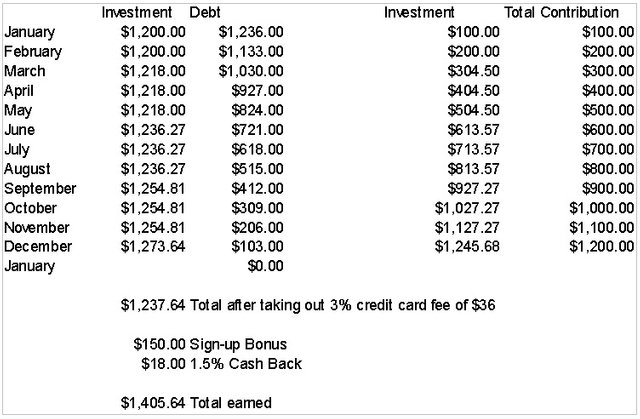

For example, let's say that you are able to save and invest $100 a month for the next year. Would it be better to use a credit card to invest $1,200 at the start of the year and just pay off the card $100 a month? The table below shows a comparison of these two strategies with a quarterly dividend of 1.5% being paid on the amount invested. Note that I am assuming a 3% fee to use the credit card for investing which is explained later in this article.

As can be seen, after the fee is factored in, the returns for investing without a credit card are slightly more. But, if a 0% credit card that offers a sign-up bonus and cash back is used, then you'd earn $159.96 more by using a credit card.

Most companies offering investments will not allow deposits to be made with credit cards and credit card companies will often charge cash advance fees for certain types of payments. This obstacle needs to be overcome in order to invest with a credit card.

How can I get cash to Invest using a Credit Card?

PayPal allows users to send payments using a credit card. All you need is two accounts set up that you can access. Maybe the other account is a sibling, spouse, family member, trusted friend, or a secondary business account. All you need is to make sure it is set up under a different name using a different email address. Here is where the 3% fee from the table above comes in. PayPal charges roughly a 3% fee in order to handle a credit card payment which is worth it if you will be investing in something that earns more than 3% a year. This transaction will not be considered a cash advance by the credit card company either.

What are the best credit cards for Investing?

I've made a list of 5 cards that are ideal for this type of investing. Some people may prefer to use airline mileage cards or other types of bonuses if they do lots of traveling or spend money in the quarterly changing categories that other cards offer. Personally, I like cards that have sign-up bonuses, cash back, no annual fee, and an introductory 0% interest rate. See the list of my favorites below with links to apply for them. Note that if you do not have a good or excellent credit than you may not be approved for these cards.

Chase Freedom Unlimited

- 0% interest for 15 months

- $150 sign up bonus after spending $500 in the first 3 months

- 1.5% cash back on all purchase

https://www.referyourchasecard.com/18/9LP59P932U

American Express Cash Magnet

- 0% interest for 15 months

- $200 sign up bonus after spending $1,000 in the first 3 months

- 1.5% cash back on all purchases

https://www.americanexpress.com/us/credit-cards/card/cash-magnet/

Wells Fargo Cash Wise

- 0% interest for 12 months

- $200 sign up bonus after spending $1,000 in the first 3 months

- 1.5% cash back on all purchases

https://www.wellsfargo.com/credit-cards/visa-wise/

Capital One Quicksilver

- 0% interest for 15 months

- $150 sign up bonus after spending $500 in the first 3 months

- 1.5% cash back on all purchases

https://www.capitalone.com/credit-cards/quicksilver/

HSBC Cash Rewards

- 0% interest for 15 months

- $150 sign up bonus after spending $2,500 in the first 3 months

- 1.5% cash back on all purchases

- 10% bonus for all cash back earned in the first year

https://www.us.hsbc.com/credit-cards/products/cash-rewards/

My favorite cards of the 5 are the Chase Freedom Unlimited and Capital One Quicksilver cards. They both have 0% interest for 15 months and have the lowest amount that needs to be spent in order to qualify for the sign up bonus. I've personally used both of these cards to invest.

What is a good Investment to Earn Safe Returns?

I would not recommend using this trick to invest in stocks or cryptocurrencies as you could end up losing your principle. Remember that I only recommend doing this if you can pay off the amount invested using your ordinary income and by making regular payments each month as shown in my table above. I do recommend investing for cashflow. Currently I am building up my investments in https://fundrise.com/ and re-investing all of my dividend payments. The 1.5% quarterly dividends in my table above was based on the most conservative portfolio offered by Fundrise. If you know of a better investment for using this trick, leave a comment below.

BONUS ROUND

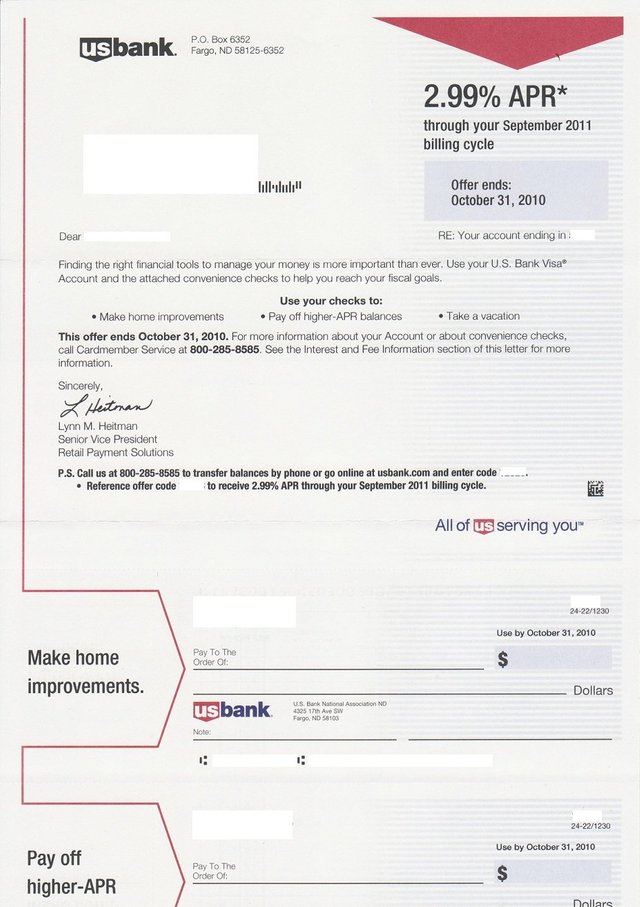

Often, once you have used your new credit card to invest, collect the sign up bonus, get your cash back, and then pay off the card, then the issuer will begin to send you convenience checks in the mail because if you don't have a balance on the card, they aren't making any profit off of you. I have gotten these offers from Chase and Wells Fargo and used them to invest even more money. Typically they have 0% interest for 9 to 12 months and carry a 3% or 4% fee on the amount of money you use them for. See the image below for an example of a convenience check.

Congratulations @lucidsenses! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @lucidsenses! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!