Investing fundamentals - Supply and Demand.

I happened to read so many articles written by self-taught economists and theorists lately where people have either been completely off the point or at least some fundamentals in their posts have been incorrect that I decided to write a little article about something that I believe absolutely everyone doing anything even remotely related to investing or trading should understand - Supply and Demand.

But before that - a quick rant.

Why am I doing this? To me personally, it's upsetting to see some of these posts read by hundreds of other people who blindly believe everything and take every word for granted. Some even conclude with idiotic comments such as "I am definitely buying more coins which are $0.0000XX per coin, because if these go up to the same price as bitcoin I will be a gazillionaire!!!". I have noticed it is a little bit like fighting windmills when you make a half-decent attempt at at least informing these people that their thinking in fundamentally incorrect, but people don't like being told they are wrong because their self-pride or their steemit-image would suffer. Such people also frequently respond with links to their other "educational" blog posts where hundreds of people are then directed to read more bull***t. This is where my battle stops. Whoever does not want to listen and learn is not worthy of my time.

But most of the time I at least give it a go. Maybe there is going to be a person or two who understands that investing is a little more complicated than finding the cheapest coin. I want everyone to make educated decisions when it comes to investing and trading and at least have the basic understanding of simple economic/financial concepts.

Steemit is a free world with a free word and inevitably there will be poor quality content, mistakes and plain and simple rubbish. It is our job to filter this kind of information out.

Getting back to the topic of the blog post!

One important thing that you need to understand if you would like to participate in crypto (or other) markets:

If you want to have at least a small chance at making money long term, you need to have a basic understanding of supply, demand, technology, function of exchanges and basic concepts of psychology. I will focus on supply and demand but will talk very briefly about the rest too.

(from Wikipedia) In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that in a competitive market, the unit price for a particular good, or other traded item such as labour or liquid financial assets, will vary until it settles at a point where the quantity demanded (at the current price) will equal the quantity supplied (at the current price), resulting in an economic equilibrium for price and quantity transacted.

In human language this means that a transaction will happen and a market price will be determined where one person is willing to supply (sell) something to another person willing to pay for it for the price requested. However, this equilibrium moves constantly as there are many people willing to sell as well as buy at any one moment.

Focusing on supply, the more abundant and readily available that something is, the higher the supply is going to be. In cryptocurrencies supply is affected by a couple of things:

- Total number of tokens available.

- Where the token is traded (more exchanges, more people have access to it).

- Perception of people (psychological aspects).

It is important to understand that some cryptocurrencies can reach or have high market cap and high unit prices whereas others don't not only because of total number of tokens available. Perception of people about the technology, scalabillity, ease and probability of adoption can affect unit price significantly (+ve or -ve).

Same goes to availability. If only one small exchange hidden in a small corner of the world has this particular token available or there are only very few people holding and offering tokens to the market, the supply is going to be limited. Logically thinking this might suggest that due to low supply the price should be high... HOWEVER, this is where demand comes into play.

Even if supply is low but there is no demand, the token or any other item is worthless. Demand, in simple terms, is the requirement for supply. And once again this will vary depending on a number of factors such as total number of tokens available (scarcity at any point in time might lead to a disbalance of the equilibrium and increase in price and vice versa), how easily available the token is and also the psychological factors as well as economic conditions at that time. And this list is not excessive, I am sure you will be able to think of more factors.

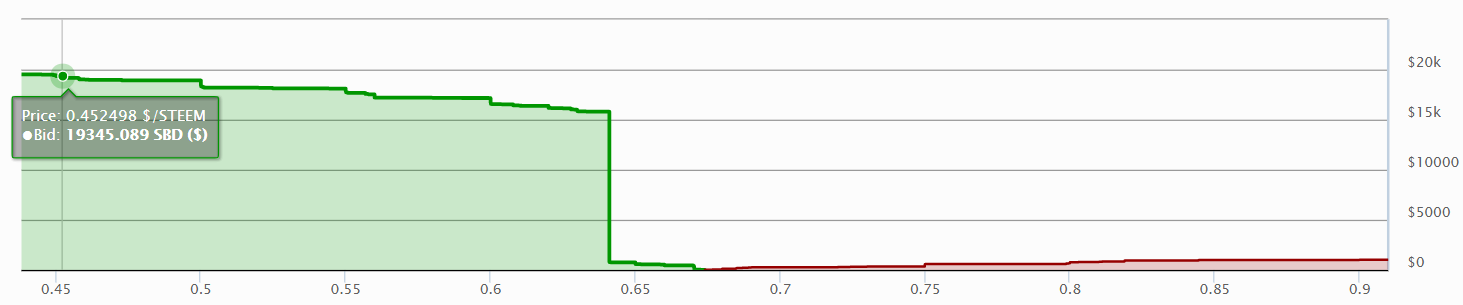

To summarize, supply and demand are in a constantly moving equilibrium which is affected by a number of factors. If you want to see a visual representation of this, go ahead and have a look at the steemit market https://steemit.com/market . It looks something like this:

I think I have made this post long enough for anybody who reached this point to be bored to death and I would like to personally thank you for spending your time reading this post. I very honestly hope this is of value and will be helpful battling your way through the dense jungle of investing. There are plenty of traps (and bullcrap) though, so be careful!

Best of luck,

A.

PS. I'd really appreciate you clicking "Upvote" below and following me for more educational information. I am happy to answer questions in comments section too!

Well said.

As someone who works in finance its alarming how many do "charts" to determine everything.

(TRX to 2.42! XVG to 19 USD! XRP to 32 USD!)

-No analysis

-No looking at volume (as you stated)

-No looking at supply

-No looking at the actual whitepaper

It's like guys just plunk BTC on a coin based on how "hot" or pumped it is.

I see alot of bagholders once this market gets the "dumb" money flying in within this year.

Too many looking for instant wealth...without doing an actual analysis of their investment.

Kinda scary when you think about it.