Blog 2: The MOST important thing to understand in the world of finance! And a personal note…

Much earlier than anticipated, I post my second blog. Work is still slow because of the holiday season and that freed up some time to write it. Hope you like it.

Please take the time to go through this blog and truly understand this concept. Understanding this concept will give you the most important insight into sustainable value creation.

This surely counts for the real (or perhaps better: traditional) world, but I expect that it is also applicable for the crypto area.

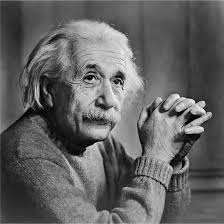

Obviously, I have not come up with it myself, but I got this lesson from probably the cleverest person that ever walked around on this world. Who that is? Can only be one, Mr. Albert Einstein (see picture).

Before we go into his concept, first a short personal note. Off course, I did never meet Mr. Einstein in person. However, my godfather – who was a professor at the university of Rotterdam and passed away a couple of years ago at an age well in the 90s – did. Can you believe that?

My godfather was my father’s mentor at the university when he was writing his thesis. After getting his Ph.D. my father started working for him, they became friends and when I was born he took the godfather responsibility.

My father, brother (@Exyle) and I visited him (uncle Jaap for us) regularly (on a half year basis) and always were captivated by his amazing stories. Not always happy ones as he was Jewish and lost a lot during the war.

Up until he died it stayed that way. He was a very special person and we were always looking forward to our conversations. He is still lively in my thoughts and the picture below where he sits beside my father in front of his house in the woods provides for some good memories.

Back to the subject of the blog and Mr. Einstein. The most important thing to understand in the world of finance is COMPOUNDED INTEREST.

Mr. Einstein even famously stated: “Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn’t... pays it.” So, why is this concept so powerful?

To begin with. What is compounded interest?

Basically, this is nothing different than making a return on a return on a return on a return, etc…

For example, if you have an asset that gives you a return of 5% per year and you start with 100. After year 1 you will have 105.00 (100.00 * 1.05) and after year 2 you will have 110.25 (105.00 * 1.05) and so on.

Why is this concept so strong?

Assume you have two assets. One asset is providing you with a yearly return of 6% and the other asset is providing you with a yearly return of 12%. Easy right, the latter is twice as good as the first. Wrong! Let me tell you why.

A dollar invested in the asset class generating a yearly return of 6% will give you 4.3 dollars after 25 years, while a dollar invested in the asset class generating a yearly return of 12% will give you 17.0 dollars after 25 years.

In finance we call that a money-multiple. The difference between the two assets is a money-multiple of slightly above 4x versus 17x. Over this 25 years period the asset generating 12% is thus four times better than the first.

Over longer periods the difference becomes progressively larger in favor of the asset generating 12%.

Understanding that only a small difference in yearly return can end up being an enormous difference over longer periods is key in investing. Although it seems simple, not many people use this force to their advantage.

In my next blog I will give an example how you can use this concept in investing in the traditional economy to your advantage and will also try to relate it to investing in crypto.

Thanks for reading! All the best,

@look4balance,

Compounding interest today I learn well! So, if we invest in a bank we should look for Compounding interest!

Cheers~

Will tell you more about it in my next blog. I would not invest in a bank... Tks for comment

That's actually a quite understandable explanation in such few words. I should talk to you more often about financial concepts. It's the one thing I am really bad at, but this I totally understood. Thanks for that :)

More than welcome!

Awesome, looking forward to your next blog!

Thanks Ben

very well work life dear i like it

Great. Tks

Last month, I was helping my daughter with her grade 12 math homework regarding coumpound interest.

It was fun watching her start to understand it. Most of the questions had two investment strategies and asked which would give the best return. In the beginning, she always guessed the one with the highest interest rate. Then she started to catch on!

Great post!

Now, to find ways to compound my steem returns. 🤔

That is exactly were we are going... Thanks!

Ahh good, I was about to ask for this in Steemit/vested SP/curation lingo :D

Clear explanation, thank you!

wow great post learn any thing ...keep it up

Will do

Hmmmn.. looking forward to next blog to learn more about investing.. thanks @look4balance

Welcome

Thank you for explaining this concept so well. For many of us, we are newbies when it comes to investing.

Thanks for the compliment!

Thanx J!!! This really helped me rethink my stupid thinking I had for years. It is so simple after I've read your post. So curious about your next post, man! Keep on Steeming!

Great to hear. Thanks s3rg3