Interest rates, and the supply and demand for a currency

Summary

- With the money market, the demand curve is still concaved towards the top right, however the supply line is a straight, vertical line.

- When the Reserve Bank wants to increases interest rates, they will sell these bonds to financial institutions in exchange for a certain amount of the countries' currency. The Reserve Bank will do this to reduce excess growth and to combat inflation.

- When the Reserve Bank wants to decreases interest rates, they will buy these bonds from financial institutions in exchange for a certain amount of the countries' currency. The Reserve Bank do this to increase growth and to combat deflation.

Introduction

Currently the western world is experiencing an abnormal interest rate level in most countries. Although it is important to understand what problems it poses, it is first important to understand how the money market works.

Money Supply and Demand

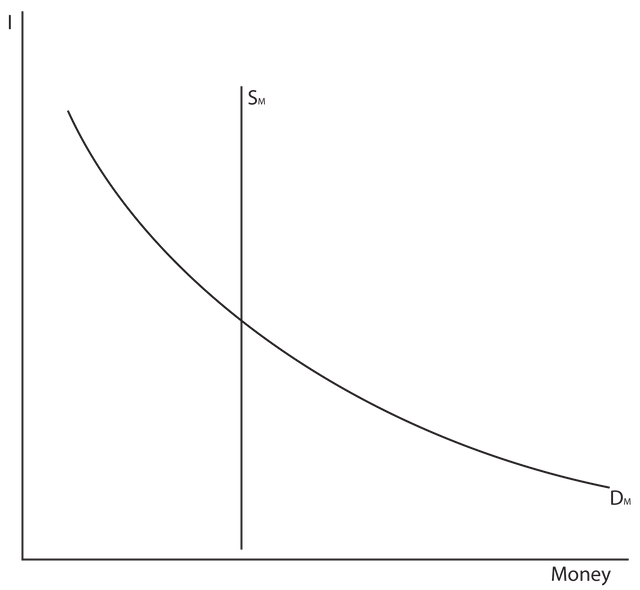

The supply and demand of money is similar to the supply and demand for most markets. A figure of the supply and demand graph is shown in Figure 1.

- Demand is the given quantity of products consumers are willing to and able to purchase at a given price, in a given period of time.

- Supply is the quantity of products sellers are willing to and able to sell to customers at a given price, in a given period of time.

- When the supply and demand curves are both place on the same graph, the equilibrium is where both these lines intercept. When the products being supplied into the market equals the amount of products being demanded.

Source: allBusiness n.d.

All markets have the same components as shown above. However, all markets will vary in where these components are. Some markets may have a steep demand curve or supply curve, other markets may have a steep supply curve and a high price.

With the money market, the demand curve is still concaved towards the top right, however the supply line is a straight, vertical line. This supply line of a countries' currency is set by an independent body called the Reserve Bank of that specific country. This Reserve Bank, is an independent body, that will increase and decrease the money supply to the country by either increasing or decreasing the interest rate.

For historic purposes, originally it was the job of the government in power to increase or decrease interest rates. However, this type of government intervention lead to interest rates been used as a political tool instead as a control for growth and inflation. Eventually, western governments legislated that the Reserve Bank should be independent of the government in power. This works differently in some countries, for example the US Federal Bank has shareholders, but the Reserve Bank of Australia is owned by the Commonwealth of Australia.

How interest rates work

Around the country, financial institutions have specific assets that are known as bonds. These bonds are either sold from or purchased by the Reserve Bank in order to increase or decrease the supply of money into the economy. A graph of a normal money market is shown below in Figure 1.

Figure 1

Source: Investopedia, n.d.

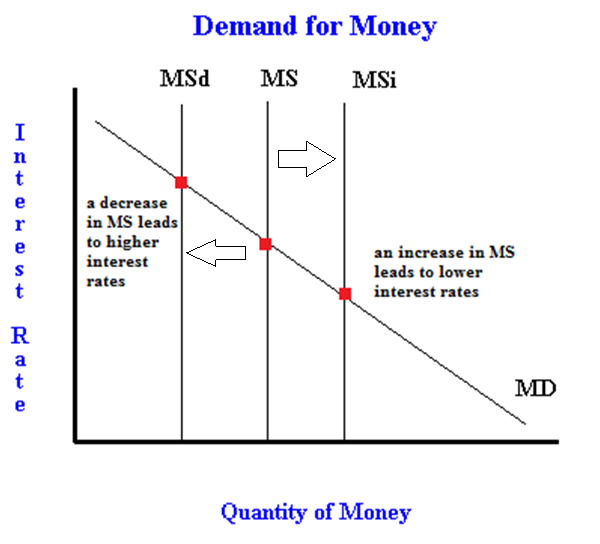

Increasing Interest Rates (From MS to MSd)

When the Reserve Bank wants to increases interest rates, they will sell these bonds to financial institutions in exchange for a certain amount of the countries' currency (i.e. how much the total amount of bonds are worth). This exchange means that in the end, the Reserve Bank has money, and the financial institutions have less money to loan to borrowers in the economy. The less money that is in the financial institution, the more scarce it is, therefore the more unwilling banks are to lend money to borrowers. This increasing unwillingness of loaning to borrowers in the economy is what decreases the money supply in an economy. Therefore, because money is more scarce in the economy, financial institutions will increase their interest rates.

Reserve Banks will increase the interest rate for two primary reasons.

- To reduce too much excess growth of the economy in a short time period the economy by decreasing the money supply for borrowers to invest and spend their money.

- To combat inflation, whereby the price of goods and services in the economy increases as there may be too much money in the system at the current time.

Source: FreeEconHelp.com n.d.

Decreasing Interest Rates (From MS to MSi)

When the Reserve Bank wants to decreases interest rates, they will buy these bonds from financial institutions in exchange for a certain amount of the countries' currency (i.e. how much the total amount of bonds are worth). This exchange means that in the end, the Reserve Bank has bonds, and the financial institutions have more money to loan to borrowers in the economy. The more money that is in the financial institution, the less scarce it is, therefore the more willing banks are to lend money to borrowers. This loaning to borrowers in the economy is what increases the money supply in an economy. Therefore, because money is less scarce in the economy, financial institutions will lower their interest rates.

Reserve Banks will decrease the interest rate for two primary reasons.

- To increase growth of the economy by increasing the money supply for borrowers to invest and spend their money.

- To combat deflation, whereby the price of goods and services in the economy decreases as money will be too scarce in the system at the current time.

Source: FreeEconHelp.com n.d.

Sources

allBusiness n.d., 'supply and demand curves, supply and demand equilibrium, 'allBusiness', retrieved 27 June 2017, https://www.allbusiness.com/barrons_dictionary/dictionary-supply-and-demand-curves-supply-and-demand-equilibrium-4958000-1.html.

FreeEconHelp.com n.d., 'The money market, open market policy (purchases and sales), in the context of monetary policy', FreeEconHelp.com, retrieved 27 June 2017, http://www.freeeconhelp.com/2011/11/money-market-open-market-policy.html.

Investopedia n.d., 'Money, Interest, Real GDP, and the Price Level', Investopedia, retrieved 27 June 2017, http://www.investopedia.com/exam-guide/cfa-level-1/macroeconomics/supply-demand-money.asp

Congratulations @zotello! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Awesome. Thank you for your support :)