Changes in Climate, Changes in Insurance and the Consumer Mindset

One of the main drivers of climate change, and more specifically severe weather events, is the consistently rising planetary temperature. Warming of the oceans increases the frequency and severity of tropical storms and hurricanes. The World Meteorological Organization made some stark predictions:

One of the next 5 years has an 80% chance of breaking current temperature records

An 86% chance that one of the next 5 years will exceed pre-industrial temperature averages by over 1.5°C

Warming in the Arctic Region will exceed the global average, increasing sea levels.

The increasing severity of weather events has proven costly for insurance companies as commercial and residential losses rise alongside global temperatures. The Insurance Bureau of Canada named 2024 the costliest year for insurance losses, surpassing $1.7 Billion (CAD). Climate driven wildfires in Jasper, Alberta accounted for $650 million on its own.

The Carrier / Client Relationship

Insurance transactions have 2 key players, the carrier and the client. The carrier generates revenue through the premiums that clients pay for insurance coverage for residential and commercial assets. Managing and optimizing premiums has to be more precise in the current insurance environment but upward adjustments can have negative effects on the client relationship and managing client confidence and expectations is essential in maintaining that relationship. Technology can provide a ‘bridge’ between the carrier and the client by delivering consumer-facing elements that bring transparency and resources while optimizing and positively adjusting primary revenue sources. Current innovations can establish a clear picture of the current environmental status of a specific area and provide data backed analysis and reporting that offer revenue optimization and client facing transparency. The importance of the insurer/client relationship lies in the fact that clients are the main source of revenue for insurance businesses.

Canadian Province Asks for More Transparency

Calls for more transparency in the insurance industry grow as coverage premiums skyrocket in Canada’s most populous province, Ontario. The Financial Services Regulatory Authority of Ontario (FSRAO) confirmed that severe weather events and the damage they cause are driving insurance coverage premiums much higher and has recommended more transparency and information about these upward trends. Investors for Paris Compliance, a corporate advisory organization, stated that insurance premiums increased by 84% since 2014 while the CPI inflation index averaged 28%, and are asking for a full blown investigation into industry pricing practices. The FSRAO also identified the strict regulatory framework of the auto insurance industry and the lack of oversight in residential and commercial property insurance. Carrier and insurance businesses can take the initiative by building bridges and strengthening client relationships through data analytics and the transparency they can provide to the client.

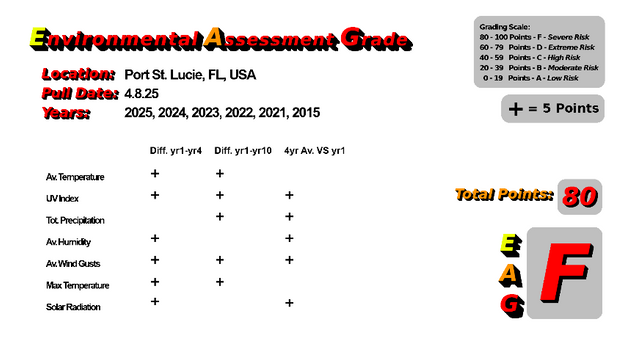

ClimAIteTRACK Serves Both Ends of the Industry

The changing climate and consumer mindset provides for a challenging landscape for insurance businesses but assistive technologies such as ClimAIteTRACK can help mitigate and overcome those challenges. Featuring a fully functional data acquisition framework, algorithmic calculation processes and deep value analytical capabilities, ClimAIteTRACK can provide benefits to revenue generation and premium adjustment initiatives as well positively impacting client confidence through transparent consumer facing elements. Establishing an Environmental Assessment Grade (EAG) through its proprietary scripting, ClimAIteTRACK can assist with premium adjustments and optimization and provide easy to understand resources for clients to ensure understanding and positively influence brand reputation. For more information, please visit the ClimaAIteTRACK microsite: https://climaitetrack.com/

Challenging Landscape for Insurers and Their Consumers

Increasing global temperatures are driving the frequency and severity of weather events and the financial impacts they cause. For insurers, managing and optimizing revenue sources becomes more critical in the face of increasing claims across residential and commercial portfolios. Adjusting premiums is a fact of life for the insurance industry and their clients but eroding client confidence can have negative long term effects for the insurance business. The data and analytical capabilities of ClimAIteTRACK offers dual benefits by delivering relevant weather and statistical reporting for a specific region and consumer-facing information elements that bring transparency and a certain degree of disclosure. Using a proprietary algorithm and static data sources, ClimAIteTRACK can analyze and grade the environmental landscape of any location in the world. Climate change is now a regular operational concern for the insurance industry and using technology can give insurance businesses information and analytics they need to increase client sourced revenue as well as maintain consumer confidence in the insurance brand.

Project Update: As development continues, a ClimAIteTRACK Sample Portal will be available soon (Early August) for ‘test-drives’ of the technology. Visit the Sample Portal for more information and to sign up for updates and credentials: https://climaitetrack.com/ClimAIteTRACK_Sample_Portal/