My Innovation Fantasy

Below is the text version of a TEDx talk I gave recently.

I wasn’t supposed to be here.

Curiosity nearly killed me several times over.

I was three when I was electrocuted for the first time.

I found a key and wanted to see if it will open the power socket.

It did not.

A year later, I was maybe four or five,

I was digging a hole in the ground with a friend.

He used a shovel

I was clearing the dirt.

For a while, we worked in wonderful synchronicity.

And then

I saw the beetle.

That was the first time I cracked my head.

By the time I was thirteen I had been bitten by a scorpion and several rodents, broke my arm so bad I nearly lost it and cracked my head again - several times.

Here’s the thing, I didn’t learn - I still don’t.

No matter how many times I got hurt - soon enough I forgot and follow my curiosity’s beetle - surprised each time by the pain.

My Name is Shahar Larry

Over the past 20 years, I led and was involved in hundreds of innovation projects, in dozens of industries - both with some of the world’s largest multinationals and with super cool tech startups.

I failed far more than I succeeded.

Today I will share what I learned from my ten thousand hours.

I will bust the “Innovation is awesome” myth - we celebrate innovators, curiosity, and creativity and at the same time, we reject them. Moreover, we're terrible at innovating.

I will propose that the reason we are so bad at innovation is a toxic combination of distracting metrics and incentives.

Finally, I will lay out a framework for a better innovation ecosystem - one that is more productive, just and less susceptible to distractions. I will also present a barrier to realizing this Innovation fantasy and how we could overcome it.

OK, no time, let’s start with busting the "innovation is awesome" myth.

We don’t like innovation.

How do I know this?

Because of this:

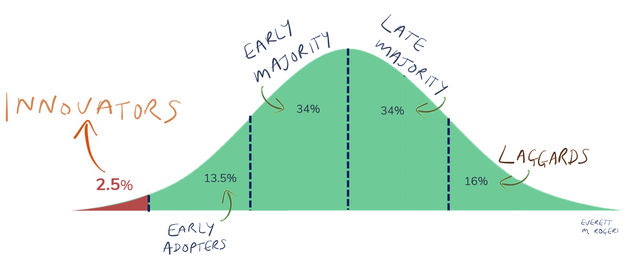

According to Rogers’ Diffusion of Innovations theory, there are different types of people when it comes to adopting innovation.

According to Rogers’ Diffusion of Innovations theory, there are different types of people when it comes to adopting innovation.

The innovators are first to try. They get excited by new things, and they welcome change. But, they make up only two and a half percent of the population.

Next, we have...well...everyone else. That’s my point. The rest aren’t adopting innovation - they are willing to try it only after someone else did. We like to like innovation but when it comes to adopting it - we’d rather wait till it’s no longer new or risky.

We also don’t really like innovators - people who think differently.

I got suspended from every school I ever attended.

I kept saying the wrong things - questioning what my teachers and peers thought was obvious. Being a source of disruption, my mother was so frequently called to school, some of the teachers were sure she was on staff.

I kept saying the wrong things - questioning what my teachers and peers thought was obvious. Being a source of disruption, my mother was so frequently called to school, some of the teachers were sure she was on staff.

Soon enough I learned to recognize when I was about to ask or say something that would get me into trouble.

I still did it.

I wasn’t brave.

I just couldn’t resist.

They say, Sergey Brin and Larry Page,

pitched 350 times before they got funding for Google.

It’s not a story of entrepreneurial tenacity. It’s a story of investors rejecting them 349 times. Every investor will tell you - they always look for a team they can trust. What Brin and Page offered was so new, the investors had to reject it, reject them.

It’s not a story of entrepreneurial tenacity. It’s a story of investors rejecting them 349 times. Every investor will tell you - they always look for a team they can trust. What Brin and Page offered was so new, the investors had to reject it, reject them.

Why didn’t they just give up?

A few years ago, while I was bootstrapping a tech startup, a friend asked me how I was doing, and I said: “I feel like I swam into the ocean and I can’t see the shore anymore”

So, he said - “that sounds awful”

I was really surprised.

“no, no, you don’t understand - it’s fine - I mean that there’s no point going back - what if the other end is closer”.

Again, I wasn’t being brave.

I was unaware of the risk.

Innovators are not

rugged pioneers braving the storm.

Innovators are

irresponsible child-like fools sailing into the ocean in a cardboard box - totally unaware of the risk and shocked to discover they are drowning.

OK, I also said that we are really bad at innovating.

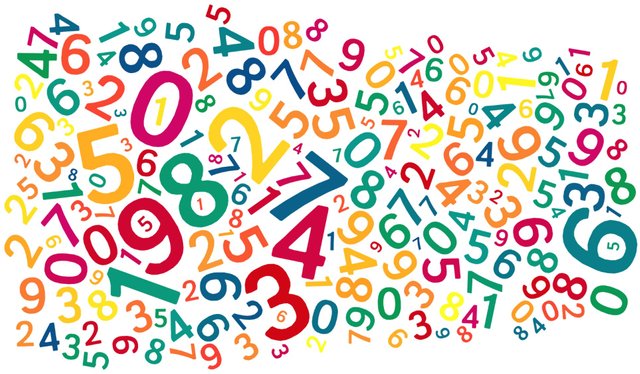

Let’s look at some numbers:

It takes anywhere between three thousands to twenty thousand ideas, hundreds of experiments, patents and dozens of major development investments to generate around ten new product launches, of which around one will be commercially successful.

Startups aren’t doing much better.

A study by TechCrunch, reviewing thirty thousand startups, shows that nearly eighty percent of them that raised seed money, failed to raise series A. It means they were dropped by their investors.

Here’s the bottom line: the overwhelming majority of corporate innovation projects and startups remain unfunded. The few that get funded hardly ever make it to the market.

VCs and captains of industry set our innovation agenda. They play the “select the best innovation” game. Unfortunately for us - they’re not very good at this game. And it’s us that are left paying for it. First, when great innovations get buried. Again, when we pay more for products and services to offset these losses. And yet again, when you consider that our pension funds are the biggest VC investors...

Why is this happening?

There are three types of actors in this world:

The money people: VCs, corporate venturing, angel investors and the likes.

The market people - the big brands

The Innovation people - the founders, entrepreneurs, the fools

They each have an angle – the one thing they do best.

For the money people, it’s, well, raising money. Remember, before they invest, they have to raise a fund.

For the market people, it’s bringing innovation to the market.

For the innovation people, it’s their different perspective.

They also have drawbacks.

The money and the market people have the same weakness - they are very bad at spotting valuable innovation.

It’s not their fault - they are distracted by their incentives. You see, the pay they get for a big exit or a spike in the share price, overshadows any other incentive. They are conditioned to maximize short-term ROI. In-fact, I can, right now, offer startups a quick advice - if you got VC funding make sure they always see you as a big exit ticket - otherwise they will drop you.

The Innovation people are usually novices in building a business - most of them have no or very little experience in fundraising, marketing, sales or even recruitment and general management.

So here’s why we are so bad at innovation:

The money and market people end up doing the one thing they are least equipped to do - filtering innovation. Their game is all about reducing risk and focusing on the “sure thing” - which almost never works.

The innovation people quickly become obsessed with one question: did you raise money? Something they are not very good at and that they hate doing. And if they do raise money, they now need to spend it. Effectively. So that their innovation makes it to the market. Are they the best, most experienced people to do that?

This is the Innovation failure in a nutshell - the right people misapplying their talents because of bad metrics and even worse incentives.

Ok, so it turns up that the innovation ecosystem is broken.

Now, I know what some of you are thinking – it’s not broken – that’s simply how the game is played.

But what if there was a better way?

Don’t answer that – it was rhetorical.

There is – and it comes from one angle we didn’t consider.

The Innovators can innovate without the corporations and VCs.

Think about it.

Most startups never get funded.

The silent majority of innovators in the world are already active without any support.

We almost never hear about them, because without support, most of them fail.

Well, it turns out there’s more than one way to get support.

Although blockchain and cryptocurrencies started driving significant innovation activity as early as 2010, for five years there were almost no corporate or VC investments.

The Vitaliks of the world - he co-founded Ethereum when he was 19 – were ignored.

In 2015 this community got tired of waiting and launched the first ICOs - Initial Coin Offerings. Just like that a new, crowd-based funding mechanism was born.

Yes, I know, some ICOs and crypto-tokens are scams. Every gold-rush attracts unsavory characters. Bad things happened, and they will happen again.

Still, in 2016 fifty ICOs raised a hundred million dollars. In the nine months of 2018, we’ve seen almost 800 ICOs raising over 20 billion dollars.

When backed into a corner, innovators will fight back and find a way.

They were able to do that because the internet, mobile phones and peer-to-peer technologies such as blockchain allow us to collaborate more easily than ever before. For the first time in history, all of us, any of us, are free to be big - “Libery de-esere garndi” - with corporations and VCs, but no longer depending on them.

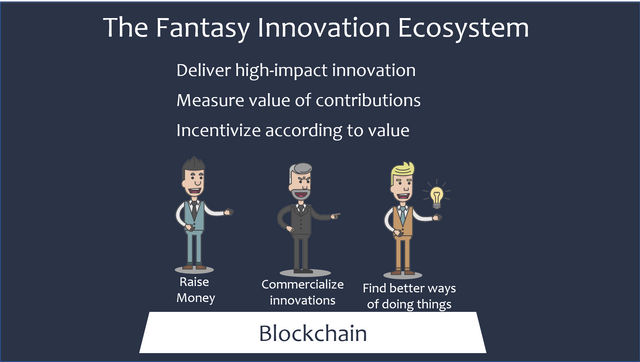

So, if we are truly free - what would a fantasy innovation ecosystem look like?

It must be focused on and measured by its ability to deliver high-impact innovation.

It must be able to measure and incentivize according the added value of each contribution.

Money people would raise money.

The corporations would focus on commercializing innovations – providing services ranging from production and logistics to sales and marketing.

The innovators will be free to do what they do best - finding better ways of doing things. They will no longer be responsible for fundraising, or commercialization.

Selecting which innovation is worth investing in will be a joint effort of all the actors, professional experts, data-driven insights and the user community.

Blockchain technology could be a great platform for this Innovation Fantasy. In a nutshell, blockchain is a way to keep records - history of transactions - that is decentralized and designed to make it almost impossible to manipulate. Without single, central control, and with immutability, it will ensure no one has an unfair advantage.

Just imagine - A decentralized, open, free, merit-based, high-impact innovation ecosystem.

Sounds awesome – but remember, I started with busting one awesome myth – So, this fantasy may sound great, but how will it all fit together. Indulge me, because I think the tougher question is not how will that work, but can it work. I talked about rewards being proportional to value being created. But can we measure that?

Think about it, in any given hour I can create huge value, no value, or destroy value. Measuring innovation with time or with the amount of money or resources invested in it, is not telling us much about the real value. We use these metrics because we have no other and because they fit nicely in an excel. We can analyze them.

That is the crux.

We are using analytical tools while trying to solve a problem, that I suspect, is not analytical.

What if we just took a guess. For example, decide to divide the value equally between the three groups – each taking a third of the future profits. Then, record the actions they take, resources they invest, the community’s rating of the value of their contribution and perhaps also expert opinion. Mix it all together and rate their contribution. Now, I am not saying that this tariff will be the right one. We can unleash it in the ecosystem and see if the people active in the ecosystem are happy with it, are more productive and a bunch of other telling variables. I am talking about a changing, learning algorithm that adapts to reactions until it optimizes its yield.

Given the state of things today - improving should not be difficult.

So I am suggesting that it is indeed possible. We can measure value of contributions and pay can now be proportional to value created. People will be encouraged to focus on the things they do best, because this will maximize their reward. I suspect it will also make them happier.

I want to end my talk with a joke from one of my favorite comedians - Jim Jeffries. He has a famous bit about the 2nd amendment - the right to bear arms. At the end of this bit he says: Sometimes people say to me “you can’t change the 2nd amendment!!” … “yes you can! It’s called an amendment”

Here’s my message to you:

The best chance we have to deal with future challenges is to stay naive, to doubt the very things everyone are sure of. And for those who say you can’t change the Innovation ecosystem...I say, yes you can...it’s called innovation.

Thank you.

Gratzia Mille

Congratulations @tinc! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @tinc! You received a personal award!

Click here to view your Board