TIB: Today I Bought (and Sold) - An Investors Journal #235 - Oil Shipping, Oil Drilling, Real Estate, Interest Rates, Bitcoin, Ethereum

Trump cans North Korea summit. Market jitters more. Going short REITs is another way to be long US Treasuries. Action in the oil patch as June options expiry heads this way. Petrobras disrupts its markets by cutting diesel prices in Brazil - ouch.

Portfolio News

Brazil I wrote last week about going short Brazil as it faces major political uncertainty ahead of October elections. I decided not to sell shares and call options I am holding in Petrobras, the state owned Brazilian oil company, because it is positively geared to the oil price. I also chose not to go short Brazil as I am getting mixed messages from commentators. Overnight Petrobras share price collapsed by 14% in Brazilian and US markets on the back of an announcement that Petrobras would be cutting diesel prices by 10%.

https://www.enca.com/money/petrobras-shares-plunge-14-after-fuel-price-cut

So it seems I was wrong on 2 out of 3 calls I made, namely, hold on to Petrobras and do not go short Brazil. Now is time to look at the detail of what is going on. There is a truck driver strike with the government and unions in the midst of negotiations. Diesel prices are set by the government via Petrobras and are based on international diesel prices - i.e., not subsidised. The price cut is temporary for 10 days while these negotiations continue. Did this warrant a 14% drop in share price?

I am going to guess 14% was an over-reaction. The impact in my portfolio is my stock psotion is still profitable. My strike 12 call options got smashed and are now out-the-money. There is still time to run. I can buy back the sold calls for a small amount (though they may well expire worthless). And it is a 10 day price drop - with luck things will go to normal again. Brazil's IMF lenders hate subsidies.

Market Jitters Donald Trump announced that there would be no summit with North Korea in Singapore next month. This rattled European and US markets - my overall portfolios were down across the board.

All the commentators jumped onto this as the key factor driving markets.

Digging under the numbers there is another story running which is much more fundamental. Interest rates fell in all markets - Japan, Europe and US. There seems to be a creeping view that the optimism in the first quarter about European growth and rising inflation in US was overdone. I watched an interview with Steen Jakobsen of Saxo Capital Markets where he was very sanguine about prospects. His words were along the lines of "the seeds of the recession are already planted. They are not showing up in the equity markets yet although bond markets are giving signals"

I am not a great follower of Steen Jakobsen as I find that he likes to present a maverick view and he talks in riddles. But there are times that maverick become contrarian and contrarian becomes right. Timing will be everything.

Bought

Transocean Ltd (RIG): Offshore Oil Driller. I have some short term call options on Transocean expiring in June. These have performed very well on the back of the oil price rise. With 3 weeks to go to expiry, it is time to review - take delivery of the stock or roll out in time to a higher strike or take the profits. I am happy with the direction of the trade and of oil prices - this can run longer. I put the bids in to roll out in time to a higher strike. While I was about it I decided to add new positions for the new target contract to two of my portfolios. I bought July 2018 strike 14 call options for $0.50 premium (3.5% of strike). The logic is simple. Price has already tested the 14 strike level. The momentum of the current price move matches moves we have seen in the past. If it runs exactly the same way price will reach $17 which makes the new trade a 500% winner.

Going back to an old chart last seen in TIB219. All I have done is add in the new expiry by moving the June line to July (dotted red line) and adding in the new contract (bought call 14 - the lime green ray).

The blue arrows come from the old chart and we can see readily that price is doing what it has done in the past. If it keeps doing that price will reach $17 which offers 500% return on the new contracts. The advantage now is there is a little more time to mid July.

Shorts

Direxion Daily MSCI Real Est Bear 3X ETF (DRV): US Real Estate. I saw this trade idea on Real Vision last week. The basic idea is as US Treasury yields rise, investors move away from other high yield investments so that they can reduce their risk. The biggest casualties are real estate investments trusts (REIT's) and utility companies. The yield on iShares US Real Estate ETF (IYR), an industry REIT ETF, is 3.8% compared to US 10 year Treasury at 3%. The REIT carries risk and the Treasury holding is risk free.

The investment idea is to go short REITs via an ETF play. There are 5 ways to do this

- Short the stock - this incurs stock borrowing costs and one has to pay away the dividends when they are paid

- Buy put options - the option premium effectively covers the costs of shorting but it also carries the expectation of how price could move

- Buy an inverse ETF. The ETF manager does the work of shorting the stock and paying the costs and dividends.

- Buy a leveraged inverse ETF. In this case, the ETF manager aims to return a multiple of the price movement. They do this by applying leverage using borrowing and/or options

- Buy call options on an inverse ETF. This applies leverage and for a leveraged inverse ETF to something that is already leveraged.

Choosing depends on time horizons, attitude to risk and compliance restrictions. Time horizon for the trade is short term. When the switch from one risk class to another happens it will be quick. The Real Vision article suggested 3 to 6 months. In one of my portfolios I cannot short stock but I can buy options or inverse funds. I chose to use the inverse ETF idea with a 3 month time horizon in my mind.

