How I make Vanguard meet Bitcoin!

I predict that cryptocurrencies will be one of the best investments over the next decade. It is easy to find investors that I greatly admire who think nothing good will come from cryptocurrencies, while others can't stop singing praises over it. I don't think cryptocurriences will replace government money, but I do think that as an asset class they will thrive over time. In another post I will give details as to why I project them to do so well, but for now let me show you how I invest in cryptocurrencies. At the end I will give you a tool that makes it easier to do the calculations.

Which crypto currencies do I buy?

I buy the top ten crytocurrencies. How do I measure what is the top. I do it by market cap. So, say there are 17 million Bitcoins in circulation and the price per Bitcoin is $6,000. Then the market cap of Bitcoin is $6,000* 21,000,000 = $102,000,000,000. That is $102 Billion. So, I find the top ten cyrptocurrencies by market cap using the website www.coinmarketcap.com. I also limit my purchases to coins that are traded on public exchanges that I have accounts with.

How much do I buy of each crypto?

If you are familiar with stock market index funds this concept will be rather familiar. I weight my portfolio by market cap. So, I calculate the market cap of the top ten cryptos and add their market caps together. Let's say the sum of the top ten cryptos by market cap is $200 Billion and the market cap of Bitcoin is $102 Billion. That means Bitcoin accounts for $102/$200 * 100% = 51% of the total value of the top ten cyrpto currencies. So, it will be 51% of my portfolio too. I go down the lines and do this for each crypto currency. So, if I have $1,000 to invest I will put $510 into Bitcoin.

What do I do after I own cryptos?

I don't lend them out or do any other kind of gimmicks, I just hold them. That is right. For a year I just hold them and go on with my life enjoying it. Then after a year and one day, I come back and look at my portfolio (in reality I check it more often because it is so tempting). Now when I look at my portfolio some of the coins have done great others have done terribly others have gone broke and there are some new cryptos in the top 10. So, I do a re balance. I sell and buy enough of each crypto to approximately match the market cap size again. So, if now Bitcoin's market cap is only 40% of the total market cap of the top ten but is 80% of my portfolio I sell enough to have it be only 40% of my portfolio and I put the earnings from the Bitcoin into the other cyrptos.

How has this performed for me?

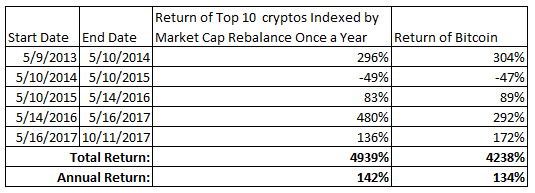

To be honest I haven't even been doing it for a whole year as of today, 10/14/2017. However, I have backtested this since May 9, 2013 by using web archives of coinmarketcap.com that are available through www.waybackmachine.org. Since then it would have returned 4,939%. That is 142% a year! As a comparison I have put the table below comparing this index fund vs. Bitcoin.

[caption id="attachment_2040" align="aligncenter" width="535"] Figure 1 The annual returns of buying and holding the top 10 cyrptocurrencies by marketcap.[/caption]

Figure 1 The annual returns of buying and holding the top 10 cyrptocurrencies by marketcap.[/caption]

Why do I invest this way in cryptocurrencies?

I am firm believer that it is smart to be diversified and while I do believe cryptocurrencies will continue to grow in value I do not know which ones will become or remain popular. Also, by holding my cryptos and not selling for a year and one day I make sure that I am charged a lower rate of taxes. Above all else though I think that this strategy will over the next decade provide excellent returns with very little work.

Warnings, where to buy, and resources...

I only put a small portion of my net worth into cryptocurrencies. Currently only about 5% of my net worth, though I may consider going higher later. I convert all the USD I want to put into cryptocurrencies into Bitcoin through www.gemini.com. Then I transfer enough of the Bitcoin to www.kraken.com where I buy the other cyrptocurrencies. If a currencies is not available on www.kraken.com I typically exclude it and take the 11th largest cryptocurrencies. If you want to double check my back test here is the Excel Workbook: WayBackMachine Index.

As some of you know, I do actively trade the markets of cyrpto currencies and stocks. If you would like to find more information like this I encourage you to follow my blog, twitter, steemit, or Collective2.

How do you invest in cryptocurrencies? Tell me in the comments.

Congratulations @charlestines.com! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP