THE FIVE LAWS OF GOLD(MONEY)

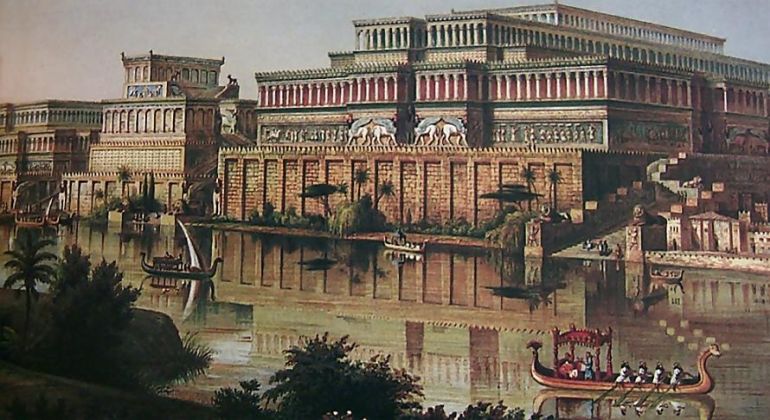

These are basically five laws that govern money from the ancient Babylonian kingdom. The Babylonian kingdom is known in history as one of the wealthiest empire. This great city had no mines, no forests , stone for building, not enough rainfall for crops to grow yet this city defied all odds. Sophisticated irrigation channels connected the Euphrates river and magnificent buildings were a reflection of the wisdom and insight this great city walked in. The wealth of some of its inhabitants was one that has left many historians pondering for years. These five laws inflected from George Clason's " The Richest Man In Babylon" removes the mystery behind the wealth of Babylon.

1.Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family.

This law of emphasizes on the importance of saving in one's journey to financial freedom. I believe success is not an event but a habit and follows a defined pattern. Learning to save and avoiding a thrifty habit is a very crucial habit in one's journey to financial freedom. Savings when invested and allowed to compound creates extraordinary wealth almost like magic though not mystical and completely mathematical.

2.Gold laboreth diligently and contentedly for the wise owner who finds for it profitable employment, multiplying even as the flocks of the field.

This is shows us the law of multiplication. Money acquired should put into profitable ventures where it can undergo multiplication and earn profits. The profits should also be reinvested to allow multiplication.

3.Gold clingeth to the protection of the cautious owner who invests it under the advice of men wise in its handling.

This law teaches us how we should consult people who are savvy about the specific ventures we want to invest our money.

4.Gold slippeth away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep.

This teaches us how one should make sure he knows much about the area he wants to invest his money. If one is not well informed, he should seek the advice of experts and not novices in that field.

5.Gold flees the man who would force it to impossible earnings or who followeth the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investments.

This teaches how we should be cautious on whose advice we pay heed to during investments irrespective of how emotionally attached we are to them.