Trulieve, a rare gem among cannabis stocks

Trulieve(CSE:TRUL) is the largest medical cannabis provider in California owning over 50% of the market. But that is not the best thing. The best part is that this company is highly profitable. With P/E value of 10, it is also cheap with this traditional valuation metric.

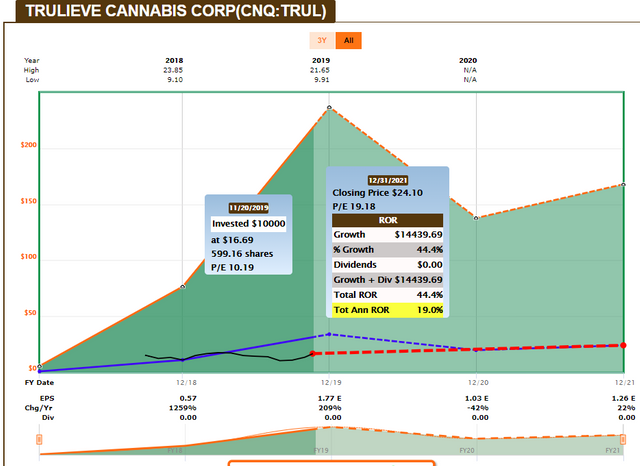

Analyzing the fundamental picture with fast graphs can give some hint of the valuation overall case.

With the P/E valuation fit to estimates, this would give you 19% annual rate of return. However this is very rough as company has been performing much better lately and there is a high probability that earnings estimates are too low for the company.

As I wrote before, legalization of weed in United states is progressing and Trulieve(CSE:TRUL) is in an excellent position to take advantage of new markets. It is very likely that consolidation will happen in the industry and Trulieve is bought as it has very good position and profitability. I see future valuation for stock to be something like 30 CAD.

Here is their investor presentation for more info:

https://investors.trulieve.com/static-files/0186d14d-960d-44cc-8089-165c8f01c803

Keep on investing