Life insurance growth and institutional sales volumes

Total annuity insurance sales in the U.S. reached $114.6 bn in the third quarter of 2024, marking a 29% year-over-year increase. This represents the 16th straight quarter of growth, just below the record set in Q4 2023, based on Beinsure Report from LIMRA‘s U.S. Individual Annuity Sales Survey.

Strong economic conditions and demand for guaranteed retirement income continue to drive robust annuity sales.

Even with the potential for further rate cuts, LIMRA expects fixed annuity products to surpass previous sales, setting new records in 2024. In the first three quarters of 2024, total annuity sales rose 23%, totaling $331.2 bn.

Top-line growth and institutional sales volumes have been strong, with record levels of fixed life annuity insurance sales. Sales volumes will remain robust, but see some slowdown in 2025, driven by expected declines in credited rates. Favorably, this should result in improved policyholder persistency YoY.

Earnings for Fitch-rated peers are well diversified, and while alternative investment income has been largely below long-term return expectations YTD, fee-based income has benefitted from favorable equity markets and claims experience has been favorable with more normalized mortality.

Lower rates are a potential positive for asset management flows, specifically fixed-income strategies. Quantitative tightening, lower interest rates and reduced liquidity can create a favorable environment for fixed-income strategies by enhancing yields, improving portfolio values, and attracting more investment flows.

U.S. life insurers stand to benefit

U.S. life insurers, with their substantial fixed-income portfolios, stand to benefit from these dynamics, as well as alleviating the unrealized losses that have emerged post-pandemic with the Fed’s monetary tightening.

Interest rate declines will lead to higher bond values and shareholders’ equity, assets under management and fee income.

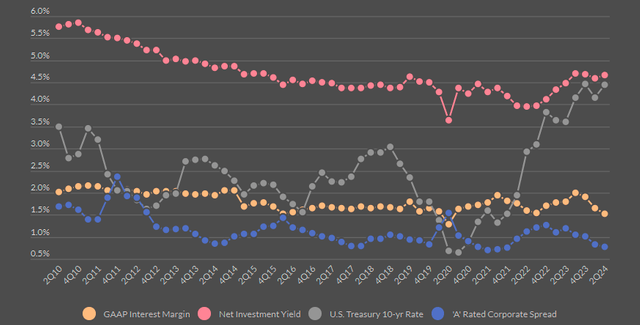

Before the Fed’s tightening cycle began in 2022, insurers tackled falling portfolio yields by shifting investments. They focused heavily on private bonds and, to a lesser extent, lower-rated bonds, predominantly ‘BBB’ rated.

Additionally, they reduced sales of interest-sensitive products, like variable annuities with guaranteed living benefits and guaranteed universal life insurance. Despite rising interest rates, these trends have continued and are expected to persist through 2025, according to Fitch.

Fitch Ratings expect weaker asset quality to emerge in private credit assets, but do not expect US life insurers to face widespread pressure on ratings, as most exposures remain small relative to other asset classes, mitigating downside risk.

Most life insurers continue to return capital in normal course, and we don’t foresee meaningful credit impacts yet.

Most of the leading best US life insurers experienced a year-over-year drop in total revenues.

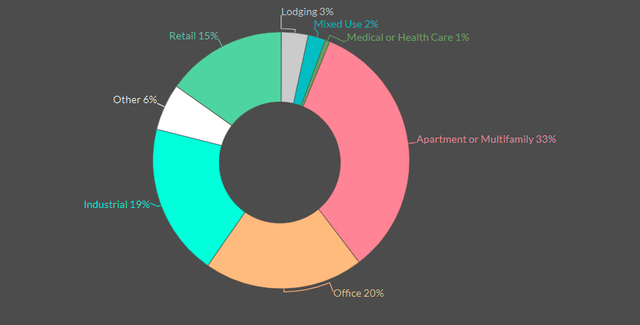

US life insurers are expected to report improving mortality results for the second quarter and field questions related to credit risk as concerns mount over the industry’s exposure to commercial real estate

U.S. Life Insurer Commercial Mortgages by Type

While Fed rate cuts have somewhat eased the pressure on commercial real estate (CRE) valuations, many properties, especially office spaces, still face significant challenges. Losses in this area are set to grow throughout 2024 and beyond. However, U.S. life insurers are unlikely to see rating downgrades driven by CRE exposure.

CRE exposure for U.S. life insurers consists of high-quality, well-diversified investment portfolios. These portfolios are managed with conservative underwriting standards, strong liquidity positions, and effective asset-liability management.