The chart tells a simple story. Price is back to where it was at the end of January 2018 and then it spiked in 3 weeks. If price goes back to where it was 72 days ago in February 2018, the trade makes 35%. I held off making the trade last week because price was already moving. Yesterday felt like a better entry.

Now there is an options trade opportunity. A November 2018 strike 12 call option offers a premium of $1.09. If price does make it to the February high of $15.62, there is a 232% profit opportunity. There is a bigger profit opportunity by using a bull call spread on the trade - buy the 12 call and sell the 16 call to trade to the top of the range - offering a return of 669%. The answer will come along after the June Federal Reserve meeting. If they do not raise rates then, the trade fails and options premiums are lost.

The other reason, I have not put an options trade on is I already have one on iShares US Real Estate ETF (IYR). Let's see how that stands - the trade was a January 2019 75/66 bear put spread bought for different reasons 12 months ago (May 2017). [Means: Bought strike 75 put options and sold strike 66 put options with the same expiry]

In TIB83, I presented two price scenarios. One was a continuation of the uprun and then the downturn and the other was a downturn. One would be profitable and the other not. What happened? Let's look at the chart. What I have done is left in the possible price scenarios I wrote about last July (up in blue and down in red).

So far price has done something between the two scenarios. It kept going up but not as steeply and then tracked sideways. When it did correct, it did not run down as long but it was as steep. All that price needs to do is make a small run down like the pink arrow on the left hand side. I can see 6 just like that - it is still a valid trade.

Eurodollar 3 Month Interest Rate Futures (GEZ): My pending short order was filled at 9701.5. I added one new position manually at 9701.45. These trades replace the ones closed at a profit last week (May 16)

Euribor 3 Month Interest Rate Futures (IZ): I placed pending short orders at the level of the previous cycle highs (9961.5) during the day. I thought price would respect those highs as a resistance level.

Wrong - price stormed right on through and the pending orders were hit. My exposure to Euribor may seem high at 13 contracts but these are December 2020 expiries and the implied interest rate is less than 3/4ths of a percent. I am confident that rates will be higher two and a half years from now as the US is already at 1.5%.

Expiring Options

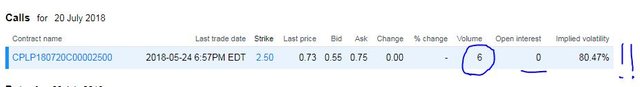

Capital Product Partners L.P (CPLP): Oil Shipping. I have some June expiries coming up. With 3 weeks to go, time value is running out. This has been a frustrating trade which has gone in-the-money but not enough to recover the options premium. The next level of frustration is strikes are far apart making rolling up infeasible. Options are to go to expiry and take delivery of the stock, sell now and take the loss or do a calendar spread. [Means: Buy the same strike for a later time period]. I chose the latter path as I feel there is still upside for oil shipping especially with new Iran sanctions changing oil flows across the world. Rolled across June 2018 strike 2.5 call options to same strike July 2018 for an additional $0.15 per contract.

This is not the first time I have rolled these contracts. An updated chart tells a story of hoping for something that may never happen. This is the December 2017 expiry chart I presented updated to latest prices and adding in the new expiry date (green dotted line on right margin). Price has basically done nothing since late 2016. I am hoping it will make a move and I have 4 weeks extra to hope in.

The word is hoping.When I look at the options chains, I see I am the only person hoping with 6 contracts opened and no open interest.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $225 (2.9% of the high). There were buyers at the new support line I drew in yesterday. Hooray!

I was one of those buyers. In my Bitmex account, I closed the September 2018 short for a $1301 per contract profit (16.8% return). I am sure hoping this support level holds as I am now long only.

In my IG markets accounts I added one new long position at $7642.

Ethereum (ETHUSD): I added one new position in IG Markets at $597.

CryptoBots

Outsourced Bot No closed trades

Profit Trailer Bot No closed trades

New Trading Bot No closed trades

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 11.0% (lower than prior day's 16.3%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Petrobras image is credited below it. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 24, 2018

another awesome post...I'm going to have to look into shorting IYR. Also, oil pulled back today, saw a clip on Real Vision about XOP, I will be buying leap options on that in the morning. I'm sure that one trade will pay for my subscription

PS - where do you see the dollar heading????

I am invested for dollar strength predicated on rising rates. The commentators are calling it both ways. The answer lies I think in the demand for Treasuries from China vs domestic US.

Quite frankly it is a crapshoot

I am invested for the dollar strength as well. Like the post! So you must be buying the big US banks then?

I have been invested since 2009. Been buying the small banks more recently

Upvoted ($0.21) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I do not understand about investing, but I support you and thank you for sharing information @carrinm

Good job @carrinm,. Resteem

I read a good article. I learn a lot. Thaank you.

Thanks for the informative post.

Immediately clarified many of the details and important diagrams.

Good luck and new achievements.

With best wishes, @singa

Thanks. That is my objective. Each one you read you will learn a little more. In time you will get the big picture yourself.

Thank you very much for the information @carrinm, a very useful post.

thanks for the information .. i want to share it.